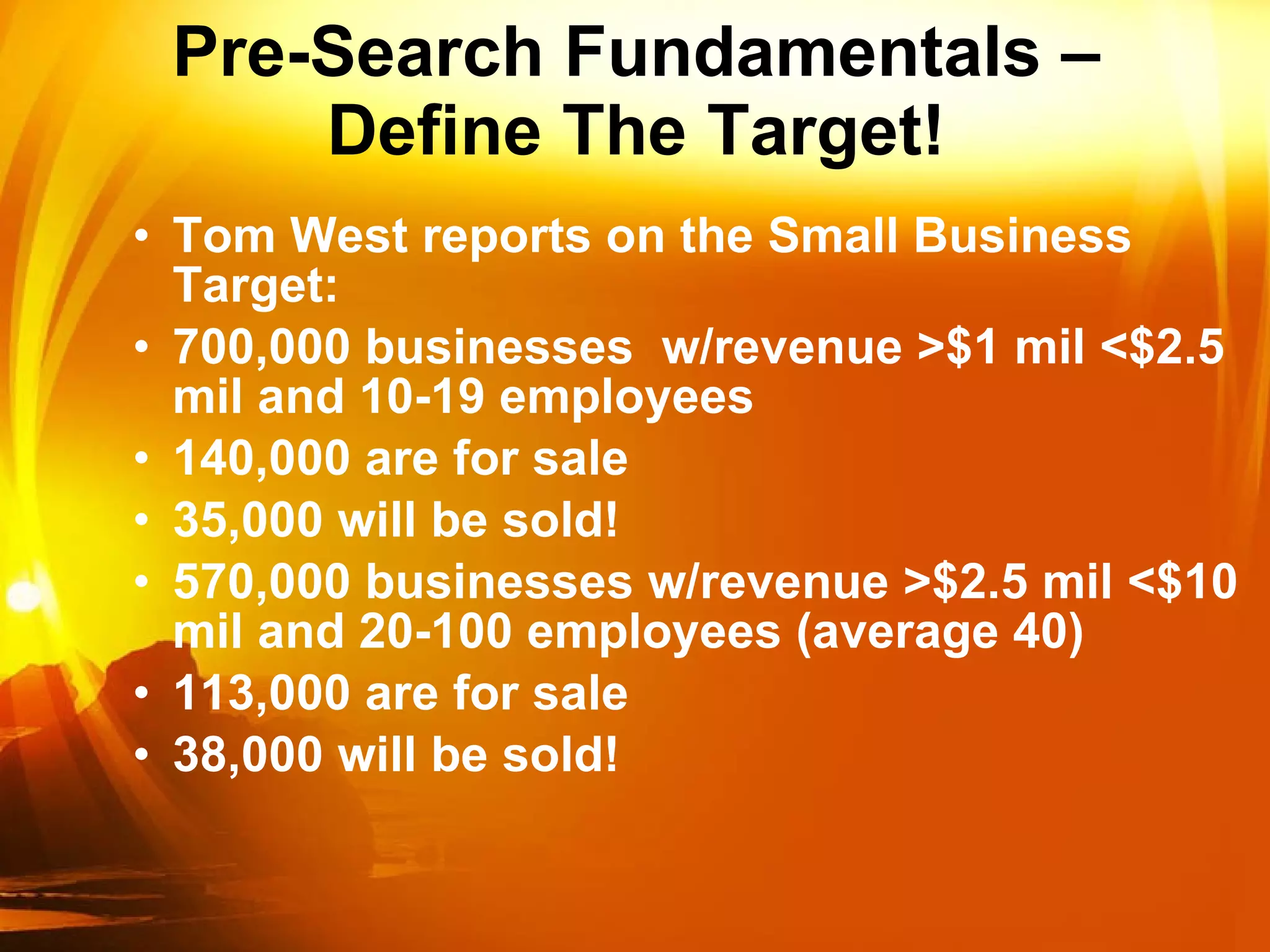

The document provides guidance for first-time business buyers on how to become informed buyers and improve their chances of successfully acquiring a business. It recommends buyers set clear acquisition objectives, understand the marketplace and deal processes, develop quality deal flow sources, consider working with professional intermediaries, and be patient as it is a lengthy process to find and close a deal.

![EBIT Associates, Ltd. Todd Cushing, Principal CBI, FRC, BTS, CBB 117 S. Cook Street, # 212 Barrington, IL 60010 Telephone: 847-566-0500 Facsimile: 847-566-0100 E-Mail: [email_address] www.ebitassociates.com Contact Information](https://image.slidesharecdn.com/ebitbuyerpresentation-12426818656-phpapp02/75/Ebit-Buyer-Presentation-48-2048.jpg)