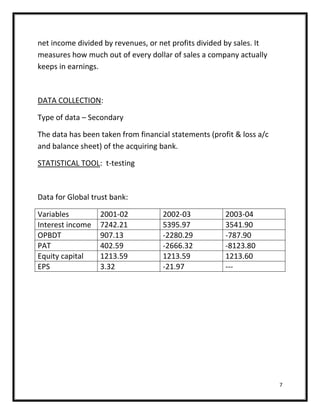

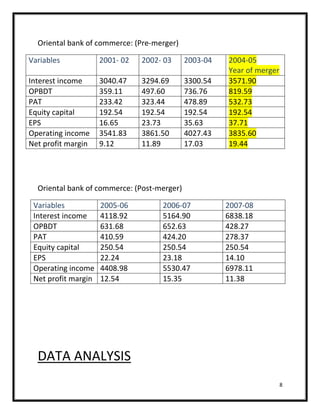

The document is a project report on mergers and acquisitions that analyzes the impact on financial performance of acquiring firms. It studies the 2004 merger of Global Trust Bank and Oriental Bank of Commerce in India. Financial data is collected before and after the merger for variables like interest income, profits, equity capital, and earnings per share. T-tests find that post-merger, all variables improved significantly for Oriental Bank of Commerce, supporting the hypothesis that mergers can improve acquiring firm performance. In conclusion, the merger positively impacted Oriental Bank of Commerce's financial results.