Embed presentation

Download to read offline

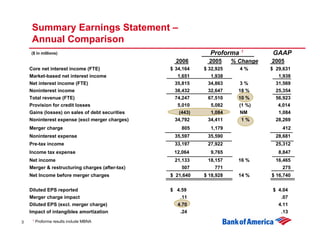

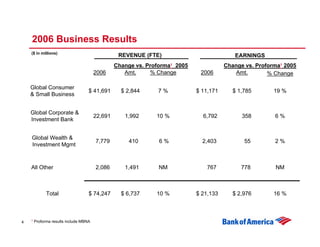

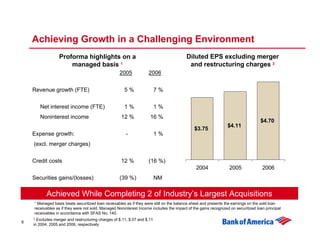

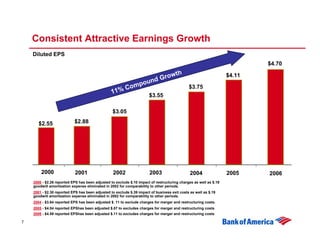

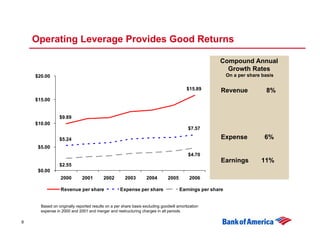

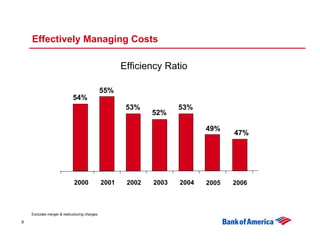

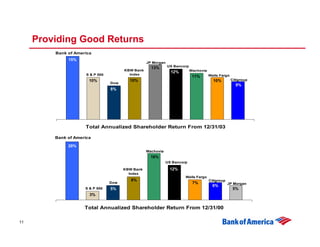

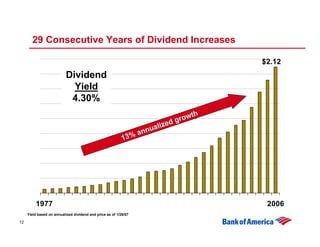

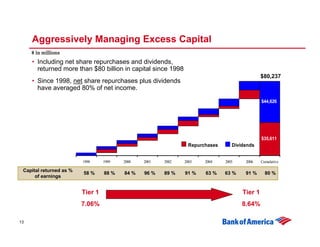

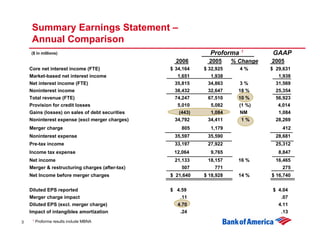

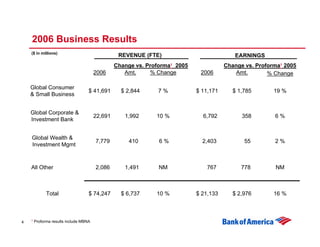

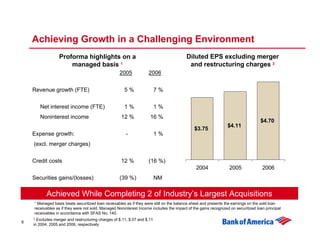

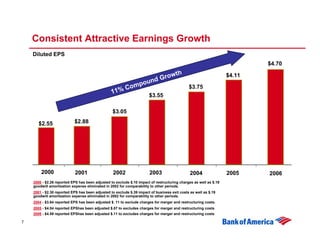

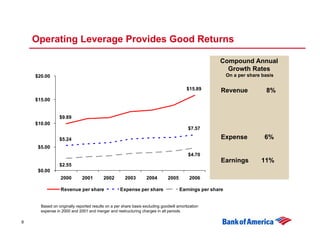

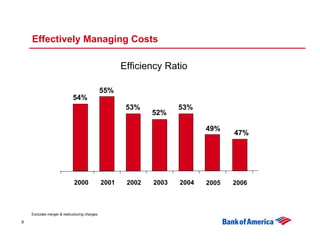

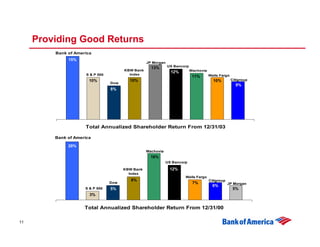

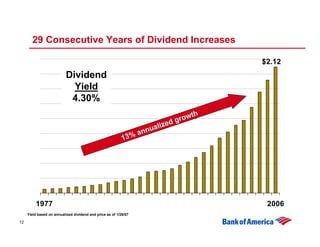

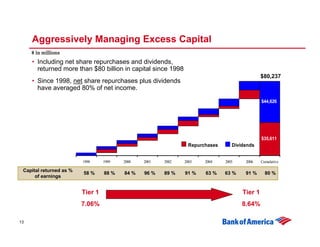

Ken Lewis, Chairman, President and CEO of Bank of America, presented at the Citigroup Financial Services Conference on January 31, 2007. The presentation highlighted opportunities for growth at Bank of America and summarized key financial metrics for 2006, including 10% revenue growth and 16% growth in net income compared to the previous year. Lewis also outlined the company's short-term outlook and strategies to continue achieving attractive earnings growth in a challenging environment.