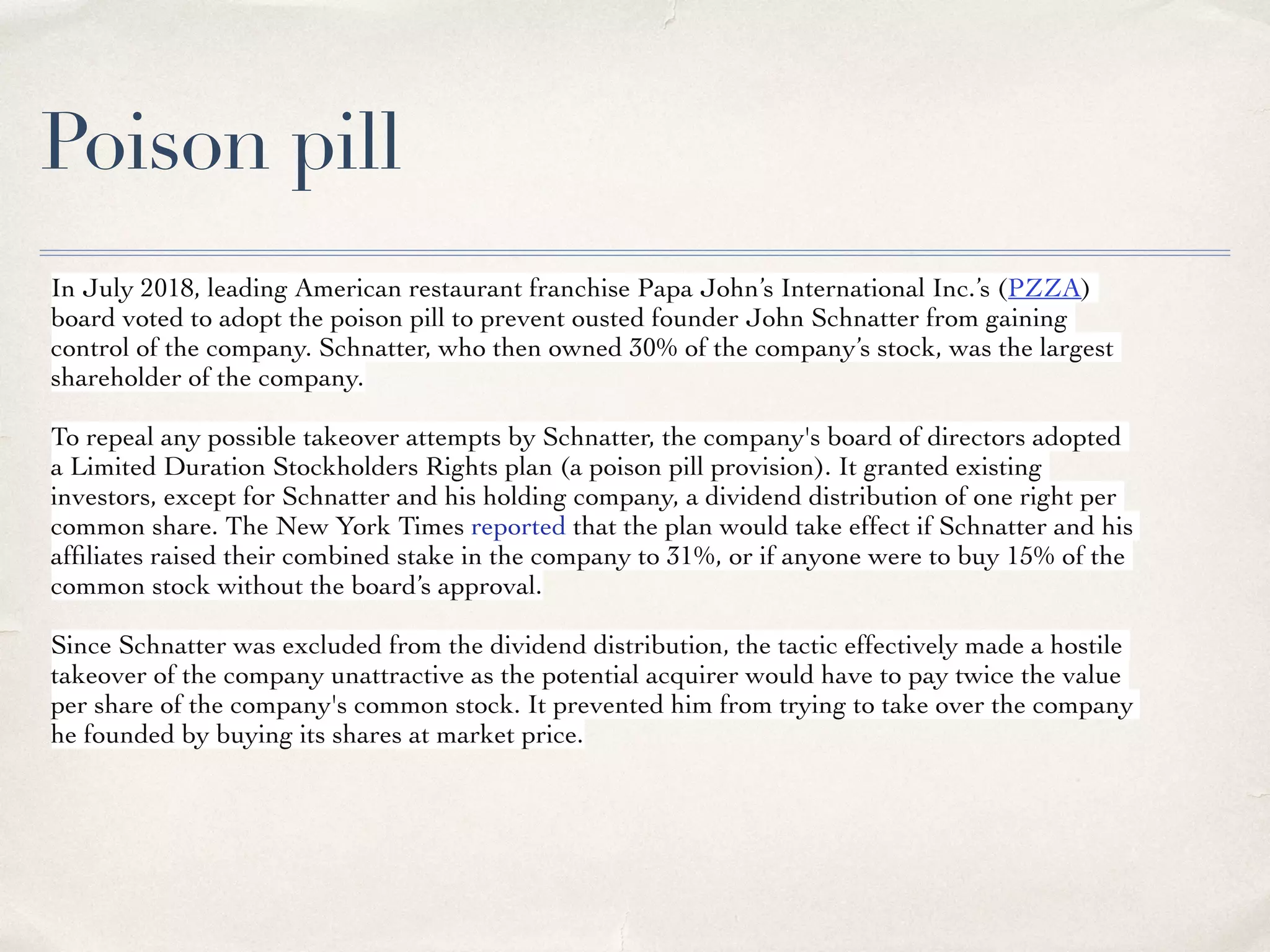

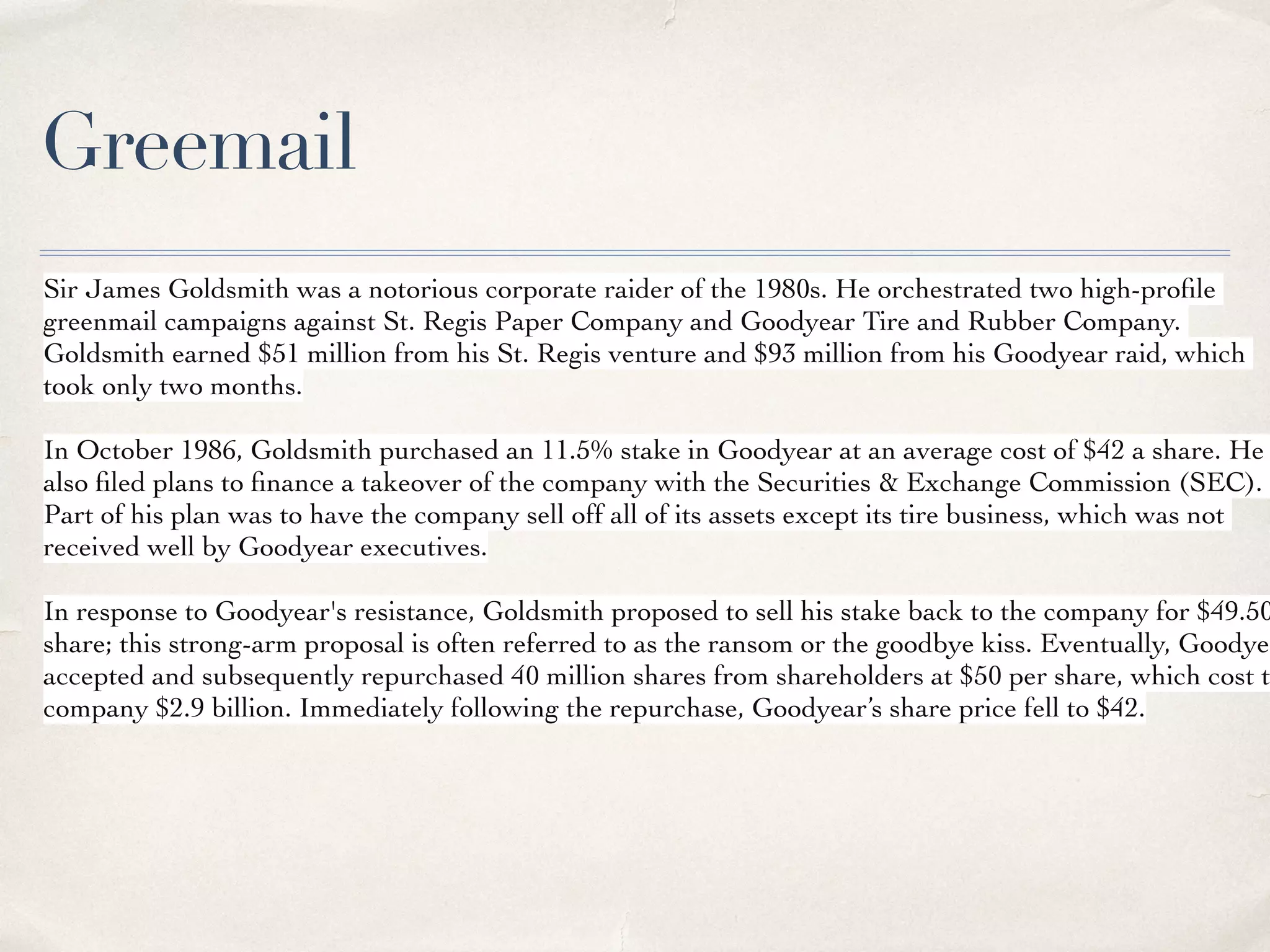

The document discusses various types of mergers and acquisitions, including horizontal, vertical, conglomerate, and concentric mergers, alongside different acquisition strategies such as friendly, reverse, back flip, and hostile acquisitions. It provides examples illustrating these concepts, such as the acquisitions of Capital Cities/ABC by Disney and the hostile takeover of Mindtree by L&T. Additionally, it outlines defensive strategies like poison pills and golden parachutes that companies employ to resist hostile takeovers.