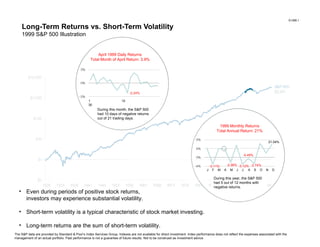

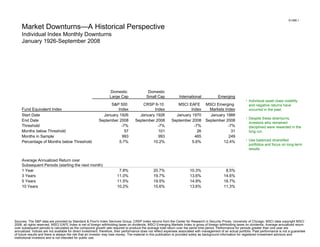

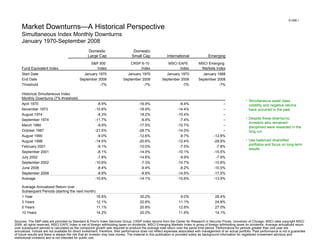

The document discusses short-term volatility and long-term returns of the S&P 500 index over various time periods from 1999 to 2008. It notes that while the S&P 500 had an annual return of 21% in 1999, it experienced negative monthly returns in 5 out of 12 months that year. Similarly, other asset class indexes like small-cap domestic stocks and international stocks routinely experienced negative monthly returns, but investors were still rewarded with strong long-term returns by remaining disciplined and diversified.