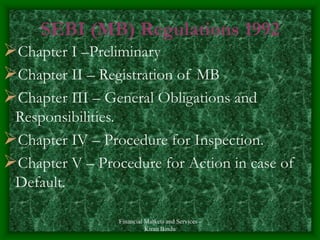

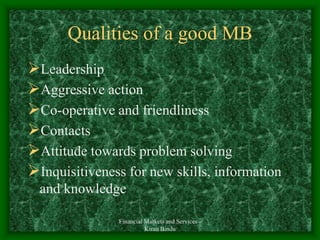

(1) Merchant banking originated in the 13th century when traders financed wars and trades as bankers to European kings. (2) Modern merchant bankers advise companies on capital structure, pricing, and managing public offerings. (3) The SEBI Regulations provide the code of conduct for merchant bankers, requiring integrity and protecting investors and clients.