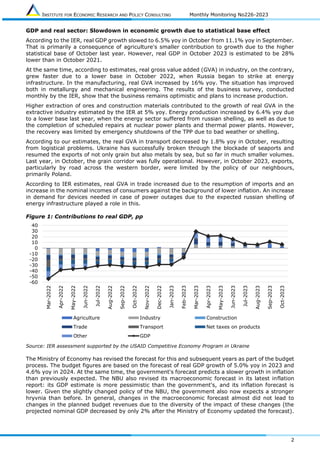

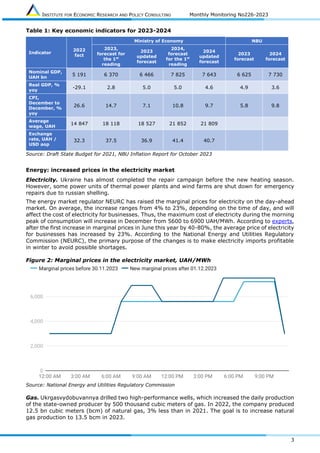

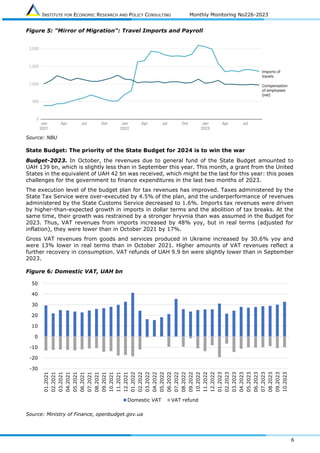

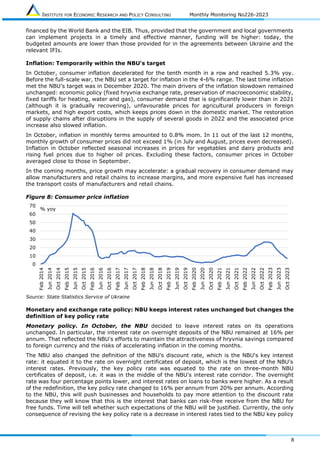

In October 2023, Ukraine's real GDP growth slowed to 6.5% year-on-year, impacted by logistical challenges and a trade deficit that reached a new high. Despite this, the recovery in sectors such as manufacturing and energy suggests resilience, while external financing needs remain significant for the upcoming budget. Key challenges include inflationary pressures and restrictions on exports due to a strike by Polish carriers, which complicate Ukrainian trade dynamics.