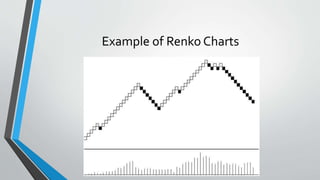

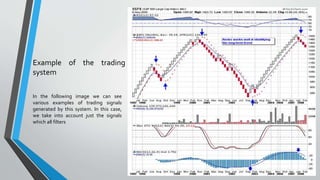

The document discusses a mechanical trading system utilizing Renko charts, which display price movements without considering time or volume. It outlines the rules for generating buy/sell signals based on the color changes of Renko bricks, complemented by indicators like EMA, stochastic oscillator, and parabolic SAR to filter false signals. The system is recommended for trending markets and encourages money management techniques to mitigate potential losses.