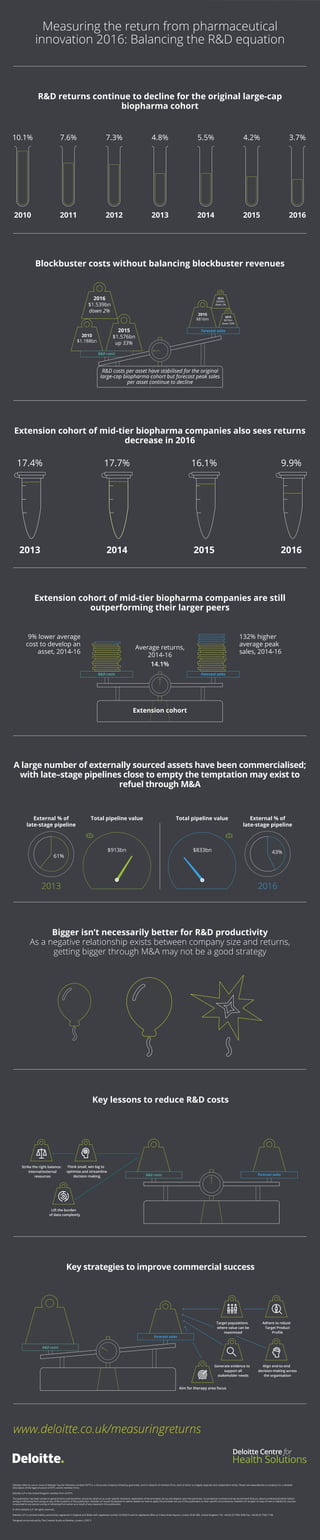

The document discusses the declining returns on R&D investments in large-cap biopharma companies, with costs rising and peak sales forecasts decreasing. It highlights the inefficiencies of mergers and acquisitions as a strategy for increasing R&D productivity and emphasizes the need for firms to optimize resources and adopt robust decision-making processes. Additionally, mid-tier biopharma companies are shown to outperform larger peers in terms of average costs and peak sales over recent years.