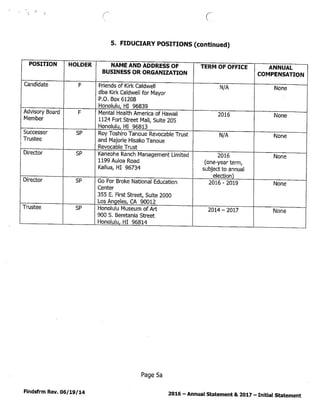

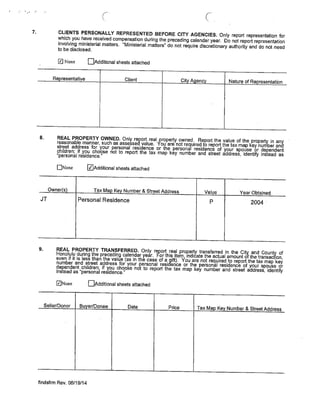

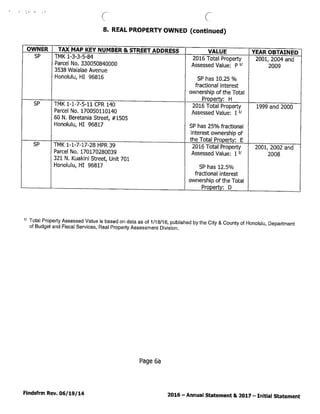

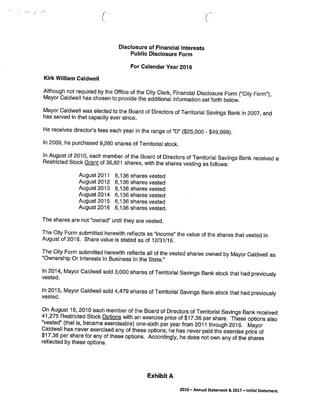

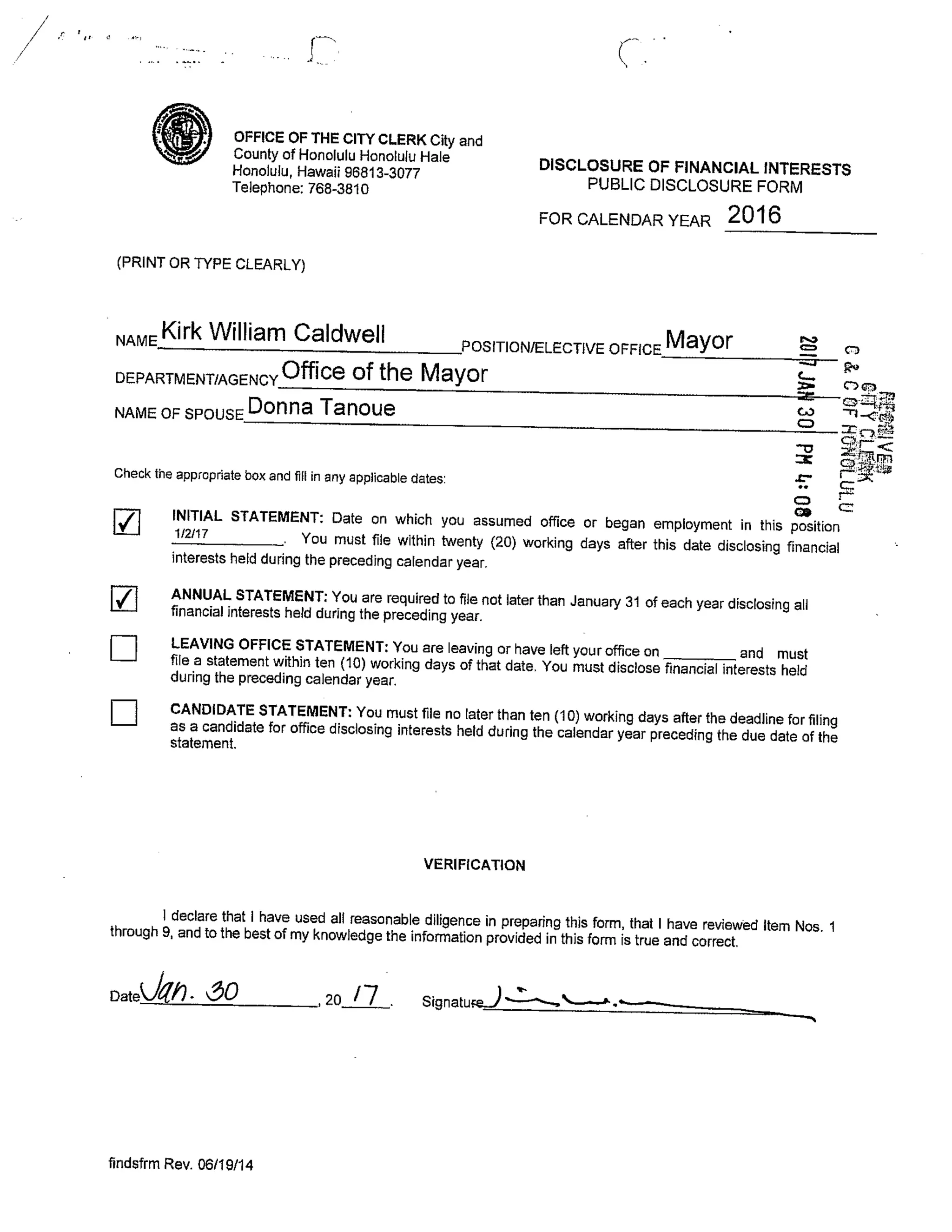

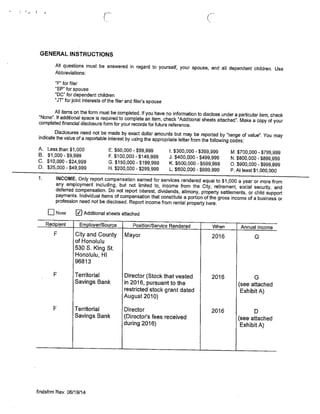

This document is a public disclosure form for calendar year 2016 filed by the filer, their spouse, and dependent children. It summarizes income, business interests, fiduciary positions, real property owned, and other financial interests. The filer discloses being the Mayor of Honolulu earning over $100,000, owning stock in Territorial Bancorp and Bank of Hawaii, serving on boards of various organizations, and jointly owning a personal residence with their spouse.

![H C

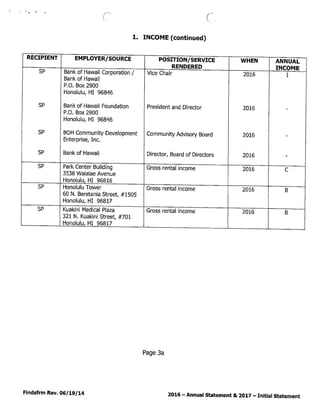

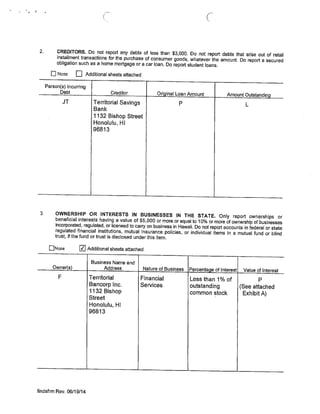

3. OWNERSHIP OR INTERESTS IN BUSINESSES IN THE STATE (continued)

OWNER(S) I BUSINESS NAME AND I NATURE OF PERCENTAGE OF VALUE oW]

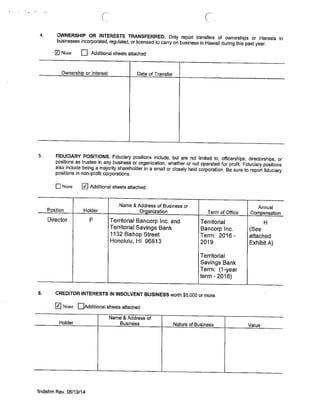

ADDRESS BUSINESS INTEREST INTEREST I

SP Bank of Hawaii Corporation Financial services Less than l% of P —

P.O. Box 2900 outstanding common (as of 12/31/16)

Honolulu, HI 96846 stock

SP Park Center Building Partnership Commercial office 10.25% partnership D

3538 Waialae Avenue building interest (10.25% of

Honolulu, HI 96816 partnership

interest)

iT KSP Equities 1, LLC Solar power Less than 1% interest Activity ended

550 Paiea Street, Suite 236 partnership in partnership in Tax Year

Honolulu, HI 96819 2014

SP Bank of Hawaii Corporation Financial services Less than 1% of B

Custodian P.O. Box 2900 outstanding common (as of 12/31/16)

for DC Honolulu, HI 96846 stock

(HawaN Uniform

Transfers to

Minors_Act)

SP

Custodian

for DC

(Hawaii Uniform

Transfers to

Minors Act)

Hawaiian Electric Industries, Inc.

900 Richards Street

Honolulu, HI 96813

Utility and financial

services

Less than 1% of

outstanding common

stock

C

(as of 12/15/15)

Page 4a

Findsfrm Rev. 06/19/14 2016 — Annual Statement & 2017 — Initial Statement](https://image.slidesharecdn.com/mayorcaldwell2016disclosure-170614033929/85/Mayor-Caldwell-s-2016-Financial-Disclosure-5-320.jpg)