This document summarizes the author's journey from graduating business school to realizing the importance of taking control of one's personal finances. It describes how the author initially struggled in his banking career, not getting the recognition he desired. This prompted him to resign and reevaluate his approach. Reading Think and Grow Rich was a turning point, opening his eyes to different ways of creating wealth beyond just a salary. He then chose to focus on managing his own finances and exploring wealth creation avenues, rather than relying solely on career progression. This realization marked an important shift in his mindset and financial independence.

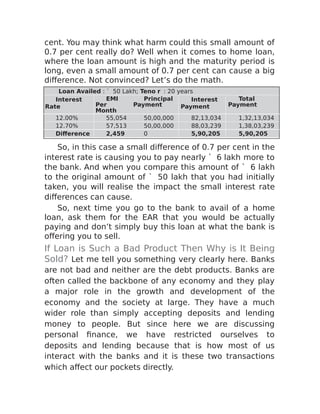

![the bill into EMI, an interest is charged over the

outstanding amount. While this interest rate (20-24 per

cent) is lower than the usual credit card interest rate (35-

40 per cent), it is still very high as compared to the

normal interest rate prevailing in the market. Second, you

need to pay a processing fees (hidden fees which are not

so obviously told to the consumers but are printed in very

small fonts somewhere in the long list of ‘Terms and

Conditions’) when you convert your bill into an EMI. And

to top it up, you need to pay tax on the processing fees.

So even in cases where there is no interest charged on

converting the bill into an EMI (very rare but some banks

do provide such a facility on a case-to-case basis), you

end up paying much more in the form of processing fees,

taxes etc. And in case you want to pre-pay this EMI, you

may need to pay pre-payment charges as well.

Also, once you take the EMI route, your credit card

limit is automatically reduced by the amount of principal

outstanding. As and when you keep paying the EMI, the

debt reduces. But till the time you bring this down to zero,

be aware of the fact that you may not shop up to the

allowed original credit card limit any more. Why? Because

the bank has known by this time that the particular

person doesn’t have the repayment capacity and it is

better not to give him any more credit. And the worst part

is that all this information is not limited to the bank which

issued you the card; it becomes a public information

among all the banks and lending institutions. So, in case

you go for a home loan after you have converted your

credit card bill into an EMI, you may face a tough time

getting it sanctioned.

You also need to understand that your credit card is

already a loan upon you. It’s an unsecured loan with a

very high interest rate. Suppose you have five credit

cards, each with a credit limit of ` 2 lakh then your CIBIL

(Credit Information Bureau [India] Ltd) report will show](https://image.slidesharecdn.com/masteryourmoney-230602085621-5a5a4e09/85/master-your-money-pdf-118-320.jpg)