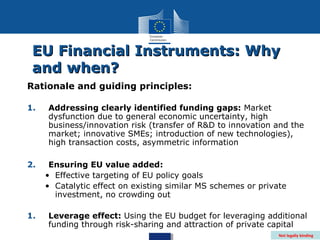

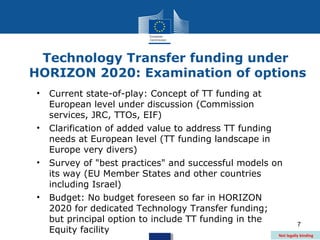

Martin Koch from the European Commission presented on financial instruments available through Horizon 2020 to support research and innovation. These include equity investments, risk capital, loans, and guarantees to financial intermediaries to increase lending. Approximately 4.5% of the Horizon 2020 budget will be allocated to these financial instruments. Two instruments are proposed: one for debt financing through loans and guarantees, and one for equity financing focused on early-stage companies. Options for including technology transfer funding through the equity instrument are being examined, considering factors like addressing funding gaps, leveraging additional capital, and achieving critical mass.