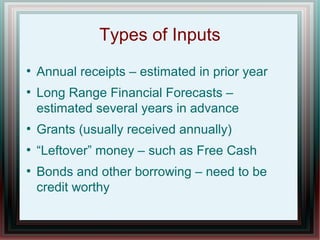

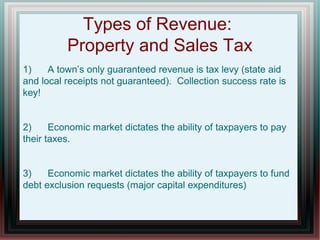

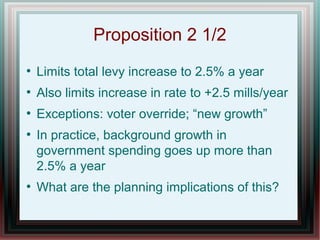

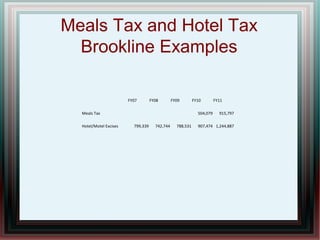

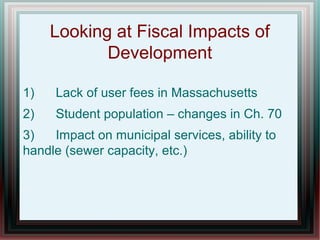

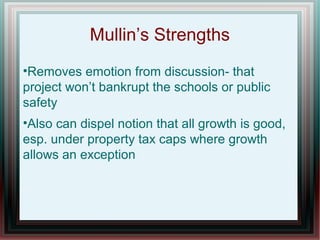

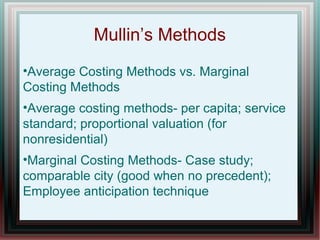

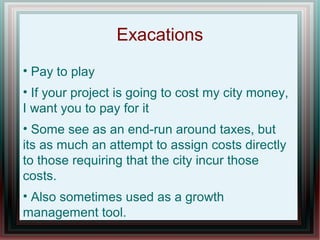

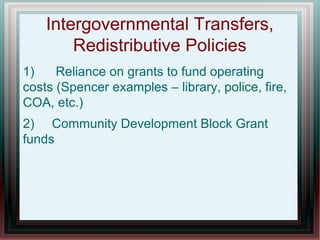

This document discusses public finance considerations for planners. It notes that planners should understand how municipal revenues and budgets work because they will be asked to explain fiscal impacts of projects and policy changes. Revenues come from sources like property taxes, fees, and state aid, which are vulnerable to economic fluctuations. Planners' decisions around development can affect budgets by impacting areas like schools, public works, and public safety. Tools like fiscal impact analyses help evaluate these costs and benefits, though they have limitations and require credible application. Overall, the document stresses the importance for planners to thoughtfully consider financial implications of their work.