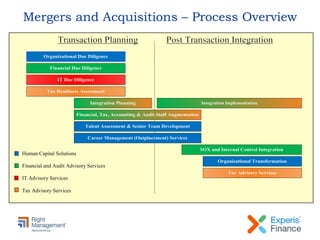

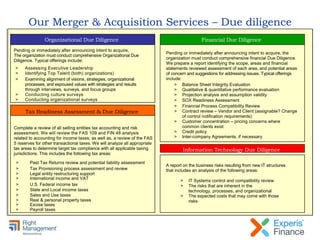

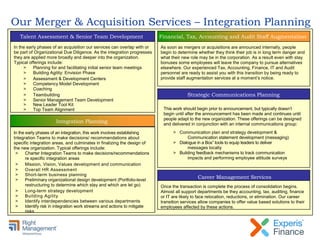

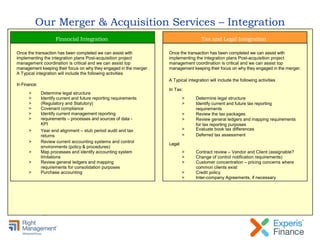

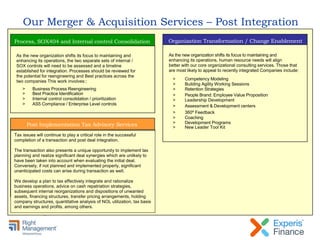

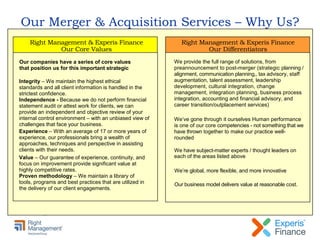

This document summarizes services related to mergers and acquisitions including due diligence, integration planning, tax advisory, staff augmentation, talent assessment, and change management. It provides an overview of the typical processes involved in organizational due diligence, financial due diligence, information technology due diligence, integration planning, communications planning, and post-integration activities.