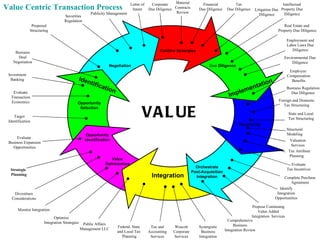

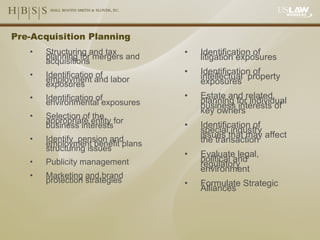

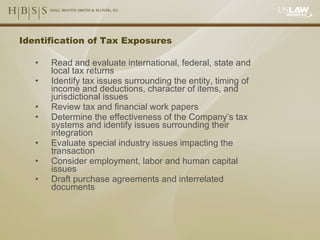

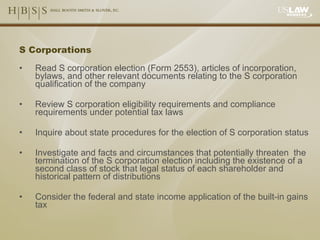

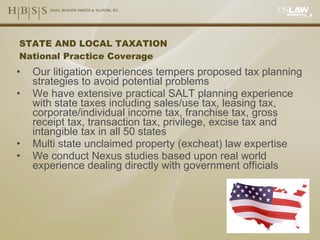

Hall, Booth, Smith & Slover, P.C. offers comprehensive transaction advisory services, focusing on a value-centric methodology that integrates multiple disciplines, including due diligence, tax planning, and risk management. Their approach aims to enhance profitability through targeted integration and practical solutions tailored to client needs. The firm emphasizes a multidisciplinary strategy that streamlines transaction processes while providing ongoing support for effective implementation.