Embed presentation

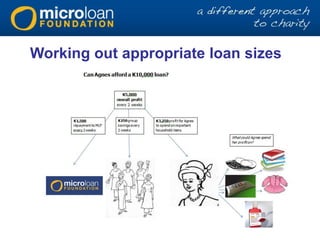

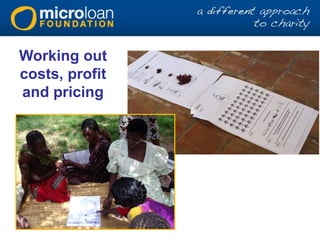

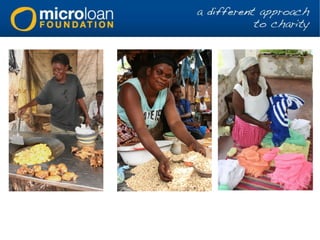

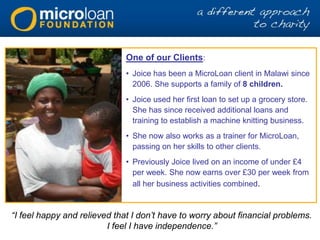

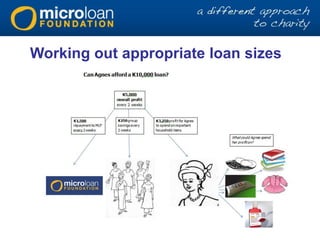

MicroLoan Foundation is a microfinance charity based in Malawi that provides small loans, bank accounts, business training, and mentoring exclusively to rural poor women. It has over 150 local staff serving more than 26,000 active clients across 21 branches in all 3 regions of Malawi, with a 98% repayment rate. One client, Joice, used loans to establish a grocery store and knitting business, increasing her weekly income from under £4 to over £30 and gaining independence to support her family of 8 children.