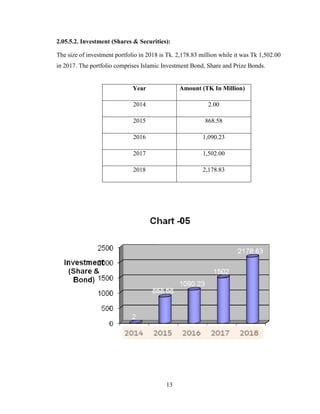

The document provides an overview of Al-Arafah Islami Bank Ltd., including its history, vision, mission, management structure, capital structure, deposits, loans, investments, profits, import/export business, and foreign remittances. Key facts include that the bank was established in 1995, has over 50,000 shareholders, and saw strong growth between 2014-2018 in deposits, investments, imports, exports, and other financial indicators.