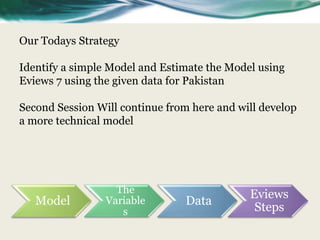

1. The document discusses modelling macroeconomic relationships in Pakistan using time series data in Eviews.

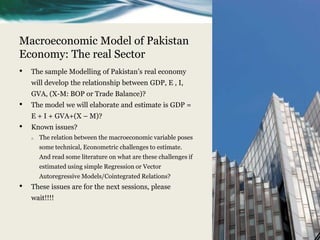

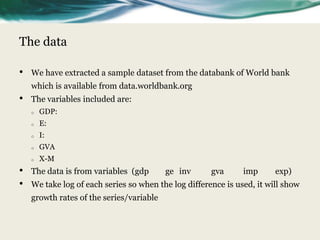

2. It presents a basic model relating GDP to consumption (E), investment (I), and net exports (X-M) to be estimated using OLS regression.

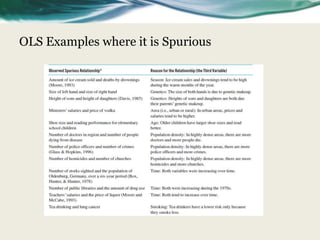

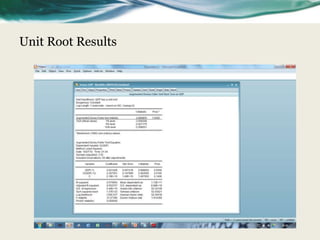

3. However, the document notes that OLS may produce spurious results with non-stationary time series data, so it introduces unit root and cointegration testing to determine the appropriate estimation technique.