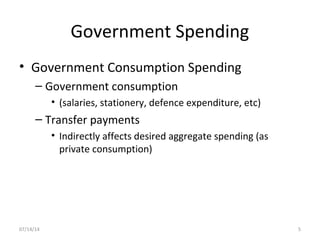

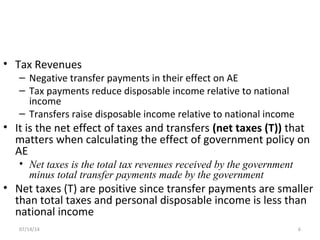

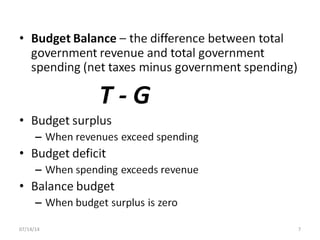

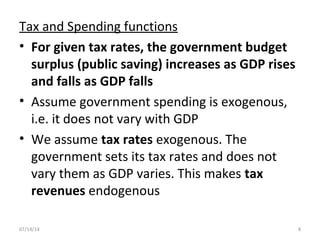

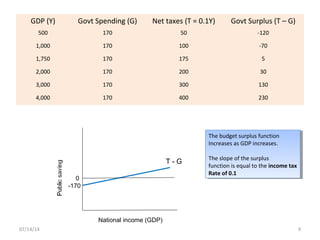

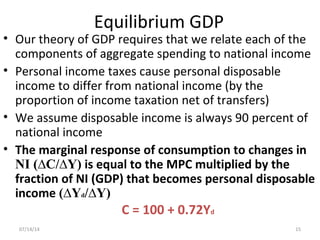

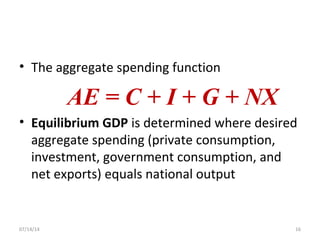

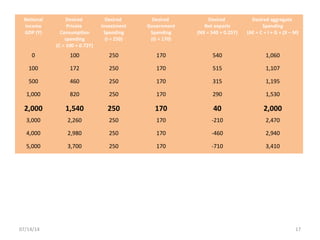

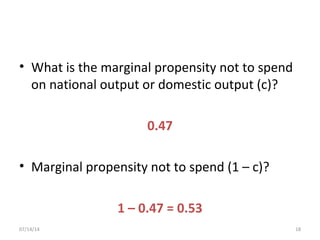

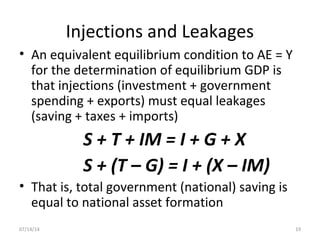

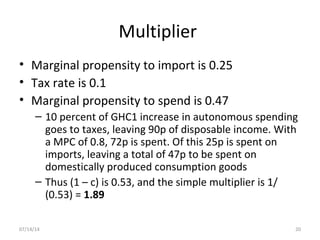

This document discusses how the government sector affects equilibrium GDP in an open economy model. It states that government spending and taxes impact GDP through their effects on autonomous and induced spending. Government spending is part of autonomous spending, while taxes reduce disposable income. A change in the tax rate would shift the aggregate expenditures curve and change equilibrium GDP. The multiplier also depends on the tax rate, with a lower rate leading to a higher multiplier. Equilibrium requires aggregate expenditures to equal GDP.