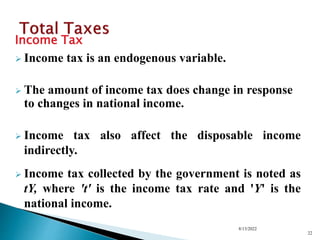

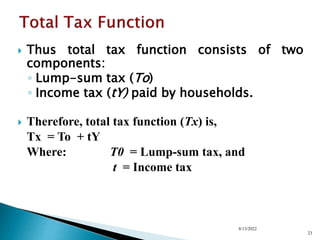

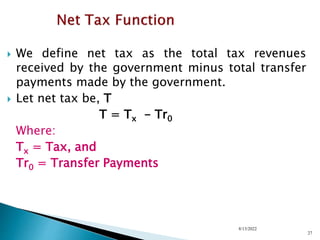

This document discusses national income accounting and the circular flow of income in economies with different numbers of sectors. It begins by defining key concepts like GDP, the expenditure and income approaches. It then examines two, three and four sector economies, defining sectors like household, business, government and foreign. It provides equations to represent the expenditure and income components in each economy, like consumption functions, investment, taxes and transfers. Overall, the document provides an overview of national income accounting and circular flow models in different types of economies.