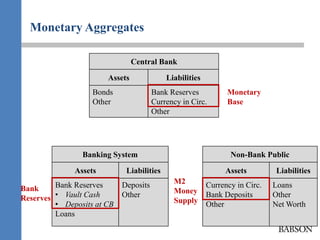

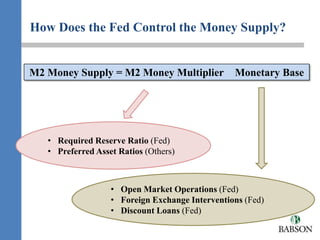

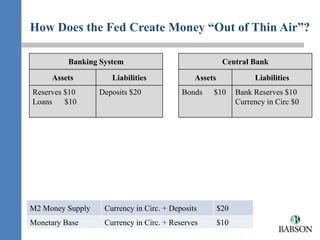

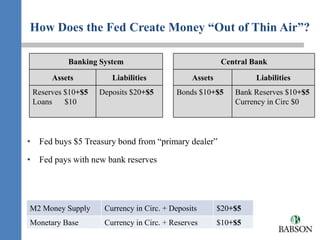

The document discusses central banks and monetary policy tools. It explains that central banks can control the money supply by changing the monetary base through open market operations, foreign exchange interventions, and discount loans. It also notes they can impact the money supply by adjusting the required reserve ratio set for banks. The document provides examples of how central banks can expand the monetary base and money supply by purchasing assets from banks, like bonds, in exchange for reserves. This process allows them to effectively create more money in the banking system.