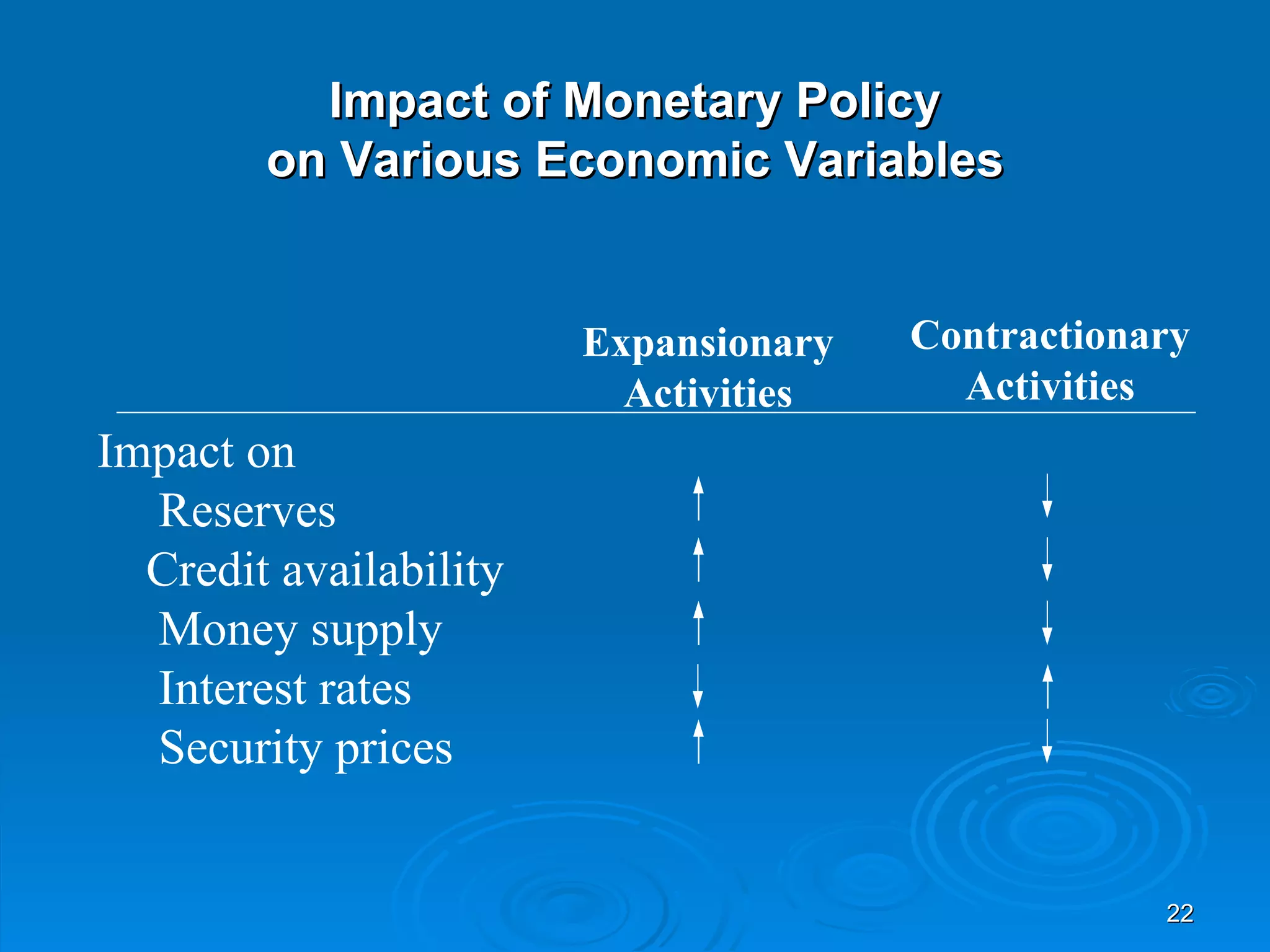

The document outlines the major duties and functions of central banks, including conducting monetary policy, supervising financial institutions, and maintaining financial stability. It describes the tools that central banks use to implement monetary policy, such as open market operations, reserve requirements, and the discount rate. The goals of monetary policy are also discussed, including price stability, economic growth, and maintaining stable interest and exchange rates.