Here are some tips for paying while travelling abroad:

- Carry some foreign cash for small purchases, but don't carry large amounts.

- Consider getting travellers' cheques in the local currency for security.

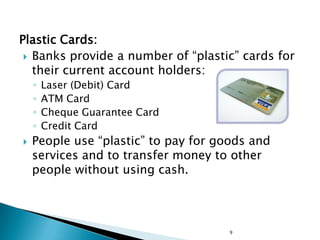

- Bring your debit card to withdraw local cash from ATMs. Inform your bank before travel.

- Bring a credit card as backup for larger purchases, but pay it off each month.

- Consider a prepaid travel card loaded with local currency to avoid fees on each transaction.

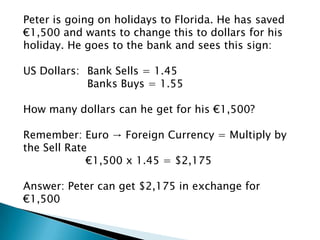

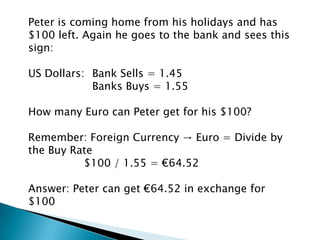

- Always keep receipts and be aware of exchange rates when paying or withdrawing funds.