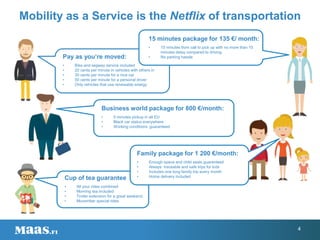

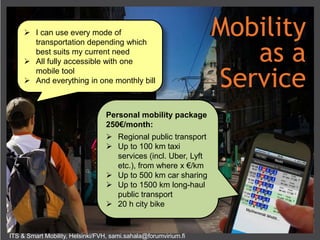

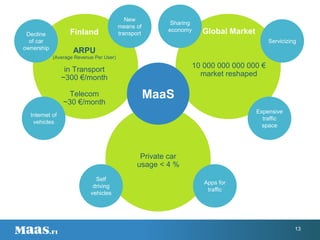

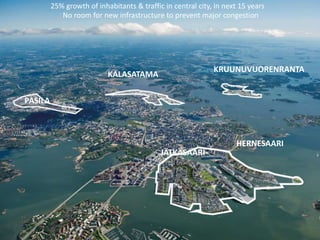

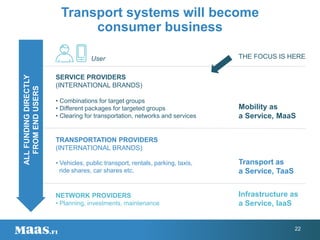

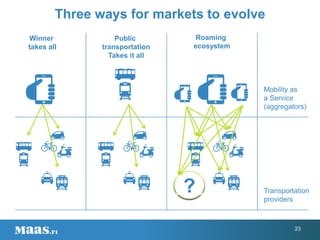

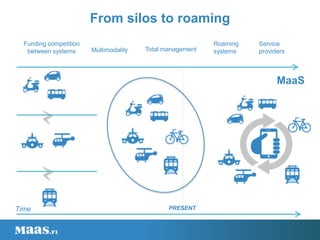

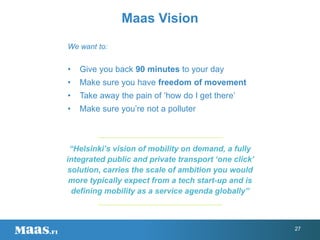

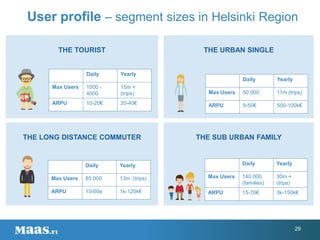

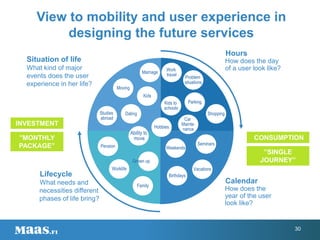

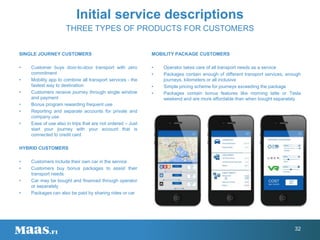

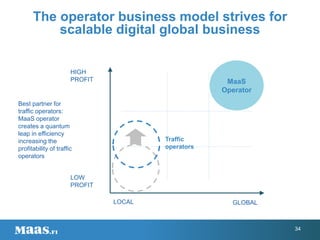

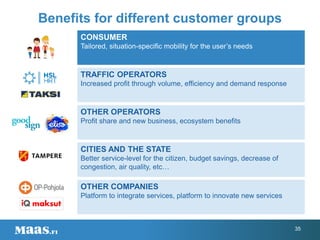

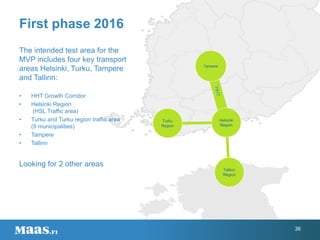

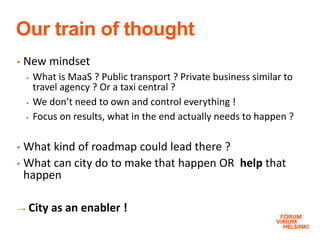

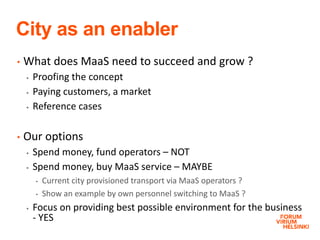

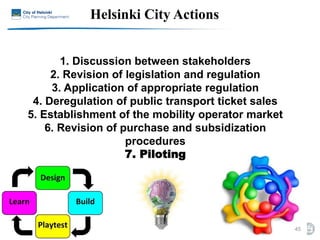

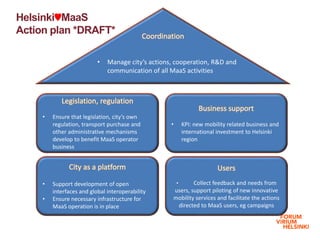

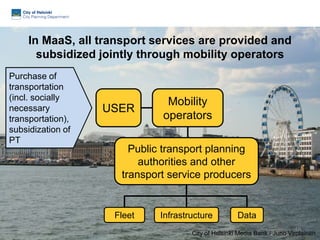

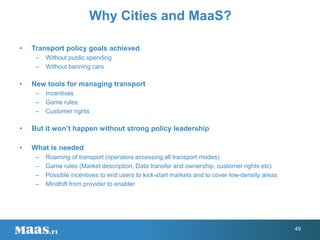

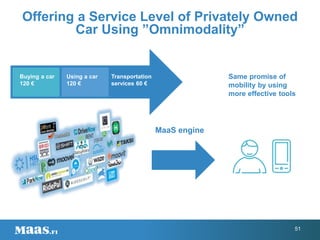

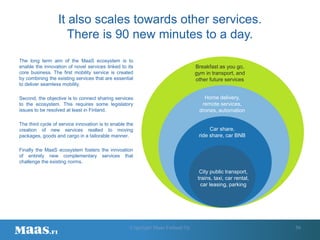

Mobility as a Service (MaaS) aims to provide integrated transportation services through monthly subscription packages. It proposes combining public transit, taxis, rental cars, and other transportation options into single service accessible through an app. Key benefits include convenience, flexibility, and reducing private car ownership. MaaS Ltd plans to launch the world's first "mobility operator" starting with pilot programs in Helsinki, Turku, Tampere, and Tallinn regions. Cities can support MaaS by enabling proof of concept tests, helping it access customers and create reference cases, without directly funding operators or services.