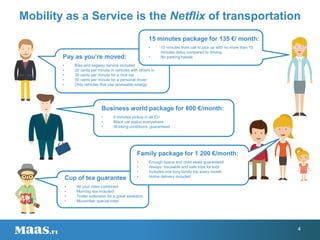

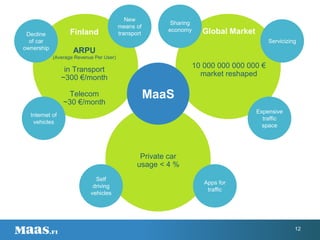

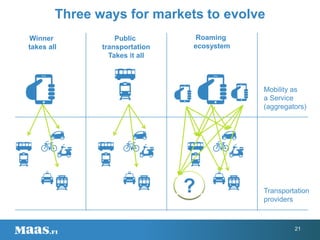

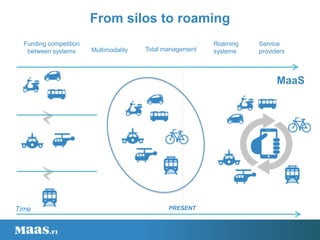

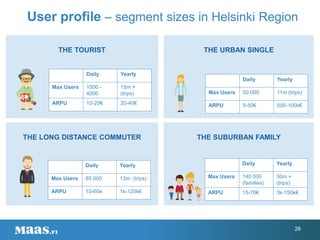

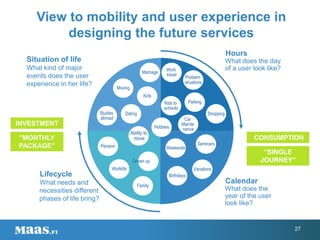

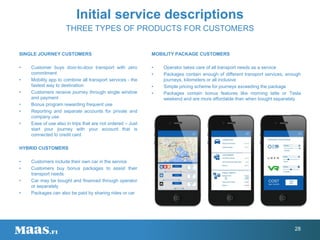

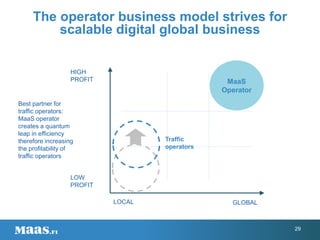

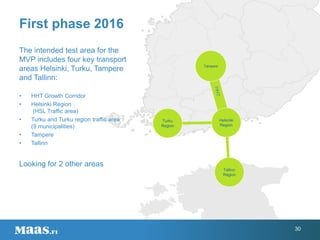

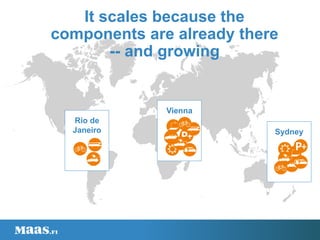

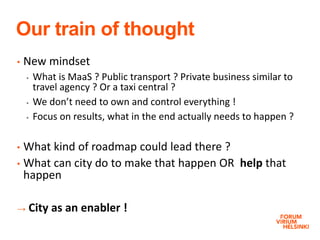

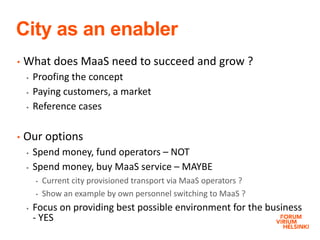

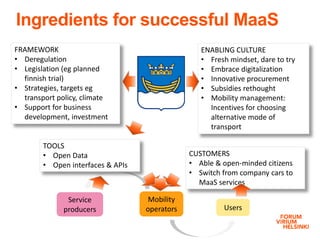

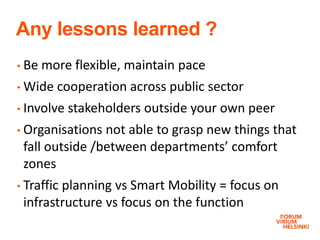

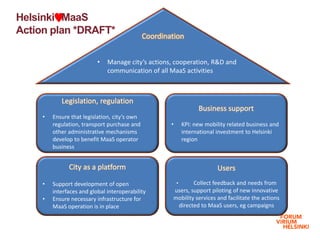

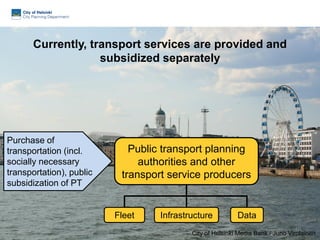

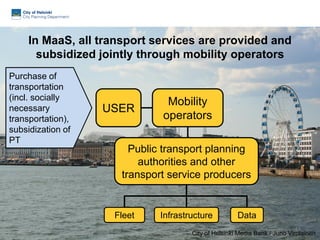

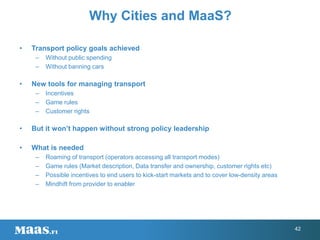

Mobility as a Service (MaaS) aims to provide integrated transport services through a single platform. It would offer monthly packages for transport needs that combine different options like public transit, taxis, rental cars and bikes. This could potentially be cheaper and more convenient than private car ownership. MaaS Ltd plans to be the world's first "mobility operator" and revolutionize transportation globally by offering customized packages through a single interface. Cities play an important role in enabling MaaS through open data, deregulation, and supporting new mobility businesses and services.