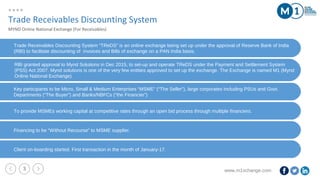

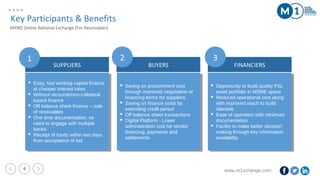

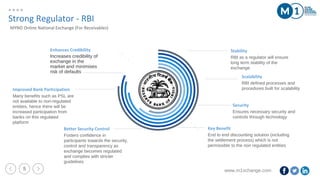

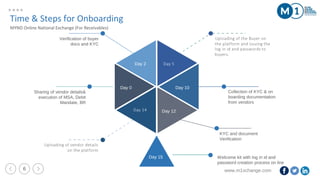

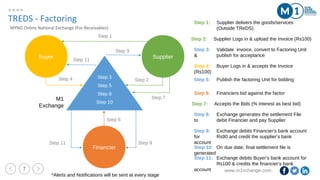

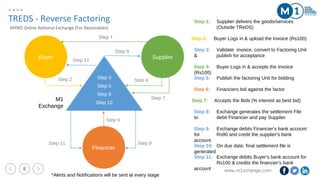

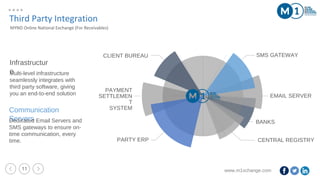

The document discusses M1, an online exchange for trade receivables discounting set up by Mynd Solutions and approved by the Reserve Bank of India. It outlines key participants like MSME suppliers, large corporate buyers, and banks/NBFCs. Suppliers can access working capital through invoice discounting via open bidding. The exchange facilitates off-balance sheet financing without recourse to suppliers. It also details participant benefits, the onboarding process, and how invoice discounting and reverse factoring work on the exchange platform.