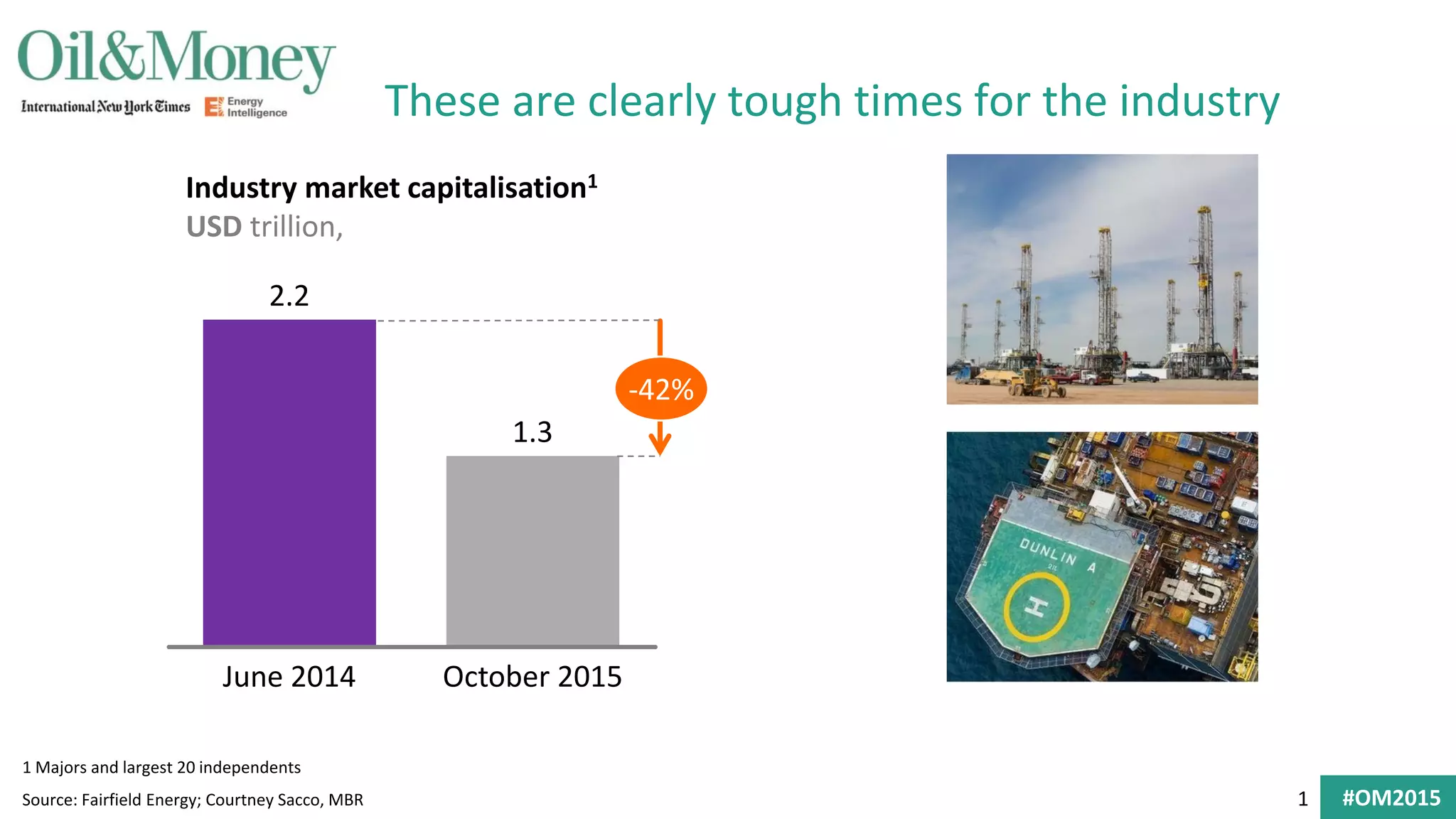

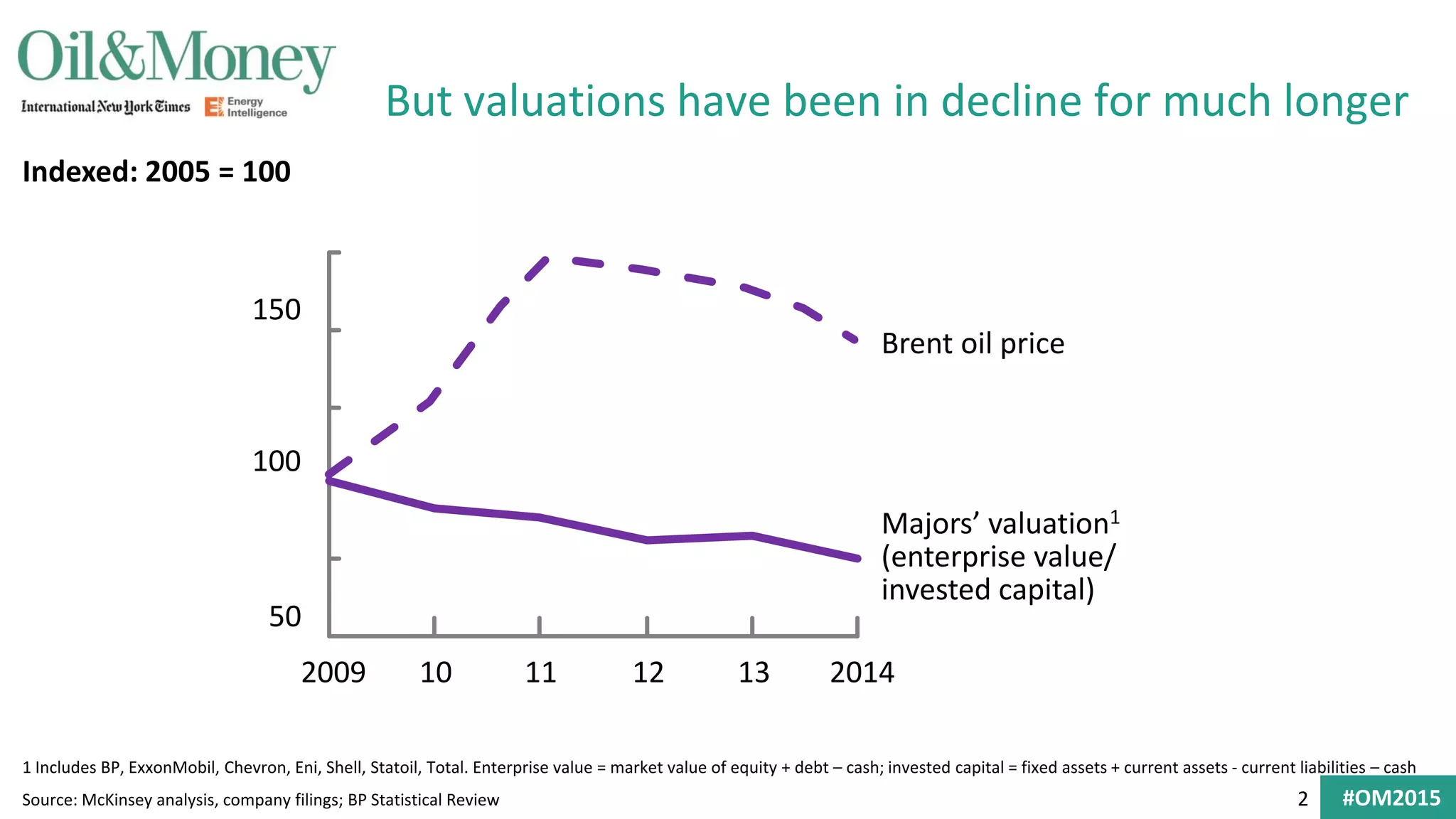

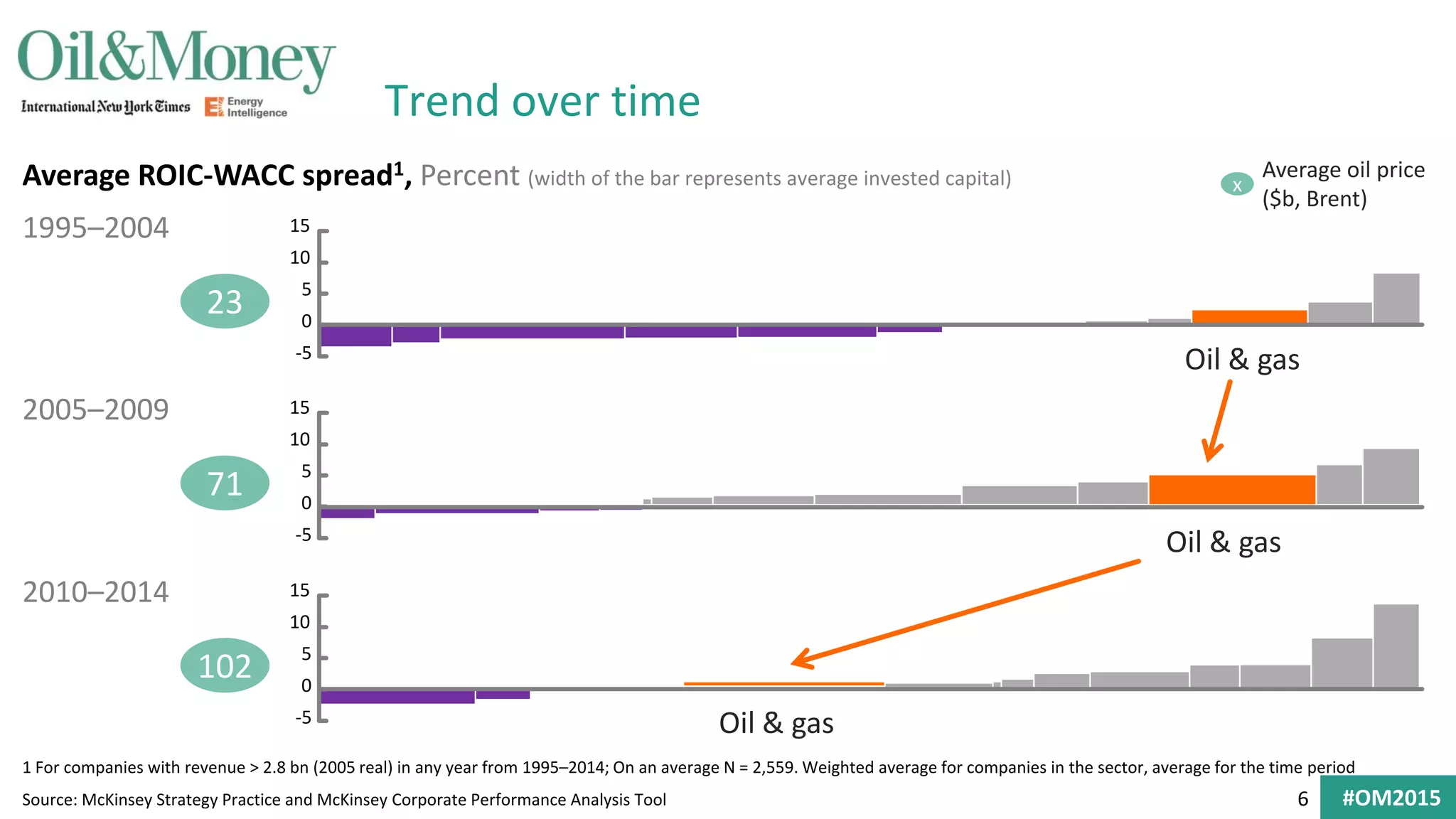

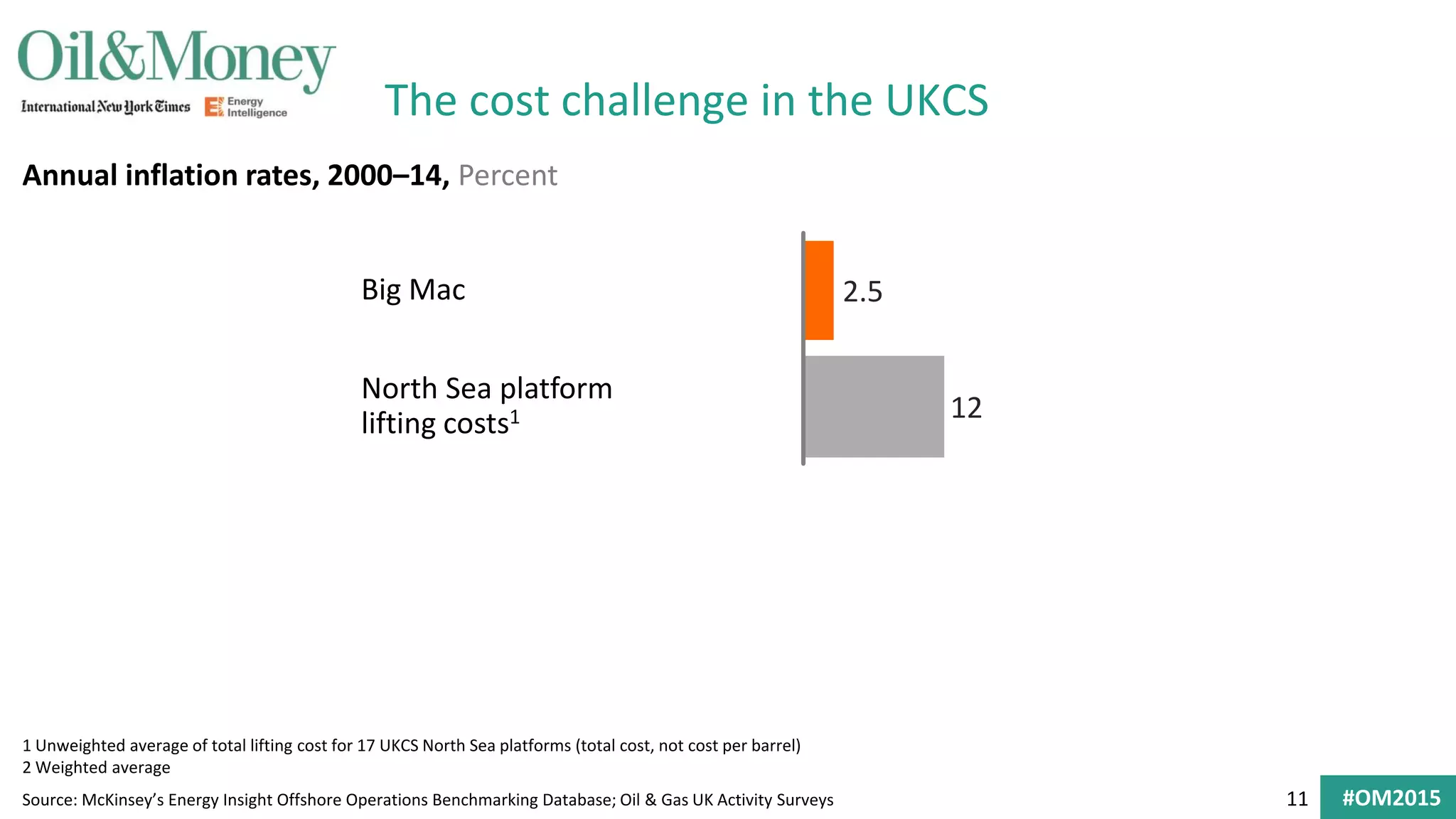

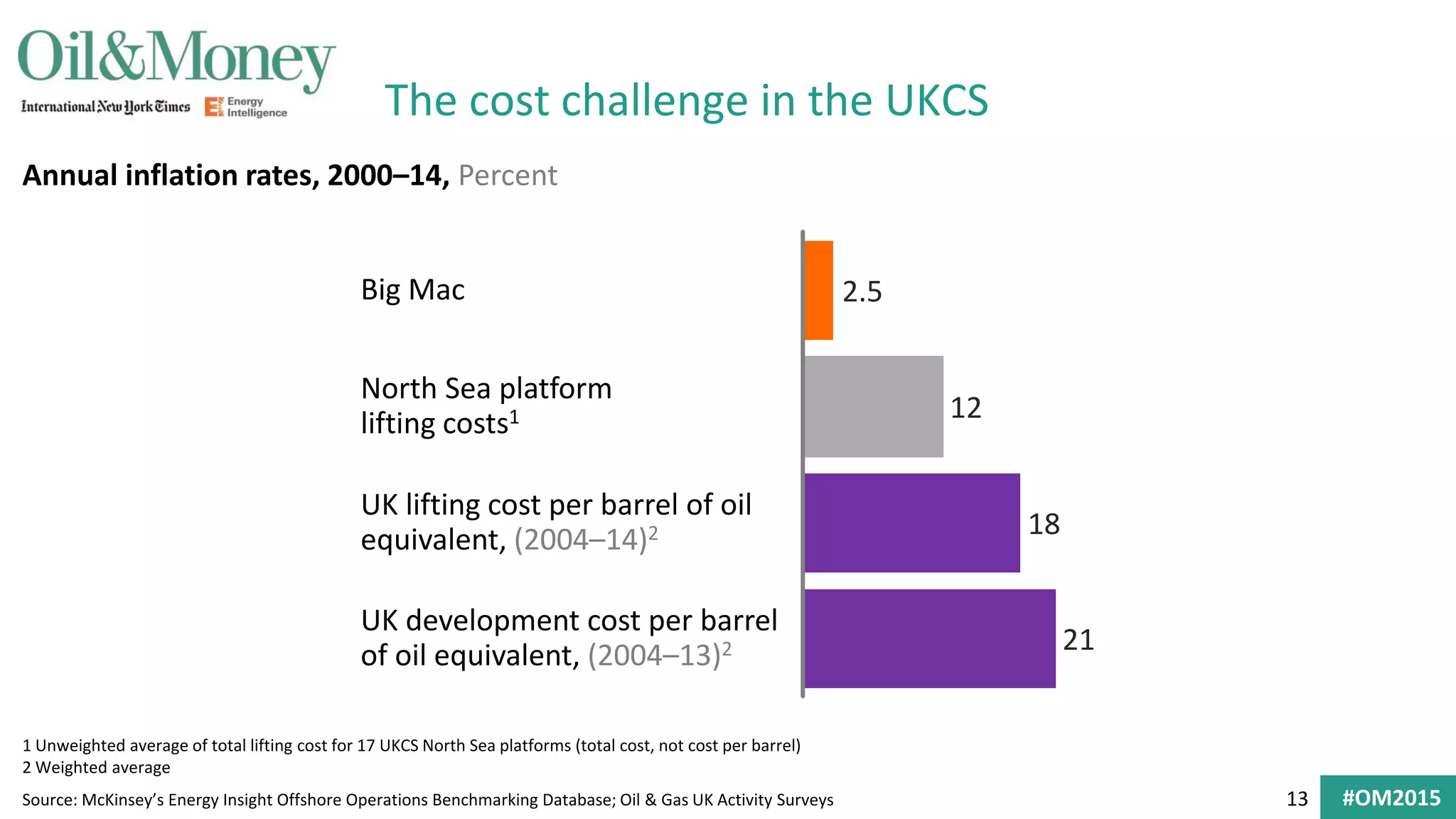

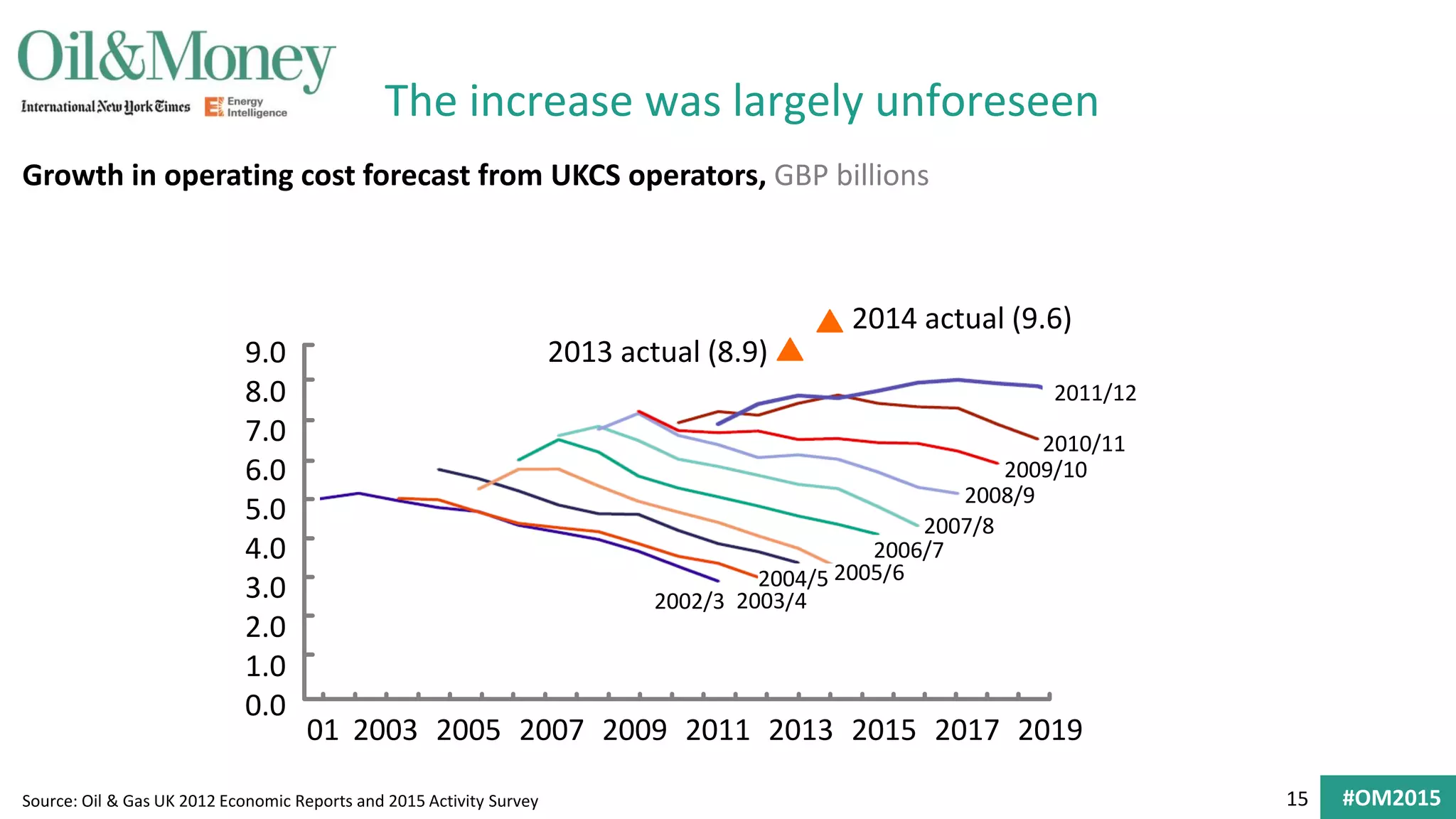

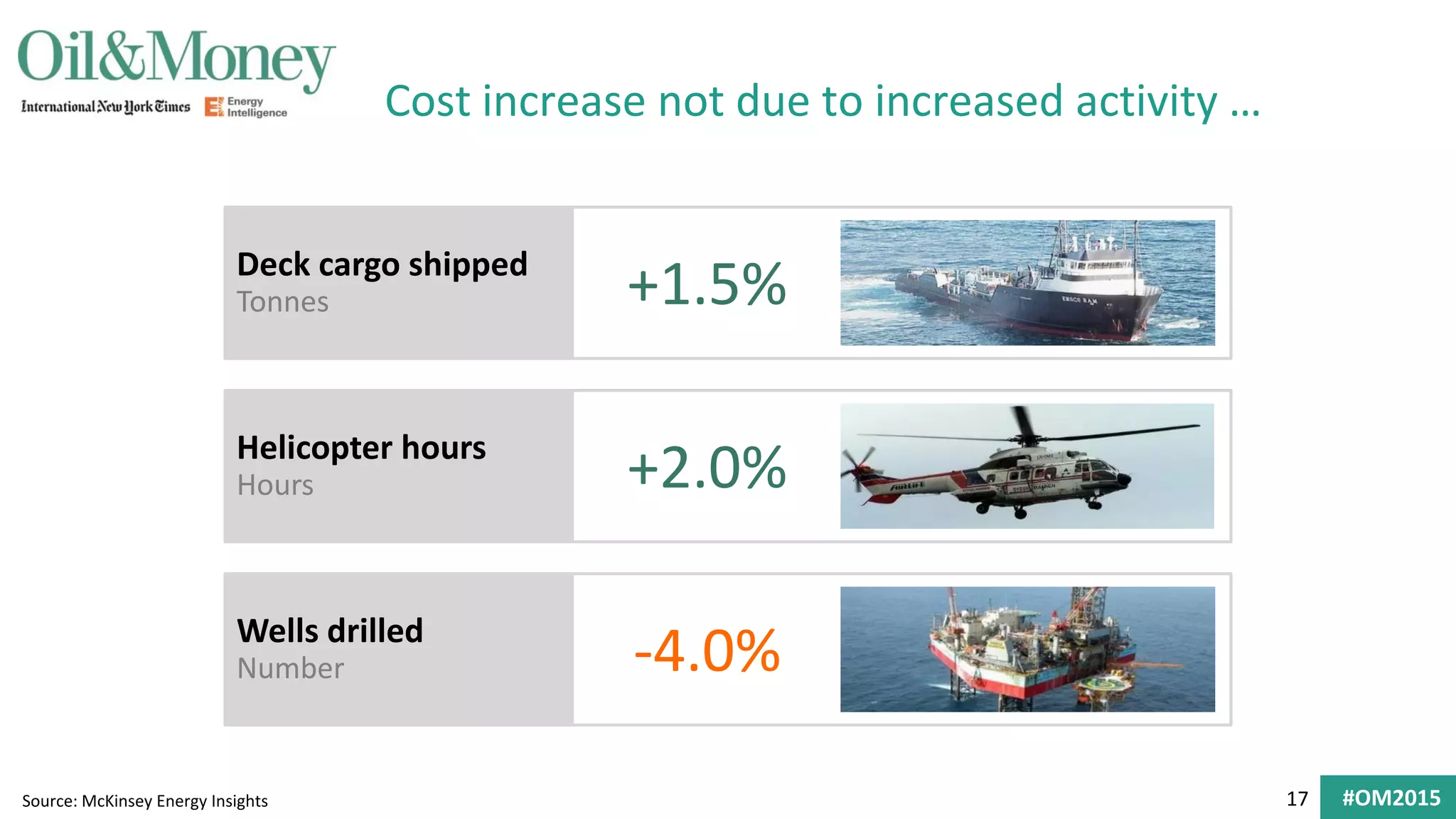

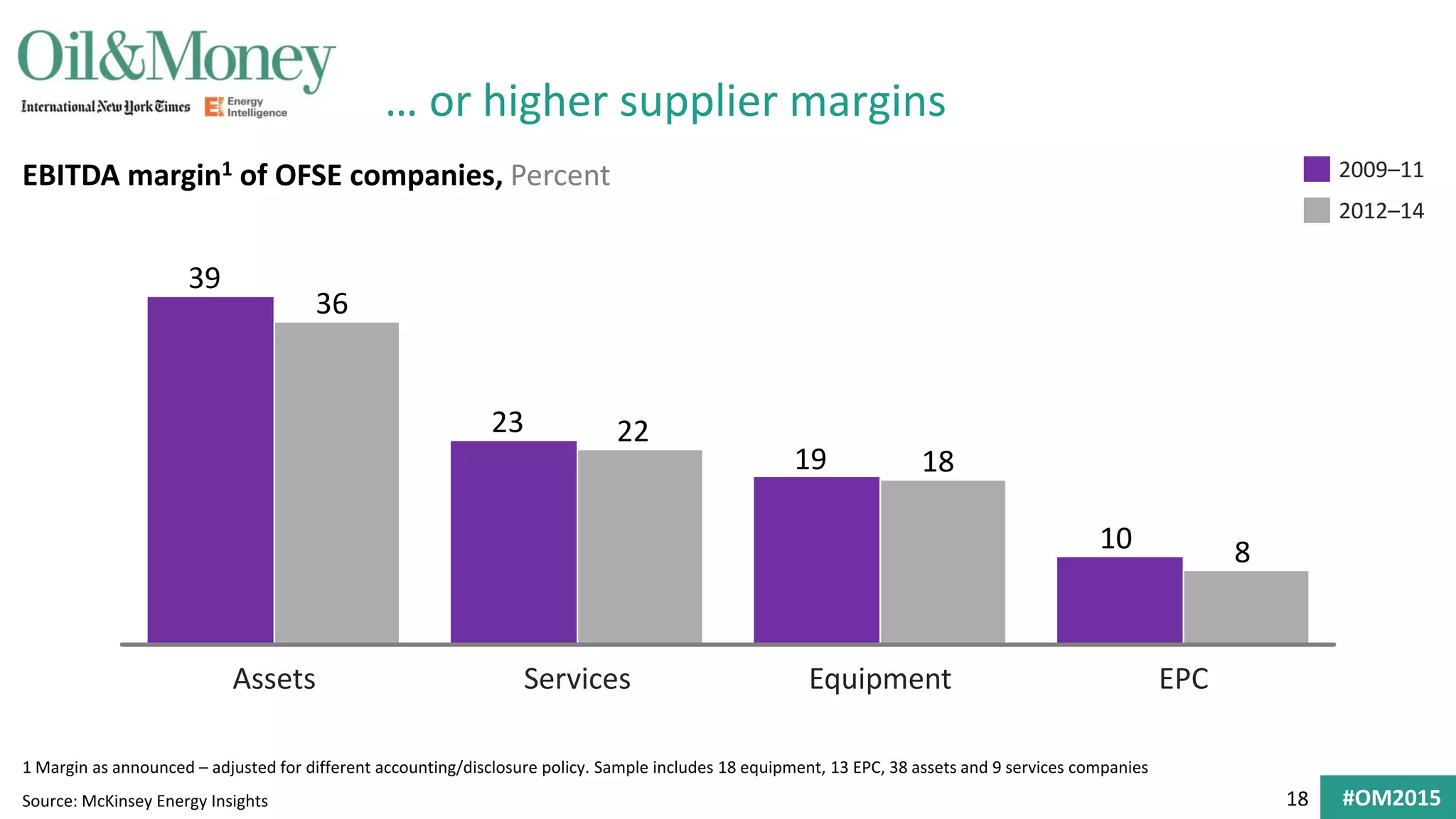

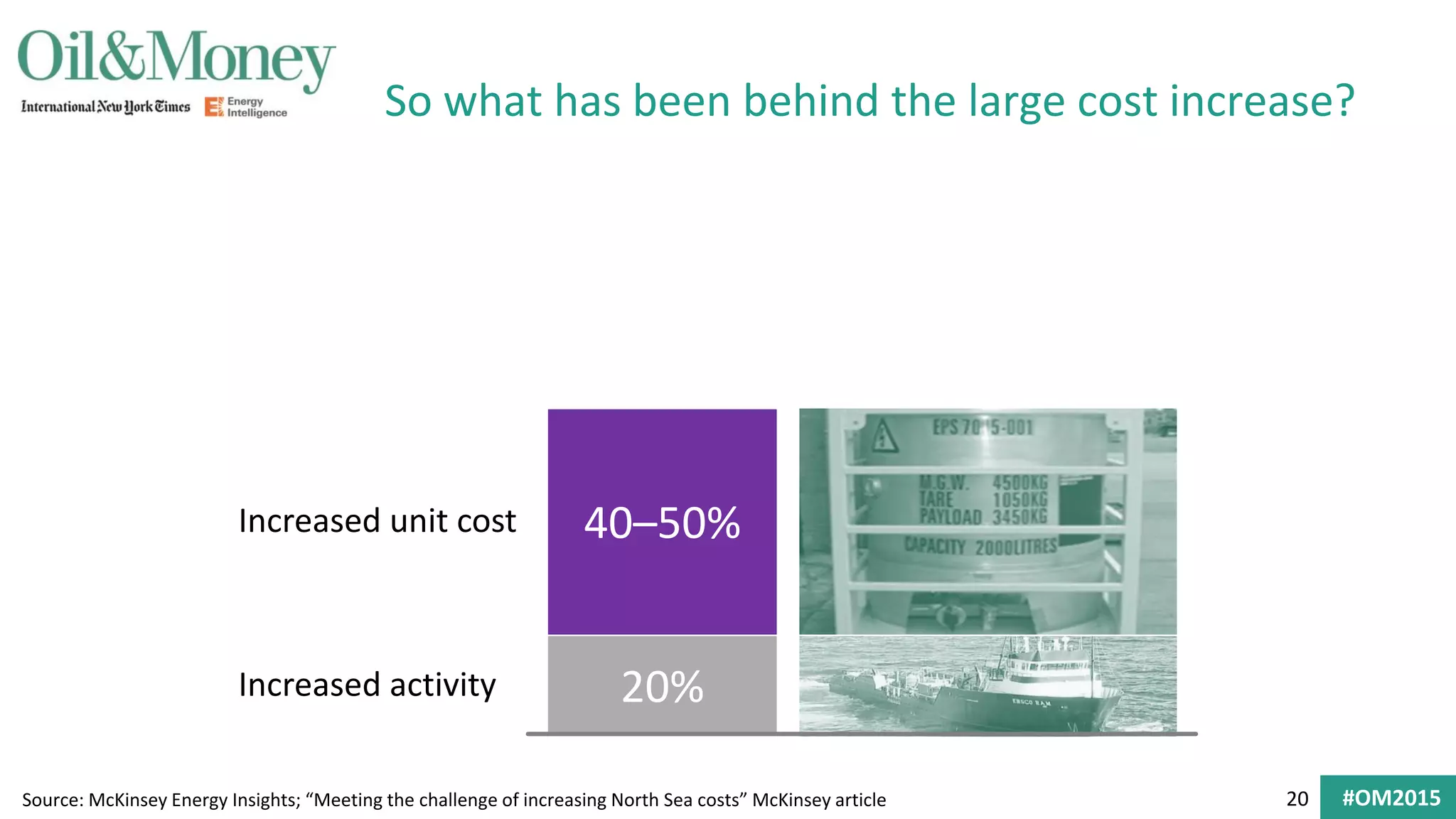

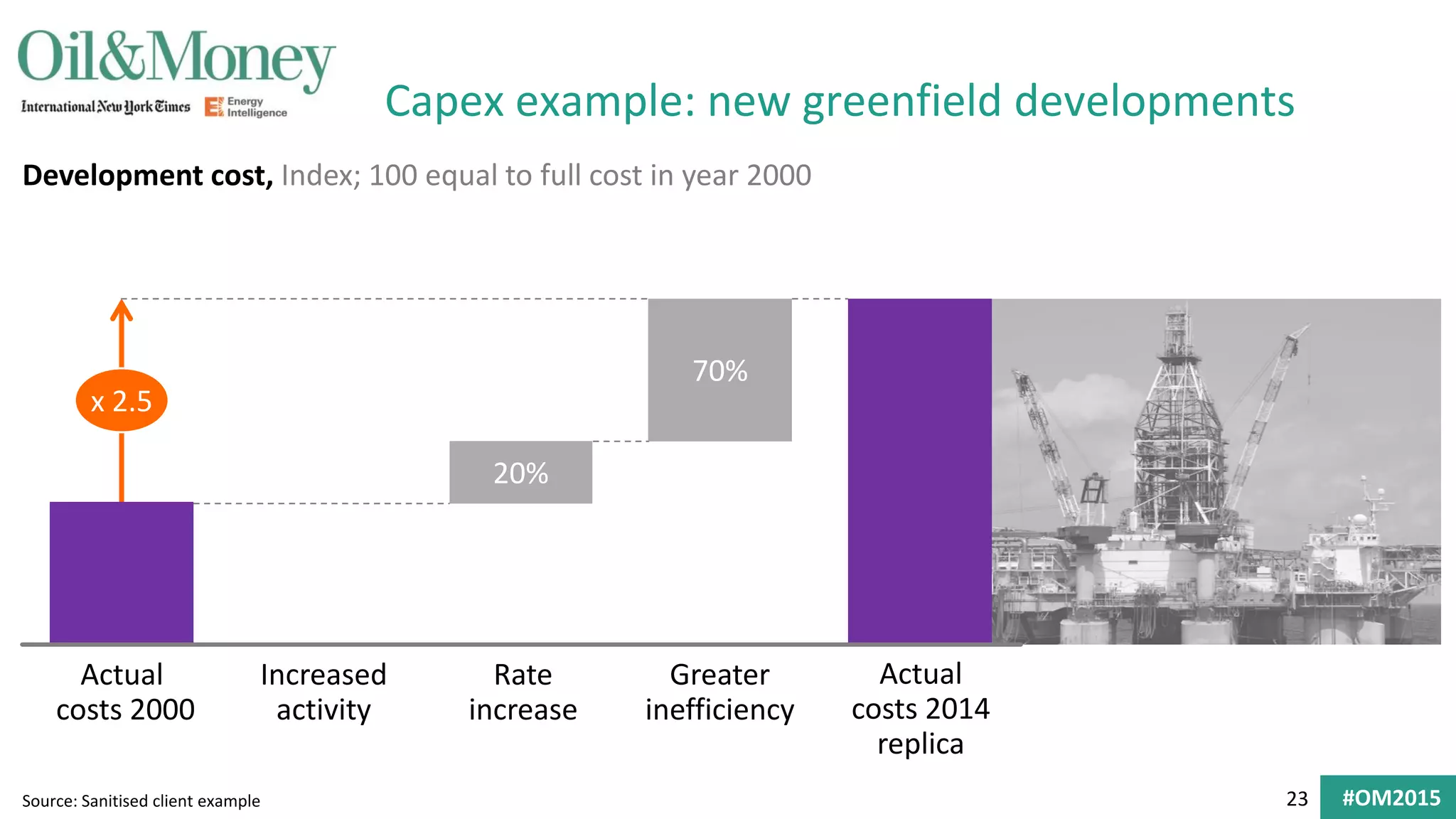

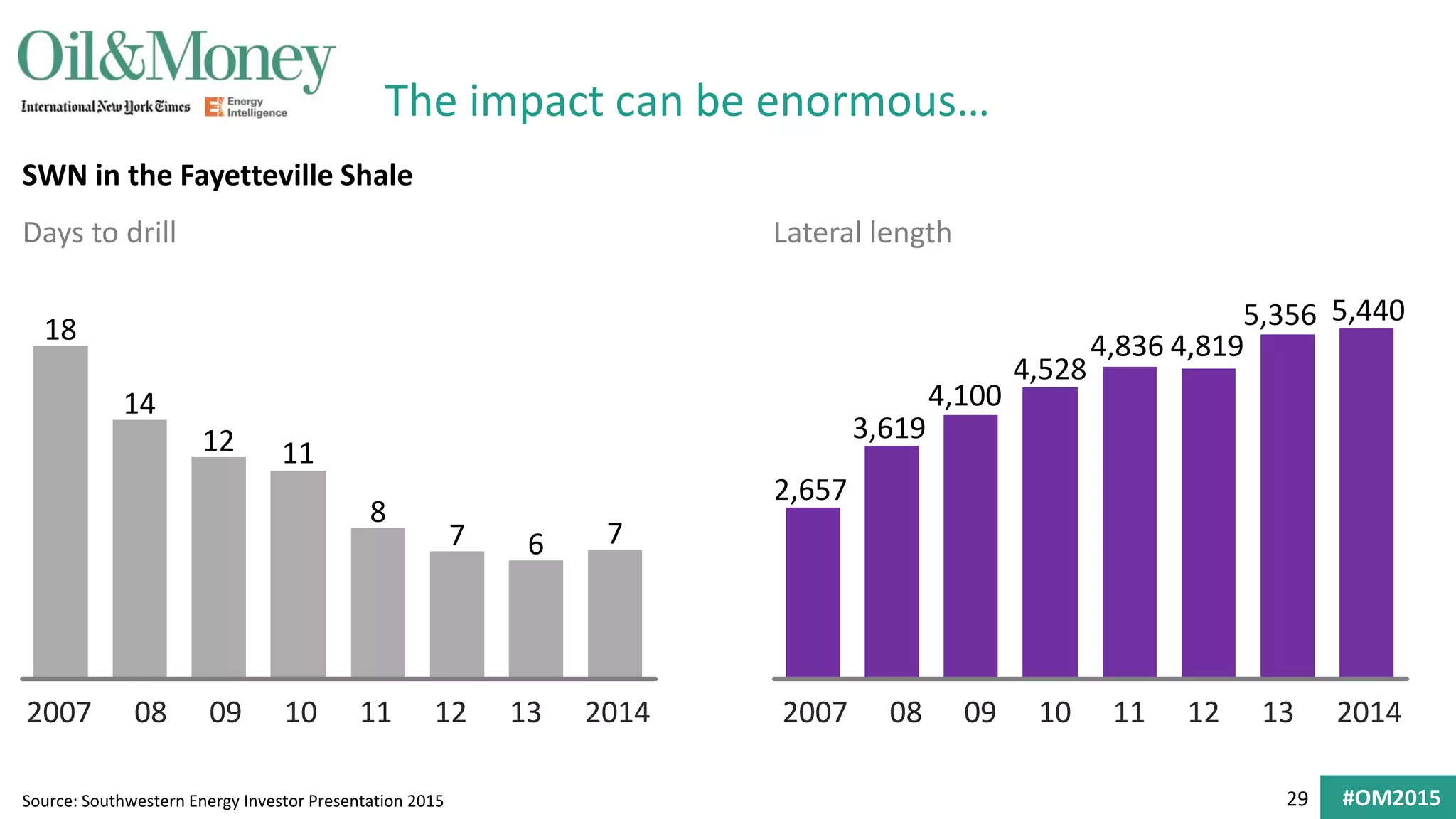

The document discusses the challenges faced by the North Sea oil and gas industry amidst declining market capitalizations, emphasizing a significant drop in valuations over time. It highlights the rising operational costs in the UK Continental Shelf (UKCS) and suggests that increased inefficiencies, rather than heightened activity, have contributed to this. The report indicates that transformative approaches and incremental improvements in operations are necessary for the sector to recover and enhance productivity.