The document provides an overview of limited liability partnerships (LLPs) in India, including:

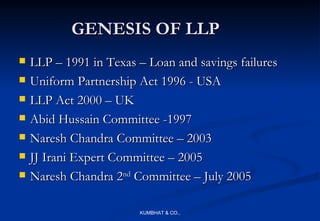

1) It traces the genesis and development of LLP laws internationally and in India through various committees from 1997-2005.

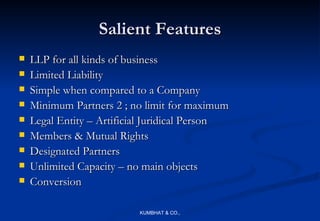

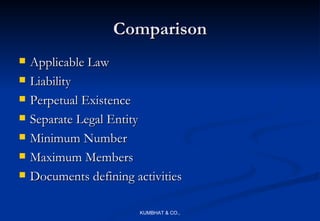

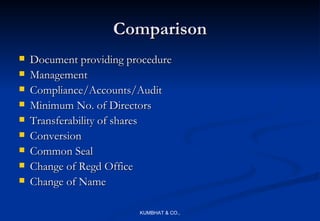

2) The key features of LLPs in India are that they provide limited liability, require a minimum of 2 partners, have no limit on maximum partners, and offer flexibility in structure while maintaining compliance requirements.

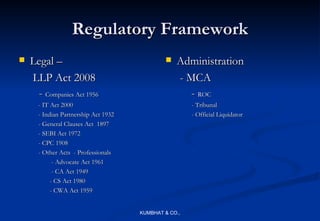

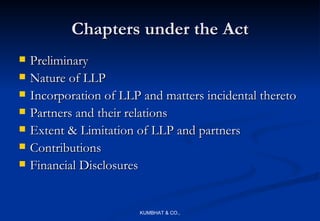

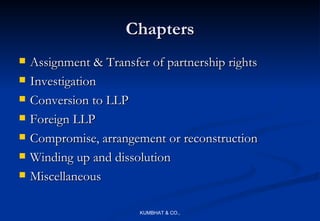

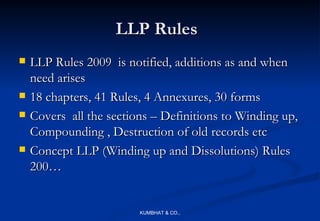

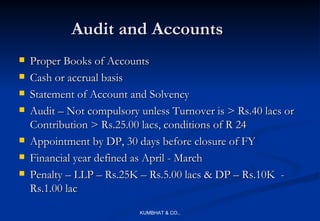

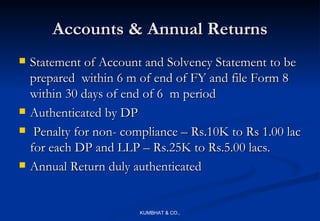

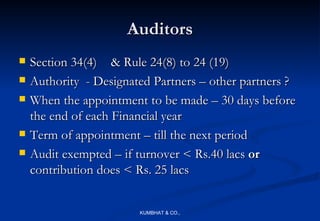

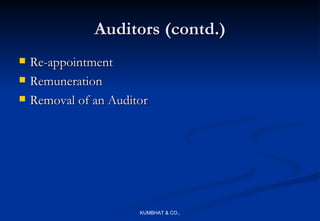

3) LLPs are formed similar to companies and are regulated through the LLP Act 2008 as well as rules on administration, taxation, and other legal frameworks.