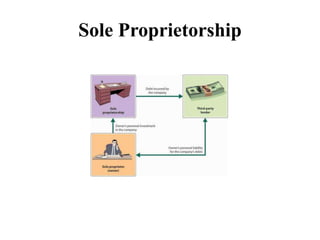

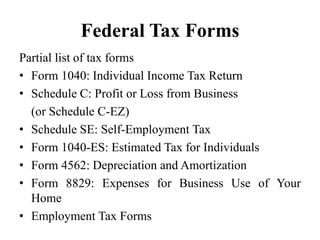

A sole proprietorship is a business owned and operated by one individual. It is the easiest business type to form, requiring no formal establishment, though licenses may be needed. The sole proprietor owns all profits and assumes all losses and liabilities of the business. Upon the owner's death, the business ceases to exist. The sole proprietor reports business income and expenses on personal tax returns using various forms like Schedule C.