The document discusses potential insurance coverage for business litigation. It provides an overview of liability insurance, explaining that it protects against legal claims and pays for both legal costs and damages if found liable. It also details the broad duty of insurance companies to defend policyholders in lawsuits. The document outlines important features of liability insurance policies and case law establishing insurers' defense obligations, even for uncovered claims or where exclusions may apply. It notes that coverage can sometimes be found in counterintuitive situations involving various types of legal claims.

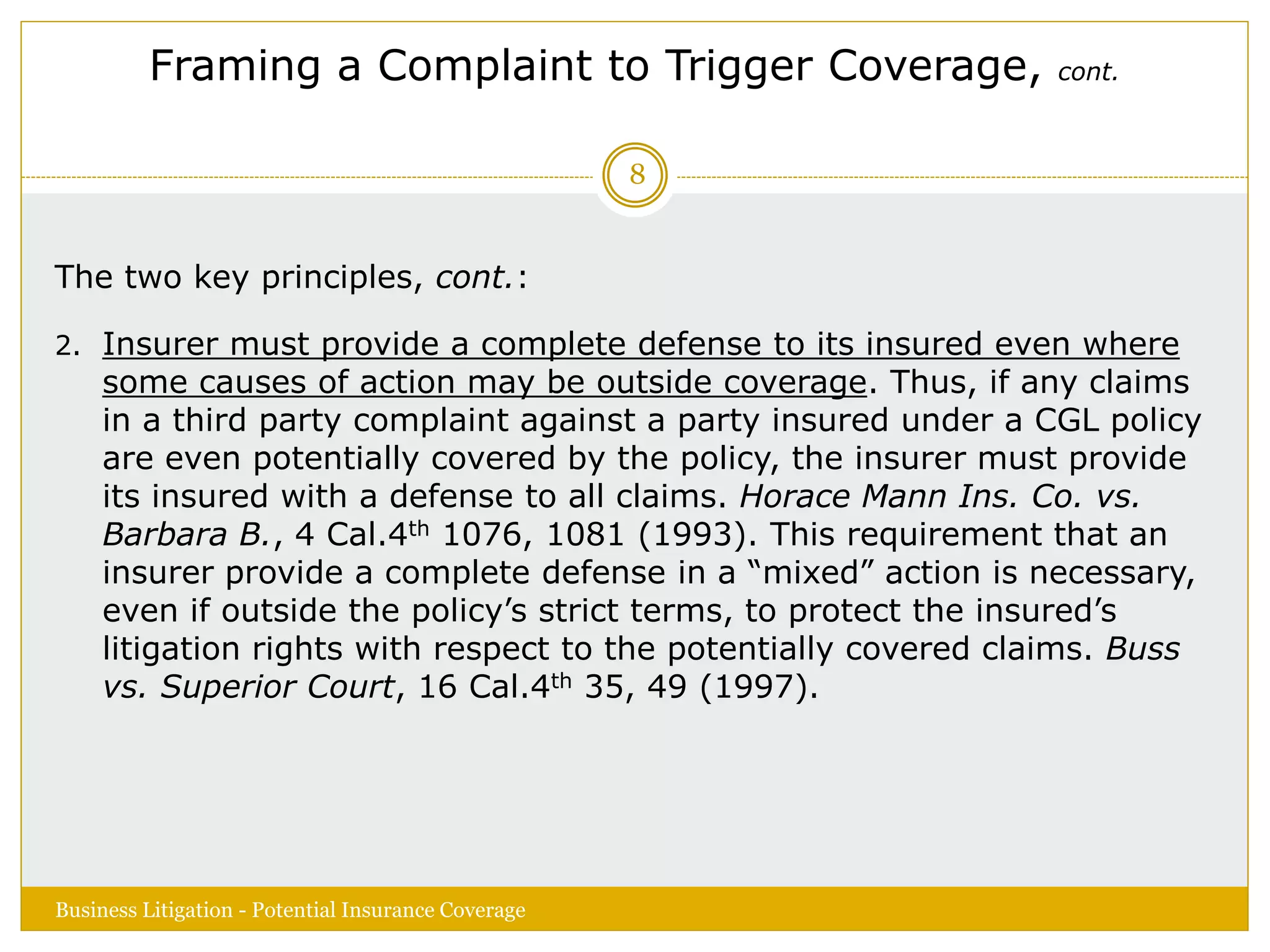

![Reservation of Rights, cont.

"An insured is entitled to know early in the litigation process whether the

insurer intends to honor [its] duty [to defend] in order that the insured may

take steps to defend himself. If in fact the insurer undertakes that defense

the insured may reasonably rely upon the nonexistence of policy defenses. To

hold otherwise would allow the insurer to conduct the defense of the action

without the knowledge of the insured that a conflict of interest exists

between itself and the insurer. The conflict is that the insurer retains a policy

defense which would relieve the insurer of all liability while simultaneously

depriving the insured of the right to conduct his own defense. It is the

reliance of the insured upon the insurer's handling of the defense and the

subsequent prejudice which gives rise to an estoppel in the first instance

against the insurer from raising policy defenses.“ Penn-America Ins Co. v.

Sanchez, 220 Ariz. 7, 202 P. 3d 472 (2008).

Business Litigation - Potential Insurance Coverage

10](https://image.slidesharecdn.com/d14c790d-eea7-4d96-99a2-c8f1aa71ea31-161012172533/75/Selvin_Potential-Insurance-Coverage-10-2048.jpg)

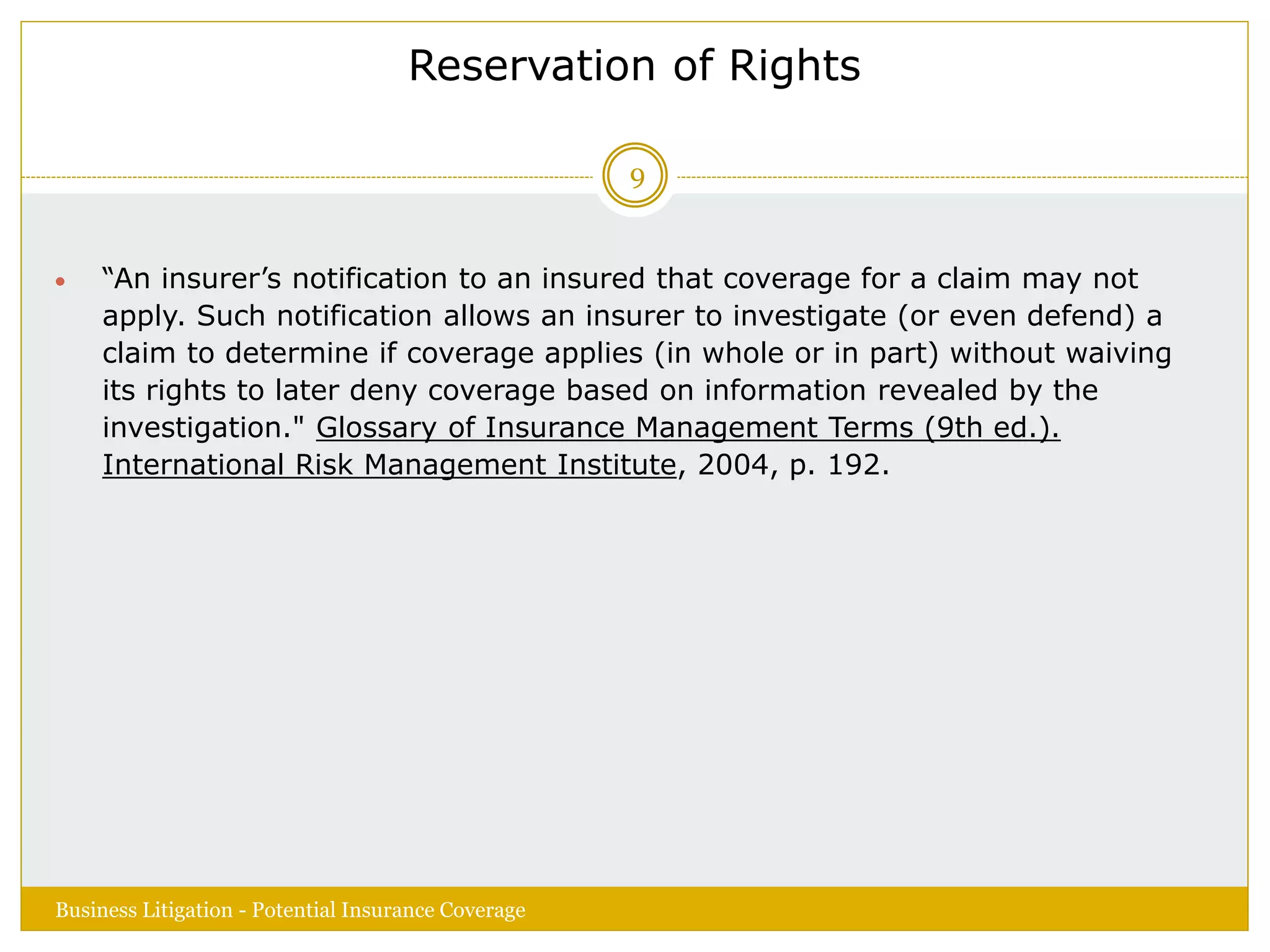

![The Duty to Defend

Under Civil Code § 2778(4), the duty to defend is implied in all liability

insurance contracts unless the policy clearly and unambiguously excludes

such a duty. One of the most basic cornerstones of modern insurance law is

that the duty to defend is broader than the duty to indemnify. Gray v. Zurich

Ins. Co., 65 Cal. 2d 263 (1966).

In order to trigger an insurer’s duty to defend, “the insured need only show

that the underlying claim may fall within policy coverage.” Montrose Chemical

Corp. v. Superior Court, 6 Cal. 4th 287, 300 (1993). “[T]he insurer must

prove it ‘cannot.’” Montrose, 6 Cal. 4th at 300 (1993). This is so even if a

claim is “insubstantial” and would not support an award of damages. Horace

Mann Ins. Co. v. Barbara B., 4 Cal. 4th 1076, 1086 (1993).

By contrast, the duty to indemnify is governed by facts established at trial.

City of Laguna Beach v. Mead Reinsurance Corp., 226 Cal. App. 3d 822, 829-

830 (1990). An insurer is obligated to indemnify against liability only if facts

proven at trial show a covered claim. (California Insurance Law Handbook

(2011) at § 46:1)

Business Litigation - Potential Insurance Coverage

11](https://image.slidesharecdn.com/d14c790d-eea7-4d96-99a2-c8f1aa71ea31-161012172533/75/Selvin_Potential-Insurance-Coverage-11-2048.jpg)

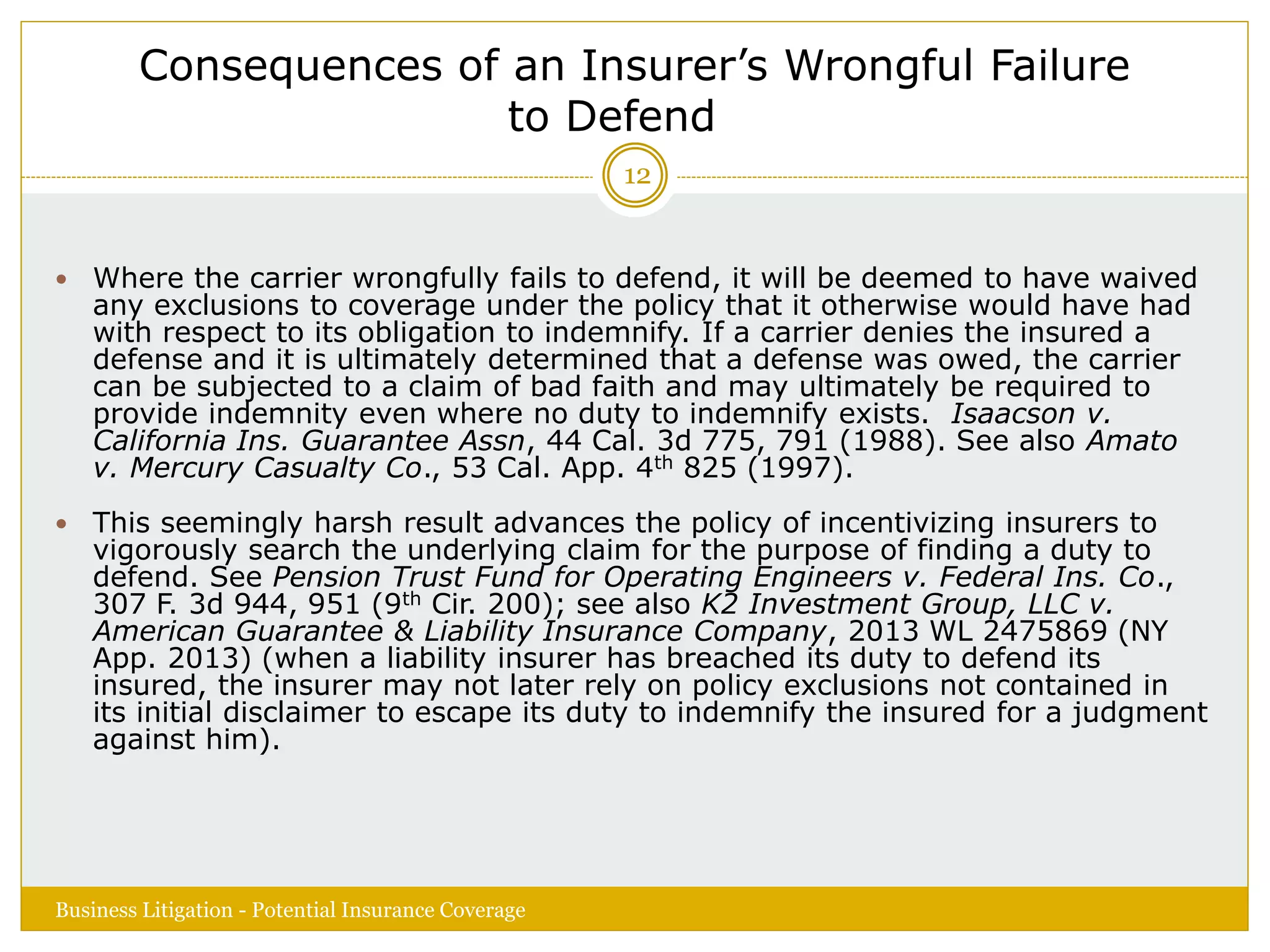

![“Cumis” Counsel’s Direct Exposure for Fees

Unnecessary for the Insureds’ Defense

In 2015, the California Supreme Court decided in Hartford Casualty

vs. J. R. Marketing, LLC, 61 Cal.4th 998 (2015) that an insurer may

seek reimbursement directly from so-called “Cumis” counsel for fees

attributable to time that was fraudulent or was otherwise manifestly

useless and wasteful when incurred.

“Cumis counsel have been unjustly enriched at the insurer’s

expense [and they] provide no convincing reason why they

should be absolutely immune from liability for enriching

themselves in this fashion.”

Business Litigation - Potential Insurance Coverage

15](https://image.slidesharecdn.com/d14c790d-eea7-4d96-99a2-c8f1aa71ea31-161012172533/75/Selvin_Potential-Insurance-Coverage-15-2048.jpg)

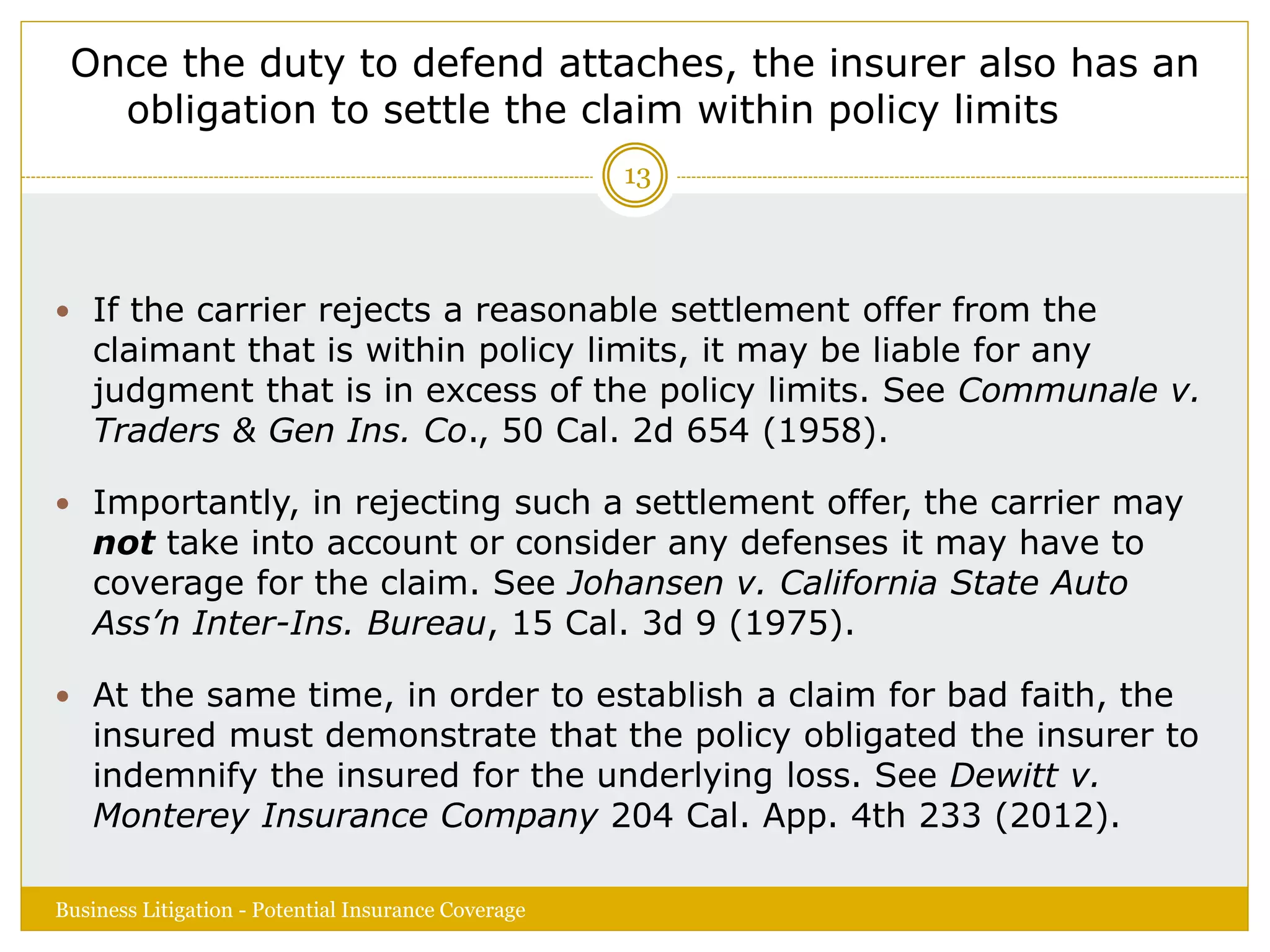

![Trade Dress Claims

Recognizing that a product’s design or appearance may inherently

also constitute a form of “advertising,” several courts have held that

trade dress inherently constitutes “advertising” within the meaning of

a CGL policy.

See St. Paul Fire and Marine Ins. Co., v. Advanced Interventional Systems, 824 F. Supp.

583, 585 (E.D. Va. 1993), affirmed 21 F. 3d 424 (4th Cir. 1994) (holding that trade dress

infringement “expresses essentially the same concept” as the term “style of doing

business”); Poof Toy Products Inc. v. U.S. Fid. & Guar. Co., 891 F. Supp. 1228, 1232

(E.D. Mich. 1995) (trade dress infringement constitutes “advertising injury” under the

advertising injury “offense” or “misappropriation of advertising ideas or style of doing

business”); Peerless Lighting Corp. v. American Motorists Ins. Co., 82 Cal. App. 4th 995,

1000, fn 4 (2000) (“infringement of trade dress arguably qualifies as ‘[m]isappropriation

of advertising ideas or style of doing business.’”)

Business Litigation - Potential Insurance Coverage

27](https://image.slidesharecdn.com/d14c790d-eea7-4d96-99a2-c8f1aa71ea31-161012172533/75/Selvin_Potential-Insurance-Coverage-27-2048.jpg)

![The California Supreme Court Decision In Hartford

Casualty v. Swift Distribution, 59 Cal. 4th 277 (2014)

But in 2014 the California Supreme Court significantly limited the

doctrine of “implied disparagement” in the insurance coverage context:

“In evaluating whether a claim of disparagement has been

alleged, courts have required that defendant’s false or misleading

statement have a degree of specificity that distinguishes direct

criticism of a competitor’s product or business from other

statements extolling the virtues or superiority of the defendant’s

product or business…[This] involves two distinct … requirements.

A false and misleading statement (1) must specifically refer to

the plaintiff’s product or business, and (2) must clearly derogate

that product or business”. Id. at 291.

Thus, an insured’s attempt to copy or infringe on the intellectual

property of another’s product does not, without more, constitute

disparagement. Id. at 296.

Business Litigation - Potential Insurance Coverage

30](https://image.slidesharecdn.com/d14c790d-eea7-4d96-99a2-c8f1aa71ea31-161012172533/75/Selvin_Potential-Insurance-Coverage-30-2048.jpg)