Bus 401 week 3 quiz

•Download as DOC, PDF•

0 likes•8 views

ash bus 401 week 3,ash bus 401week 3,ash bus 401,ash bus 401 week 3 tutorial,ash bus 401week 3 assignment,ash bus 401week 3 help,ash bus 401 week 3 dq 1,ash bus 401 week 3 dq 2,ash bus 401 week 3 quiz,ash bus 401 week 3 return on investment education funding

Report

Share

Report

Share

Recommended

Recommended

More Related Content

What's hot

What's hot (10)

Similar to Bus 401 week 3 quiz

International Best Tax practices in India || An Article by CA. Sudha G. BhushanInternational Best Tax practices in India || An Article by CA. Sudha G. Bhushan

International Best Tax practices in India || An Article by CA. Sudha G. BhushanTAXPERT PROFESSIONALS

Similar to Bus 401 week 3 quiz (20)

FIN 534 Week 8 Part 2 Capital Structure DecisionsSlide 1Intro.docx

FIN 534 Week 8 Part 2 Capital Structure DecisionsSlide 1Intro.docx

International Best Tax practices in India || An Article by CA. Sudha G. Bhushan

International Best Tax practices in India || An Article by CA. Sudha G. Bhushan

More from eyavagal

More from eyavagal (20)

Uop mpa 573 week 5 city council advisement part iii recent

Uop mpa 573 week 5 city council advisement part iii recent

Uop mpa 573 week 2 policy presentation (forecasting) recent

Uop mpa 573 week 2 policy presentation (forecasting) recent

Strayer mis 535 week 6 course project proposal paper

Strayer mis 535 week 6 course project proposal paper

Strayer mis 535 week 6 course project proposal paper (certify for employees)

Strayer mis 535 week 6 course project proposal paper (certify for employees)

Ash ece 353 week 5 discussions 1 cognitive development and learning new

Ash ece 353 week 5 discussions 1 cognitive development and learning new

Ash ece 353 week 4 discussions 2 relationships between cognitive

Ash ece 353 week 4 discussions 2 relationships between cognitive

Ese 633 week 5 assignment collaborative problem solving

Ese 633 week 5 assignment collaborative problem solving

Ese 633 week 4 assignment helping parents promote independence

Ese 633 week 4 assignment helping parents promote independence

Ese 633 week 3 dq 2 collaborative consultation model

Ese 633 week 3 dq 2 collaborative consultation model

Ese 633 week 2 assignment developing curriculum design

Ese 633 week 2 assignment developing curriculum design

Ese 633 week 1 assignment assessing conflict styles

Ese 633 week 1 assignment assessing conflict styles

Recently uploaded

https://app.box.com/s/x7vf0j7xaxl2hlczxm3ny497y4yto33i80 ĐỀ THI THỬ TUYỂN SINH TIẾNG ANH VÀO 10 SỞ GD – ĐT THÀNH PHỐ HỒ CHÍ MINH NĂ...

80 ĐỀ THI THỬ TUYỂN SINH TIẾNG ANH VÀO 10 SỞ GD – ĐT THÀNH PHỐ HỒ CHÍ MINH NĂ...Nguyen Thanh Tu Collection

Mehran University Newsletter is a Quarterly Publication from Public Relations OfficeMehran University Newsletter Vol-X, Issue-I, 2024

Mehran University Newsletter Vol-X, Issue-I, 2024Mehran University of Engineering & Technology, Jamshoro

https://app.box.com/s/7hlvjxjalkrik7fb082xx3jk7xd7liz3TỔNG ÔN TẬP THI VÀO LỚP 10 MÔN TIẾNG ANH NĂM HỌC 2023 - 2024 CÓ ĐÁP ÁN (NGỮ Â...

TỔNG ÔN TẬP THI VÀO LỚP 10 MÔN TIẾNG ANH NĂM HỌC 2023 - 2024 CÓ ĐÁP ÁN (NGỮ Â...Nguyen Thanh Tu Collection

Recently uploaded (20)

On National Teacher Day, meet the 2024-25 Kenan Fellows

On National Teacher Day, meet the 2024-25 Kenan Fellows

80 ĐỀ THI THỬ TUYỂN SINH TIẾNG ANH VÀO 10 SỞ GD – ĐT THÀNH PHỐ HỒ CHÍ MINH NĂ...

80 ĐỀ THI THỬ TUYỂN SINH TIẾNG ANH VÀO 10 SỞ GD – ĐT THÀNH PHỐ HỒ CHÍ MINH NĂ...

Unit 3 Emotional Intelligence and Spiritual Intelligence.pdf

Unit 3 Emotional Intelligence and Spiritual Intelligence.pdf

TỔNG ÔN TẬP THI VÀO LỚP 10 MÔN TIẾNG ANH NĂM HỌC 2023 - 2024 CÓ ĐÁP ÁN (NGỮ Â...

TỔNG ÔN TẬP THI VÀO LỚP 10 MÔN TIẾNG ANH NĂM HỌC 2023 - 2024 CÓ ĐÁP ÁN (NGỮ Â...

Bus 401 week 3 quiz

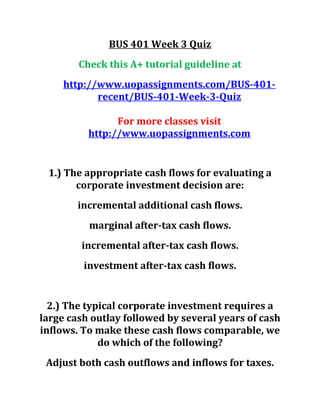

- 1. BUS 401 Week 3 Quiz Check this A+ tutorial guideline at http://www.uopassignments.com/BUS-401- recent/BUS-401-Week-3-Quiz For more classes visit http://www.uopassignments.com 1.) The appropriate cash flows for evaluating a corporate investment decision are: incremental additional cash flows. marginal after-tax cash flows. incremental after-tax cash flows. investment after-tax cash flows. 2.) The typical corporate investment requires a large cash outlay followed by several years of cash inflows. To make these cash flows comparable, we do which of the following? Adjust both cash outflows and inflows for taxes.

- 2. Subtract interest charges to reflect the time value of money. Adjust both outflows and inflows for the effects of depreciation. Apply time value of money concepts and compare present values. 3.) If depreciation expense is a noncash charge, why do we consider it when determining cash flows? because depreciation expense reduces taxable income, so reduces the amount of taxes paid because depreciation expense offsets part of the initial cash outlay for depreciable assets because depreciation expense reduces net income because depreciation expense is a method for allocating costs 4.) The internal rate of return is: the discount rate at which the NPV is maximized.

- 3. the discount rate used by people within the company to evaluate projects. the rate of return that a project must exceed to be acceptable. the discount rate that equates the present value of benefits to the present value of costs. 5.) Chapter 7 introduced three methods for evaluating a corporate investment decision. Which of the following is not one of those methods? payback period net present value (NPV) return on assets (ROA) internal rate of return (IRR) 6.) In perfect capital markets, the capital structure decision is: important because it affects the cash flows to shareholders. important because debt and equity are taxed differently.

- 4. irrelevant because the decision has no effect on cash flows. important sometimes. 7.) The interplay of the tax advantages of debt and the threat of bankruptcy results in: companies that have some optimal level of debt that maximizes firm value. all companies having a debt-to-equity ratio close to 50%. all companies having a debt-to-equity ratio close to 30%. capital structure being irrelevant. 8.) Costs associated with bankruptcy include: legal fees, managerial time shifted away from value creation, and loss of brand value. legal fees, additional inventory costs from sales growth, and loss of brand value. legal fees, managerial time shifted away from value creation, and increased market share.

- 5. legal fees, employees leaving the company, and cost savings from lower labor costs. 9.) All else being equal, as debt replaces equity in a profitable company’s capital structure, which of the following occurs? Interest expense increases, reducing taxable income and reducing taxes. Interest expense increases, reducing net income and earnings per share. Interest expense increases, reducing cash flows available to shareholders. Interest expense increases, reducing profitability and the wealth of shareholders. 10.) Two important aspects of debt financing are its tax advantages and the threat of bankruptcy. As a company shifts to more and more debt financing: these factors reinforce one another, implying that more debt is always better.

- 6. the tax advantage always outweighs bankruptcy risk. the threat of bankruptcy makes only very low levels of debt acceptable. the threat of bankruptcy eventually completely offsets the tax advantage of debt.

- 7. the tax advantage always outweighs bankruptcy risk. the threat of bankruptcy makes only very low levels of debt acceptable. the threat of bankruptcy eventually completely offsets the tax advantage of debt.