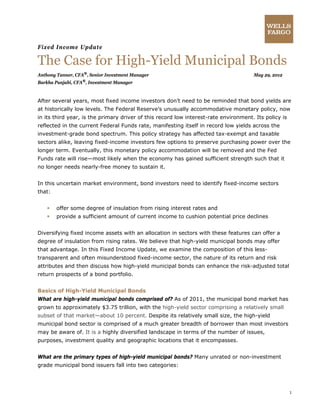

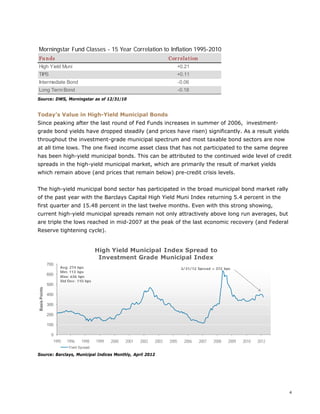

The document discusses the current landscape of high-yield municipal bonds amidst historically low bond yields driven by prolonged accommodative monetary policy. It highlights that these bonds offer potential insulation from rising interest rates and demonstrate lower default rates compared to corporate bonds, making them attractive for fixed-income investors. Additionally, the report advocates for investing in high-yield municipal bonds through mutual funds for better diversification and risk management.