The document discusses several volume-based technical indicators:

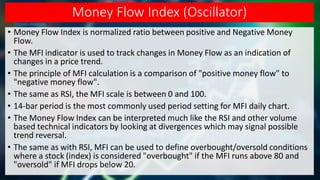

- Money Flow Index (MFI) which tracks changes in money flow as an indication of price trend changes. A 14-period setting is commonly used on daily charts. MFI can indicate overbought (>80) and oversold (<20) conditions.

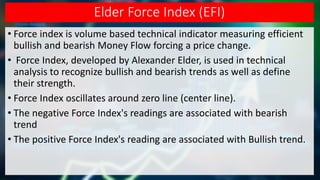

- Elder Force Index (EFI) which measures bullish and bearish money flow forcing price changes. Positive readings indicate bullish trends and negative readings bearish trends.

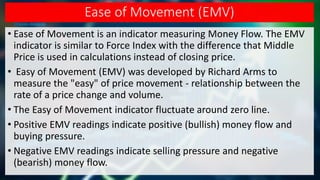

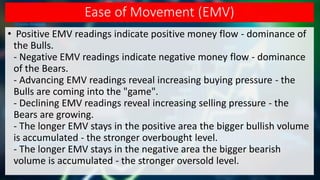

- Ease of Movement (EMV) which measures money flow using middle price instead of close. Positive readings indicate positive money flow and buying pressure while negative readings indicate selling pressure.

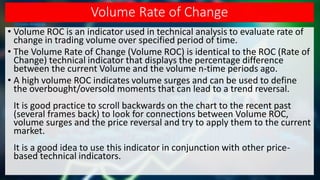

- Volume Rate of Change (ROC) which