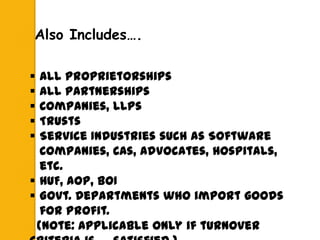

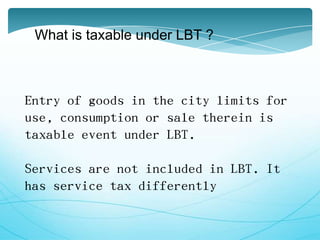

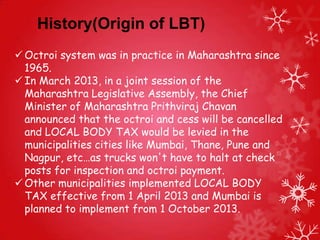

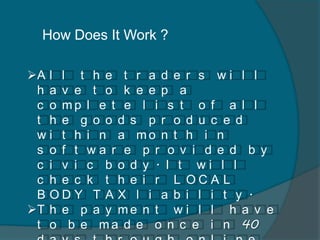

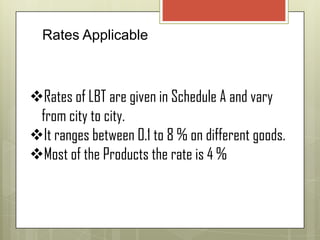

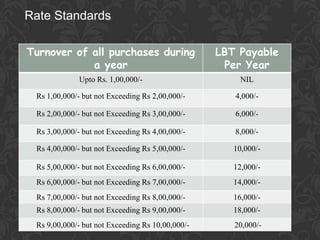

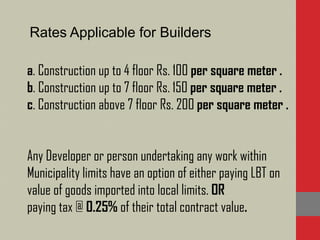

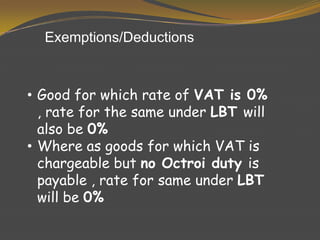

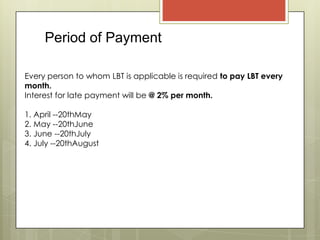

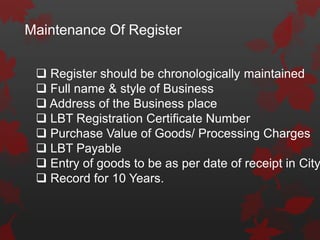

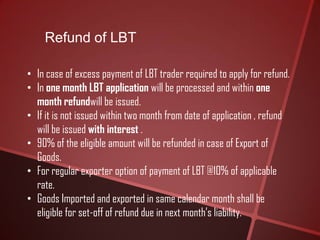

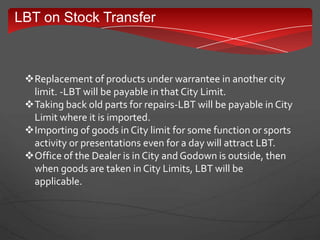

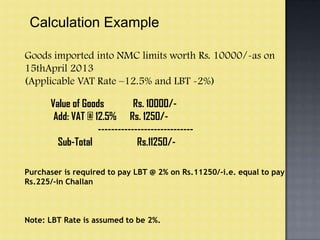

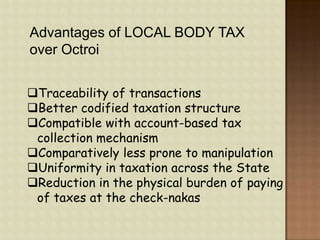

Local Body Tax (LBT) is a tax imposed by local civic bodies in India on the entry of goods into a local area for consumption, use, or sale. Any trader with an annual turnover of Rs. 5,000 or more is liable to pay LBT. Rates range from 0.1-8% depending on the goods. While octroi was previously collected at checkpoints, LBT allows traders to self-report goods brought into local areas using online software. Traders must maintain purchase records and pay LBT monthly. Exemptions and refunds are provided in some cases. Overall, proponents argue LBT provides more transparency and uniformity compared to octroi.