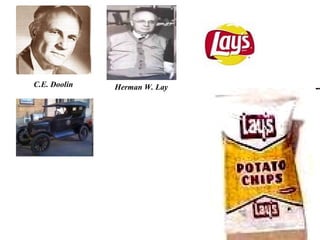

Lays

- 1. Herman W. Lay C.E. Doolin

- 4. Simple Magic WASH SEASON PEEL SLICE COOK

- 11. PRODUCT SALES

- 13. s Frito-Lay is a manufacturer and marketer of salty snack foods, which is nationally recognized. The net sales of Frito-Lay in 1985 approached $3 billion. The dip business is part of the Frito-Lay Company. There were three dips sold by the company until 1983. During 1983 and 1984, there were a number of cheese-based dips introduced by the company. All the dips were displayed in the salty snack section of supermarkets, where 80 percent of dip sales are made. There are many internal factors of the company, which affect their strengths and weaknesses. The company does have a well-experienced marketing department but they have a weak leader. A well developed line of salty snack foods are offered by the company, which can help the sales of the dips. The dips are displayed besides the salty snack food section. Whenever a person buys some chips they will also be heavily inclined to buy a dip to go with it. This can helps to increase sales of the dip. The company does try to offer more choice of dips but is still not enough. People need different taste and more choice. People are loyal but still want to try new tastes sometimes. Frito-Lay recognizes the up and coming health consciousness of Americans and is considering the expansion into the vegetable dip niche. The Frito-Lay Company has national awareness and has distribution center across the U.S. The company has 350,000 outlets that distribute the products nationally. They have many kinds of distributors throughout the states but the majority of Frito-Lay dips are sold through supermarkets. There are four geographical zones that organize the distribution system and cover the entire United States. Thirty-three percent of salty snack food tonnage sold in the United States was captured by Frito-Lay. This will also help a brand recognizing by the customers. Cheese dip was introduced and it has a good initial penetration of the market. This can also shows that a different kind of dip will catch people's eye and get interest in buying it. The Cheese dip sales have tapered off because the novelty of shelf-stable cheese dips has passed. The company is organized around four geographical zones and each zone contains distribution centers to provide inventory for the sales force. During an average day, the sales force makes 400,000 sales and delivery calls. Each salesperson has their own route for selling the company products. Frito-Lay uses a "front-door store" delivery system that is suited the 270,000 non-chain outlets. The supermarkets, which are chain-store accounts, were not favored by the front-door store delivery system. A Frito-Lay region or division manager always required participating. This is necessary because the chain-store buyers responsible for the outlets in the chain also approve in-store merchandising plans as well. Frito-Lay has the opportunity to capitalize on their present commanding position in the dip market by expanding their product line to include vegetable dips that will complement their successful cheese and picante (Mexican) dip lines. With the correct launch and positioning, Frito-Lay, Inc. could penetrate and stake a claim to a large and undefined, yet extremely viable, vegetable dip market. This is a market which does not have a major competitor in a strong competitive position, there isn't a shelf-stable sour cream-based dip offered by anyone (Frito-Lay has one ready to be released), and consumers are becoming more concerned over the content of the food they eat and buying enough "substitute dip" (salad dressing) to support growth in this market at an astonishing 18% compounded rate per annum. This growth rate has been sustained since 1978. The vegetable dip market is estimated at $23 million in sales per year Further, sour cream dips are the most popular flavor, accounting for about 50% of dip sales in the salty snack dip segment of the market. Combining this prior information with the additional fact that after cost analysis, the gross margin on the sour cream dip will be a healthy 45% and you have all the makings of a cash cow product line. Now if Frito-Lay can muster the resources and intestinal fortitude, they could really start working on the next billion in sales for the company in '87. Naturally, in a free market, there are always risks that are associated with any undertaking. The company faces several threats from the market that must be objectively weighed when conducting the planning for expansion into a new market segment. Principally, as the new sour cream dip will be positioned in a different part of the supermarket, away from the rest of the Frito-Lay salty snack food products, the normal front-door delivery system will need to be changed. New contacts with the produce managers in each store will have to be developed so as to get proper positioning and exposure for this new dip. The company sales force will need additional training and marketing expenditure at the supermarket level to capture interest and assist in the placing of the new product. If the stores can't or won't make space in their produce sections, then this venture faces the possibility of a very limited lifespan. Perhaps the marketing department could develop new display racks that would attach to the top of produce bins and offer supermarkets additional marketing space without sacrificing floor space.