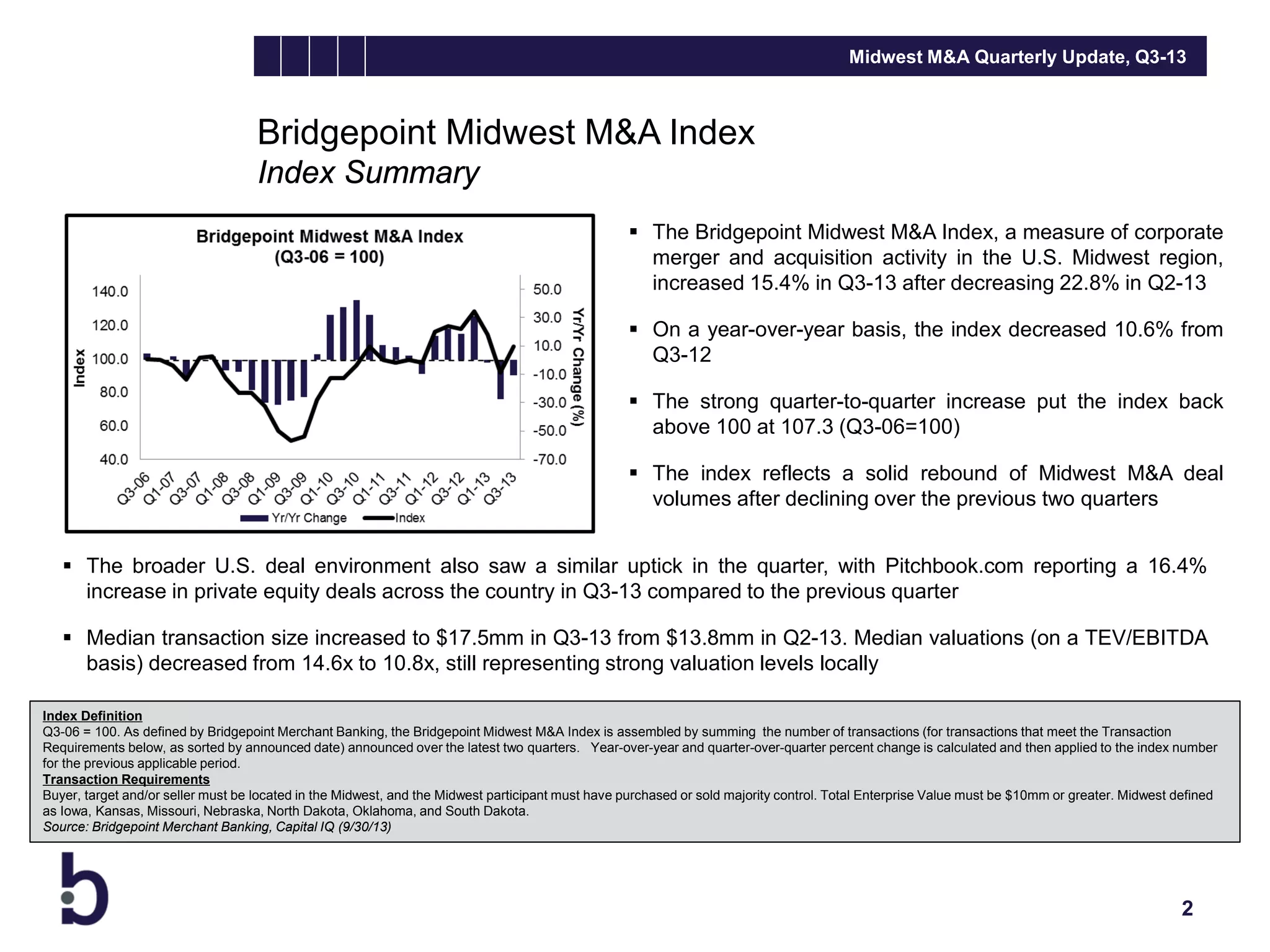

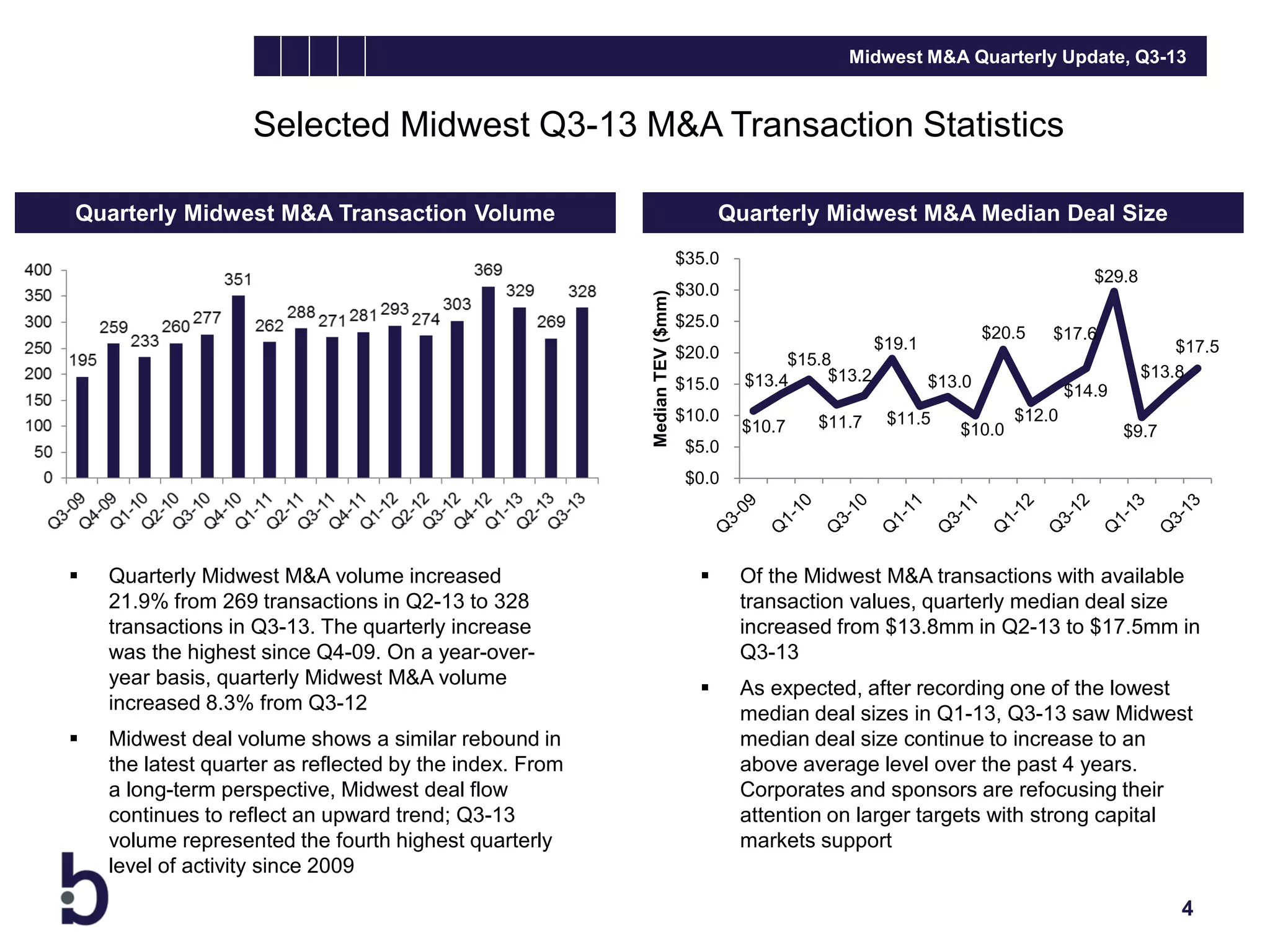

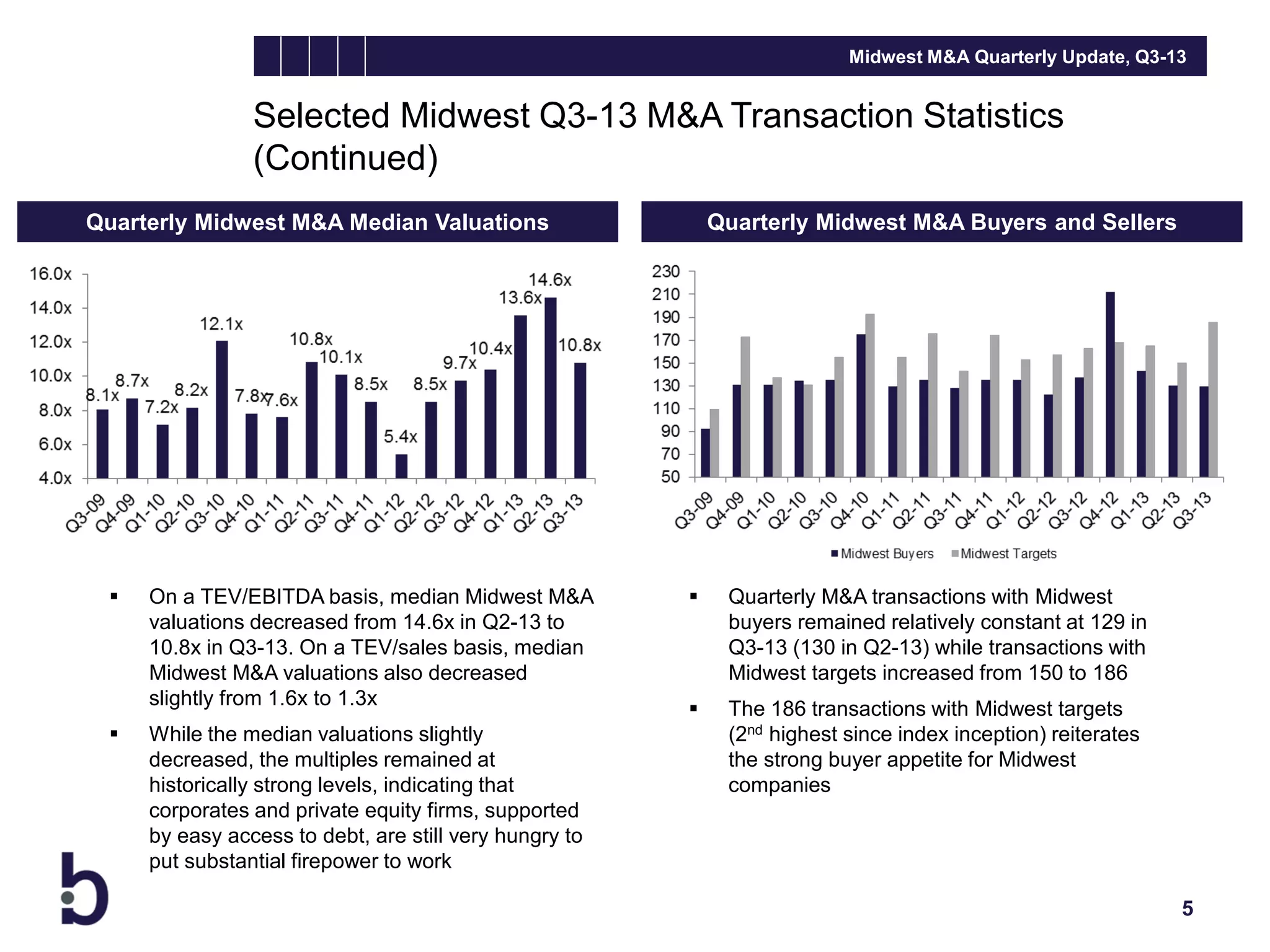

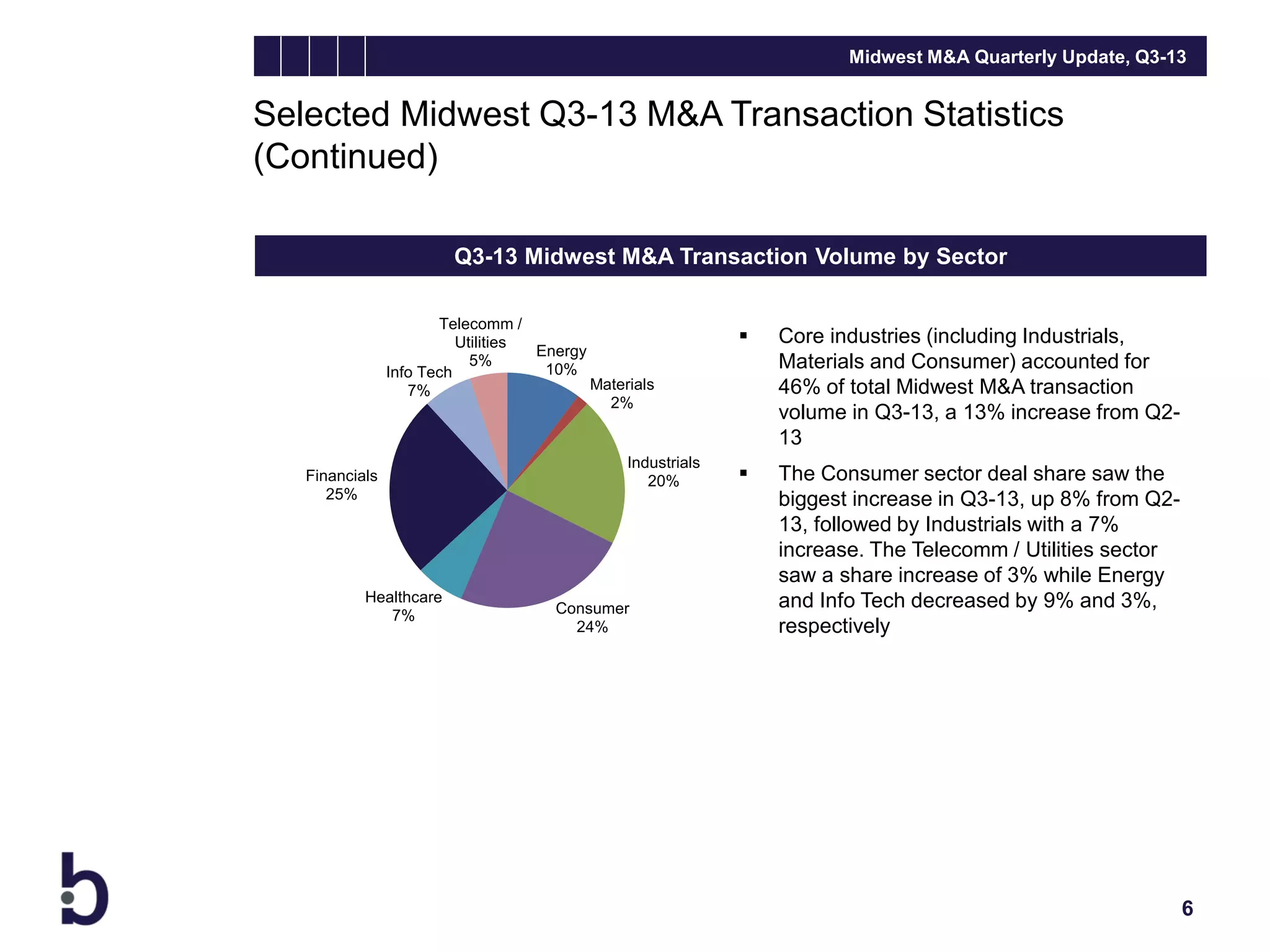

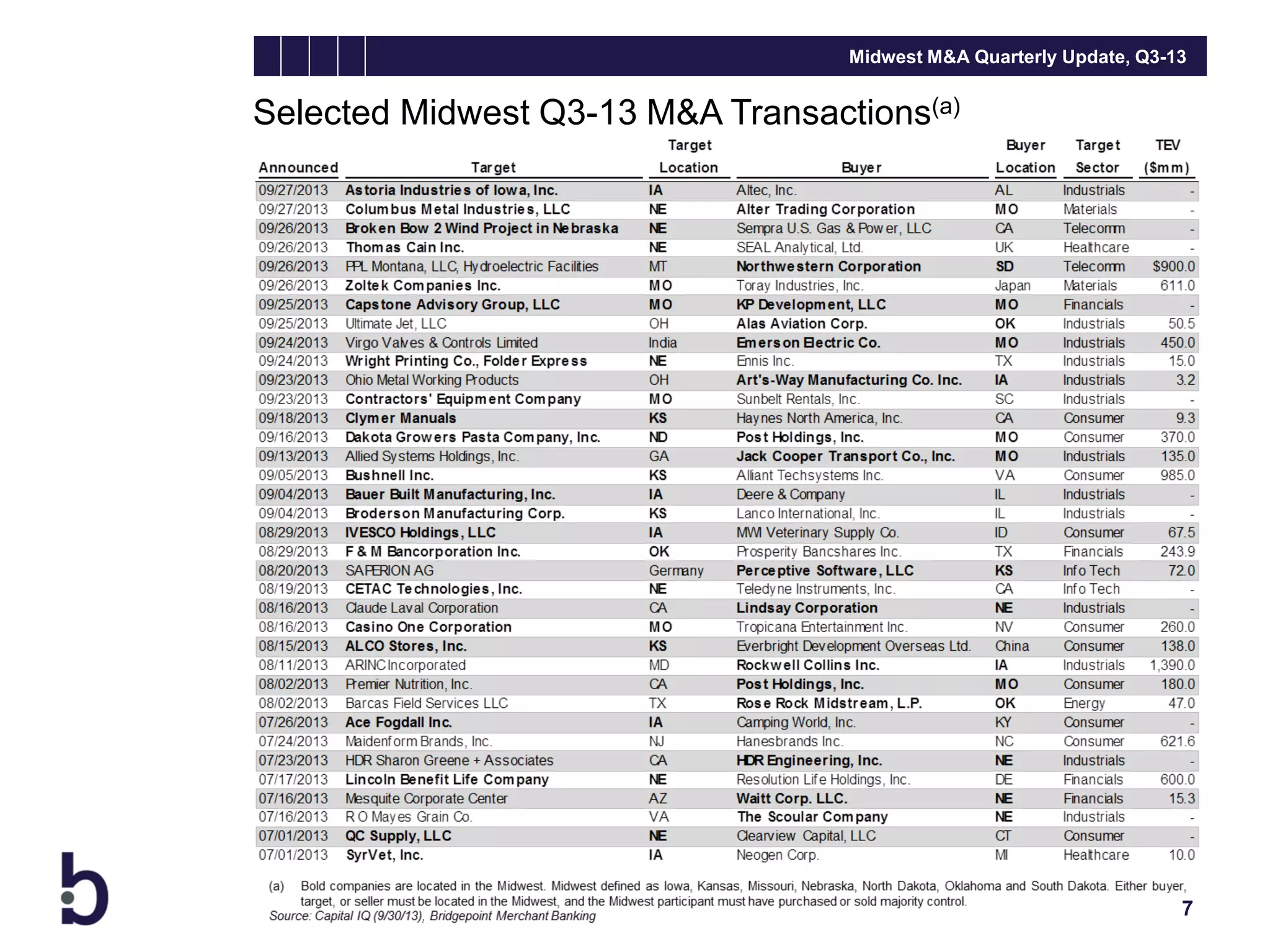

The Bridgepoint Midwest M&A Index, which measures merger and acquisition activity in the Midwest US, increased 15.4% in Q3 2013 after declining in the previous quarter. The number of M&A deals in the Midwest increased 21.9% from the previous quarter. Median deal size rose to $17.5 million from $13.8 million in Q2 2013, while median valuations decreased slightly. Several sectors saw increased deal volume, such as consumer and industrials. The rebound in M&A activity in the Midwest in Q3 2013 indicates strong appetite from buyers for acquisition targets in the region.