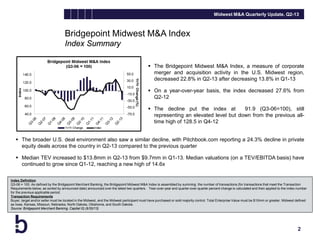

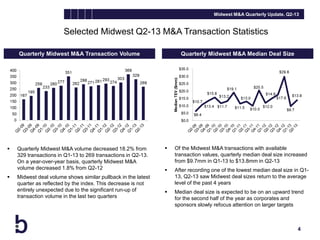

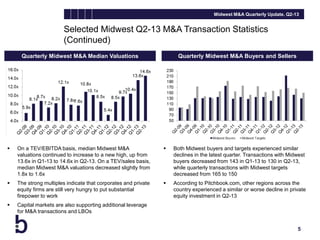

The Bridgepoint Midwest M&A Index, which measures M&A activity in the Midwest US, decreased 22.8% in Q2 2013 from Q1 2013, and was down 27.6% from Q2 2012. The number of M&A transactions in the Midwest fell 18.2% between the quarters while median deal size increased to $13.8 million. Despite the decline, valuations reached a new high of 14.6x EBITDA, indicating strong demand from corporate and private equity buyers.