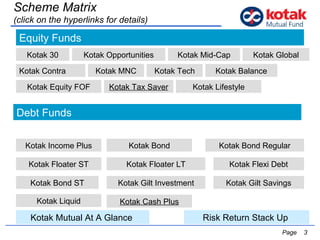

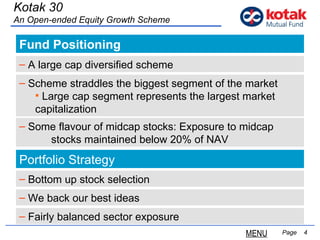

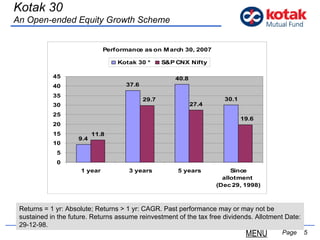

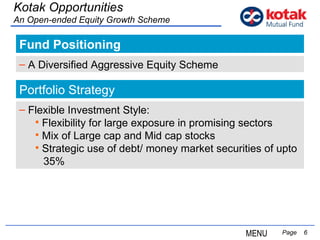

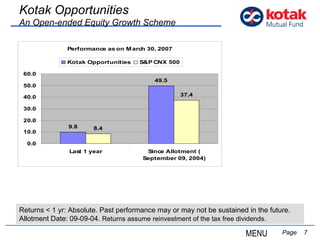

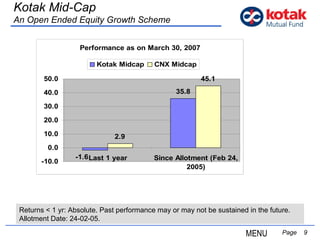

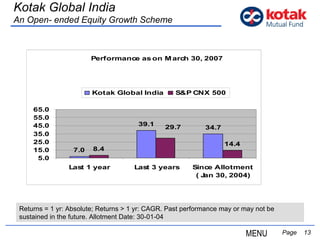

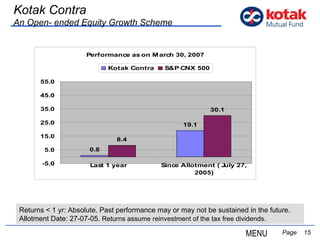

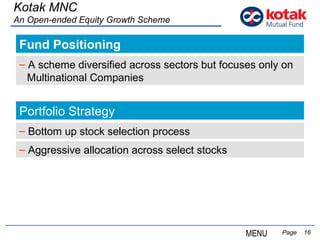

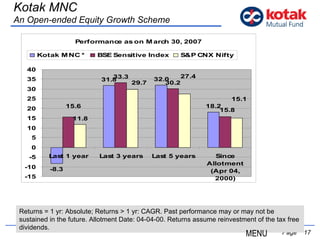

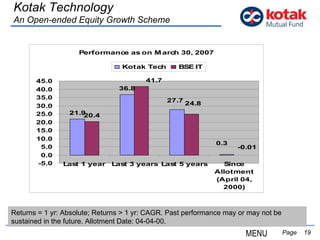

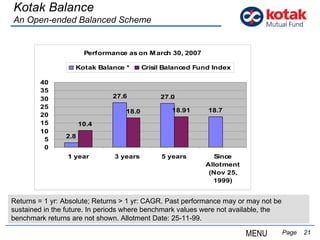

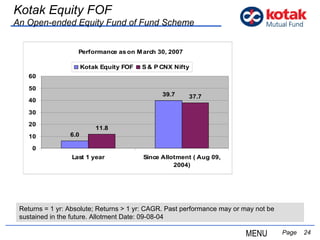

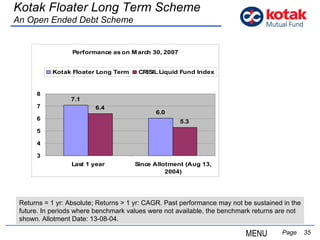

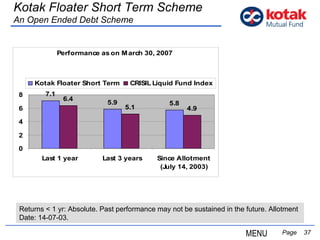

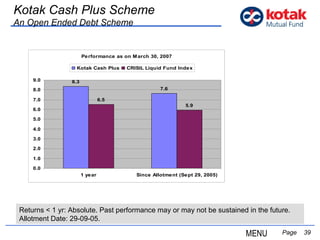

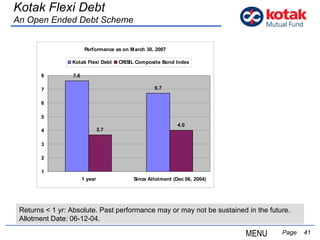

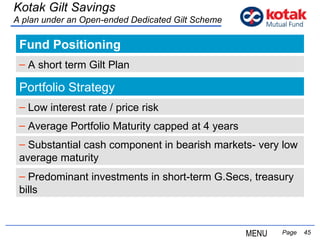

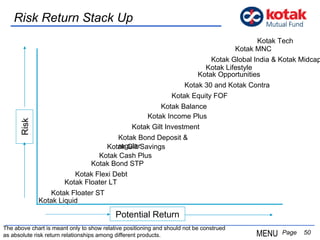

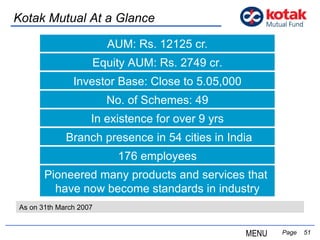

This document provides positioning and strategy summaries for various mutual fund schemes offered by Kotak Mutual Fund in March 2007. It describes the investment objectives, strategies, and positioning of 17 equity schemes, 9 debt schemes, and 1 liquid scheme. Performance metrics and positioning on a risk-return spectrum are also included for several schemes.

![Fund Positioning Page Kotak Contra An Open- ended Equity Growth Scheme Follows contrarian style of investing Favours bargain hunting over the momentum approach to stock picking Portfolio Strategy Invests in [1] companies, which are fundamentally sound and are having long-term growth potential, but are currently undervalued, [2] Companies / sectors whose changing fundamentals are not recognized by markets. [3] Companies / Sectors whose long-term potential is partly or wholly unrecognized by markets. MENU](https://image.slidesharecdn.com/productpresentation-110627053620-phpapp01/85/Product-presentation-14-320.jpg)

![Page Ranking Methodology CRISIL: [A] Crisil Best Fund Awards 2003 is based on the ranking methodology of Crisil Fund Services. The Award recognizes consistency of mutual fund performance and is based on CRISIL~ CPRs (Composite Performance Rankings) across four-quarter ends (Sept-02, Dec-02, March-03 & June-03). These quarterly rankings took into account the performance and the portfolios of 19 Open End Income Schemes. [B] The criteria used in computing the CRISIL Composite CPR are Superior Return Ratio based on NAVs over the 2-year period for respective quarter ends, Concentration, Asset Quality, Liquidity and the Asset Size of the scheme. The methodology does not take into account the entry and exit loads levied by the scheme. [C] Individual CPR parameter scores were averaged for the fourth quarter and further multiplied by the parameter weight as per the CPR methodology to arrive at the final scores. The CPR rankings are published by Business Standard.](https://image.slidesharecdn.com/productpresentation-110627053620-phpapp01/85/Product-presentation-57-320.jpg)