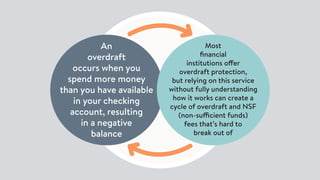

1) An overdraft occurs when you spend more than what is available in your checking account, resulting in a negative balance. Most banks offer overdraft protection but the fees can be substantial.

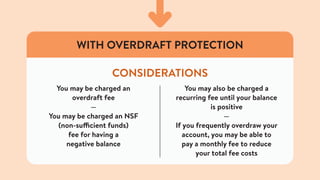

2) With overdraft protection, a purchase made with insufficient funds may be covered by transferring funds from your savings and incur a fee. Without it, the card will be declined to avoid fees but can be inconvenient.

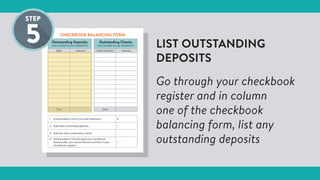

3) To avoid overdraft fees, set up account alerts, use a credit card for emergencies, and balance your checkbook regularly to accurately track your account balance.