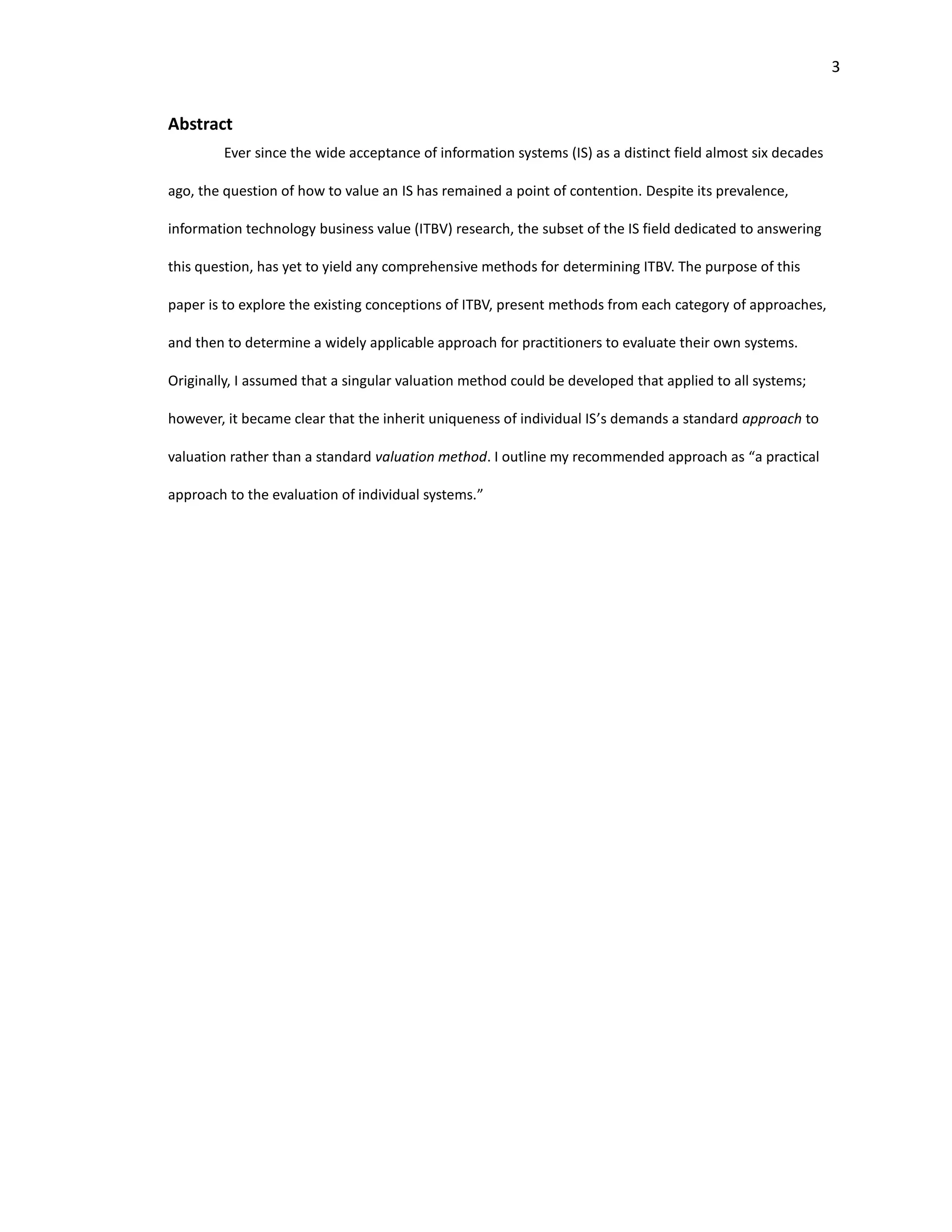

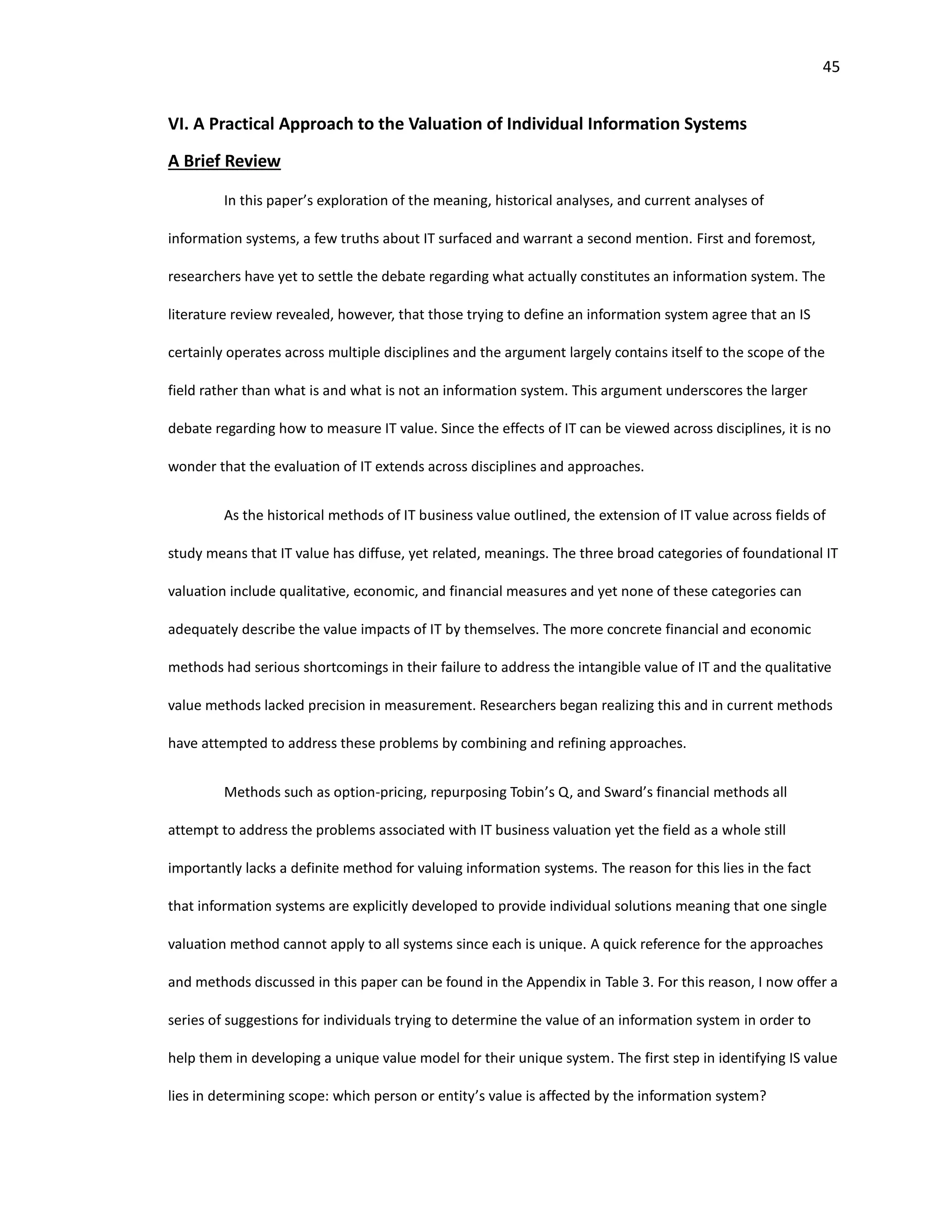

This document provides an overview of a paper submitted by Edward Knish to fulfill honors requirements at the University of North Carolina Wilmington. The paper explores methods for evaluating the value of information systems from both historical and current perspectives. It first defines key terms like information and information systems. It then reviews qualitative, economic, and financial valuation methods used historically. Current methods like IT option pricing and Tobin's Q are also examined. The goal is to synthesize these approaches into a practical model for practitioners to evaluate individual information systems based on determining scope, requirements, impact levels, and matching costs and benefits. The paper concludes that a single valuation method cannot apply to all systems due to their unique nature, requiring instead a standard evaluation approach tailored for

![4

I. Introduction

IT business value research encompasses a variety of disciplines in an attempt to prescribe

financial value to an information system (IS) and its related technologies. While this research may seem to

be a simple marriage of information system studies and financial practice, IT business value research

extends across fields from ergonomics to macroeconomics, psychology to operations management, and

even epistemology to software engineering. A comprehensive review of IT business value would take

volumes to fully integrate all of these concepts. This paper does not seek to provide this corresponding

magnitude of information. Rather, the focus remains on historical and current methods of deriving the

value of information systems and exploring these various frameworks in order to establish a way for

financial practitioners to calculate the intrinsic value of a proposed information system.

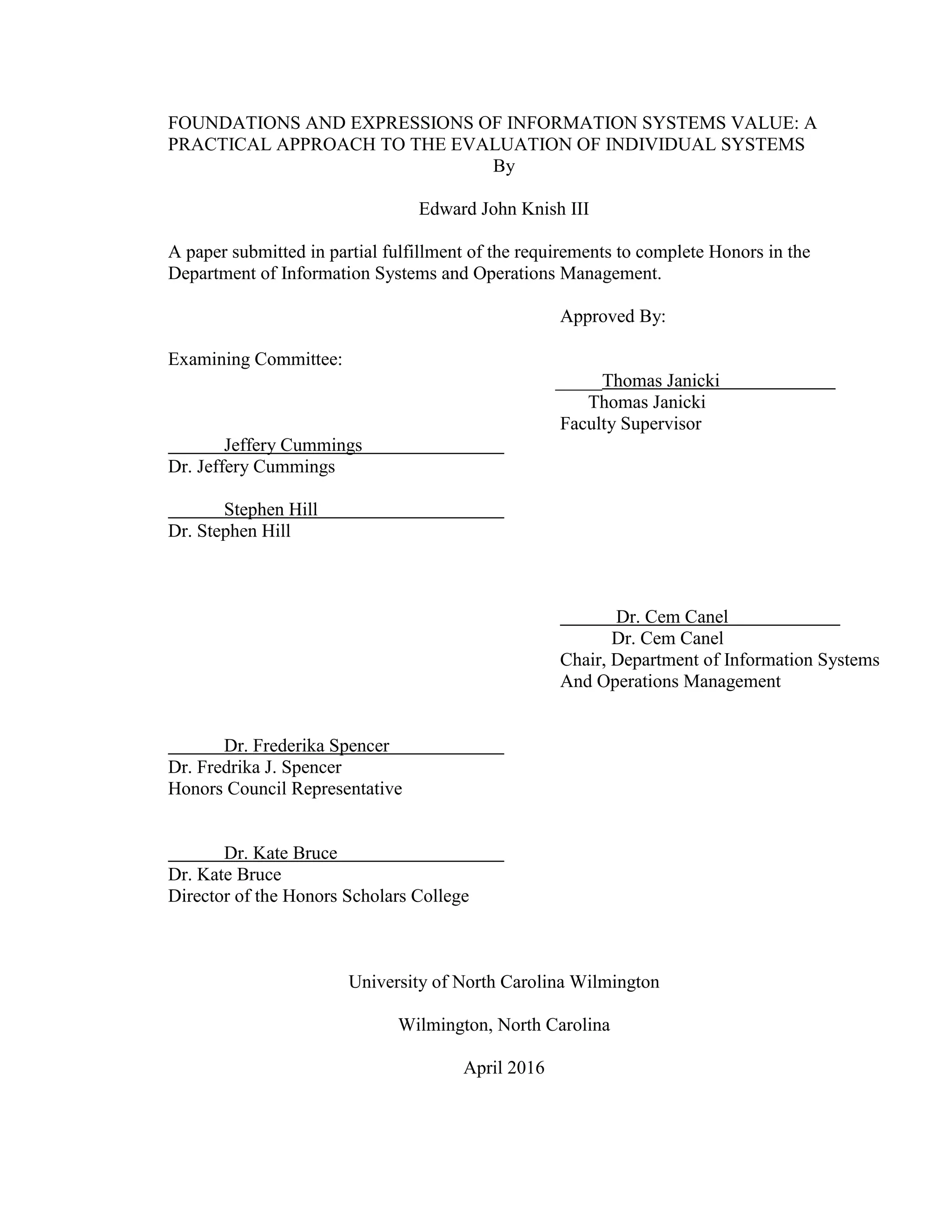

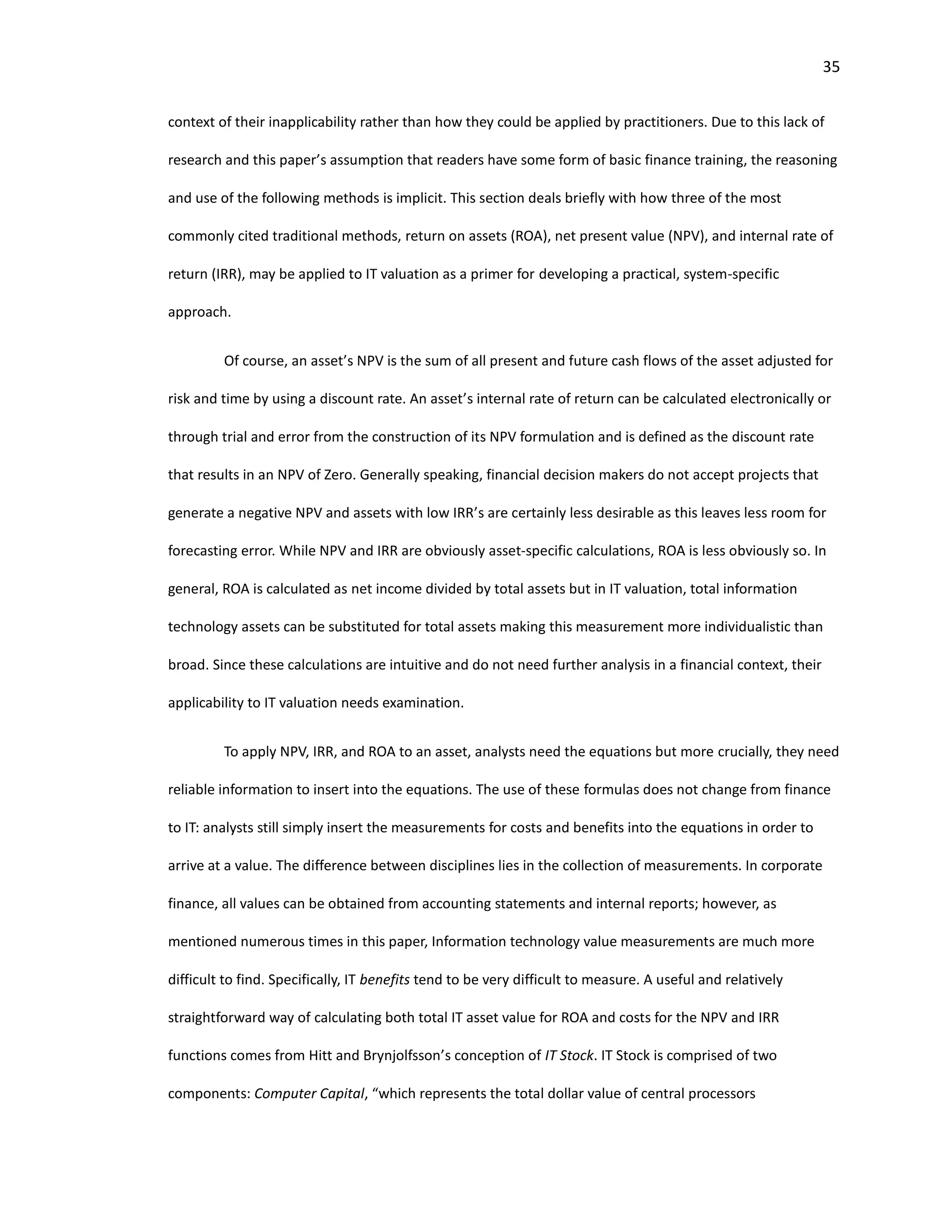

With the birth of wide-scale internet access and its resulting technological revolution, a majority

of IT professionals have come to perceive information systems as sources of enormous intrinsic value.

However, the financial field still tends to approach them as cost centers rather than value creators [1, p. 4].

For those not particularly motivated by the study of ITBV, its importance to business professionals cannot

be overstated. Figure 1 – U.S. IT Expenditures, taken and adjusted data from the US Bureau of Economic

Analysis [2] shows the inflation-adjusted levels of IT expenditures from 1960-2014 in terms of 2014

dollars. Using standard linear regression, I calculated a year-over-year $8.21 billion average annual growth

in corporate IT expenditures between 1960 and 1999. While expenditures peaked in 2000 and have yet to

climb back to the maximum $401.8 billion outlay, they remain at an all-time high in the context of IS

history. Furthermore, the current slump seems to have tapered to a consistent ~$300 billion annual IT

outlay. This data underscores the huge role that IT plays in the corporate world and the sometimes

enormous costs associated with it. ITBV research is integral to developing the ability to reliably evaluate

information technology investments which represent large percentages of yearly corporate budgets and

directly affect how and how well a company will operate. The pervasiveness and high costs of IT make

neglecting ITBV a very costly decision. (Graph data presented in Table 1)](https://image.slidesharecdn.com/4c50210b-939f-4c7a-aa9c-2c2e10faf755-160510070431/75/KNISH-EDWARD-Spring2016-4-2048.jpg)

![5

0

50

100

150

200

250

300

350

400

450

1950 1960 1970 1980 1990 2000 2010 2020

Expenditures(Billions)

Year

Inflation Adjusted IT Expenditures

Figure 1 – U.S. IT Expenditures, taken and adjusted data from the US Bureau of

Economic Analysis [2]](https://image.slidesharecdn.com/4c50210b-939f-4c7a-aa9c-2c2e10faf755-160510070431/75/KNISH-EDWARD-Spring2016-5-2048.jpg)

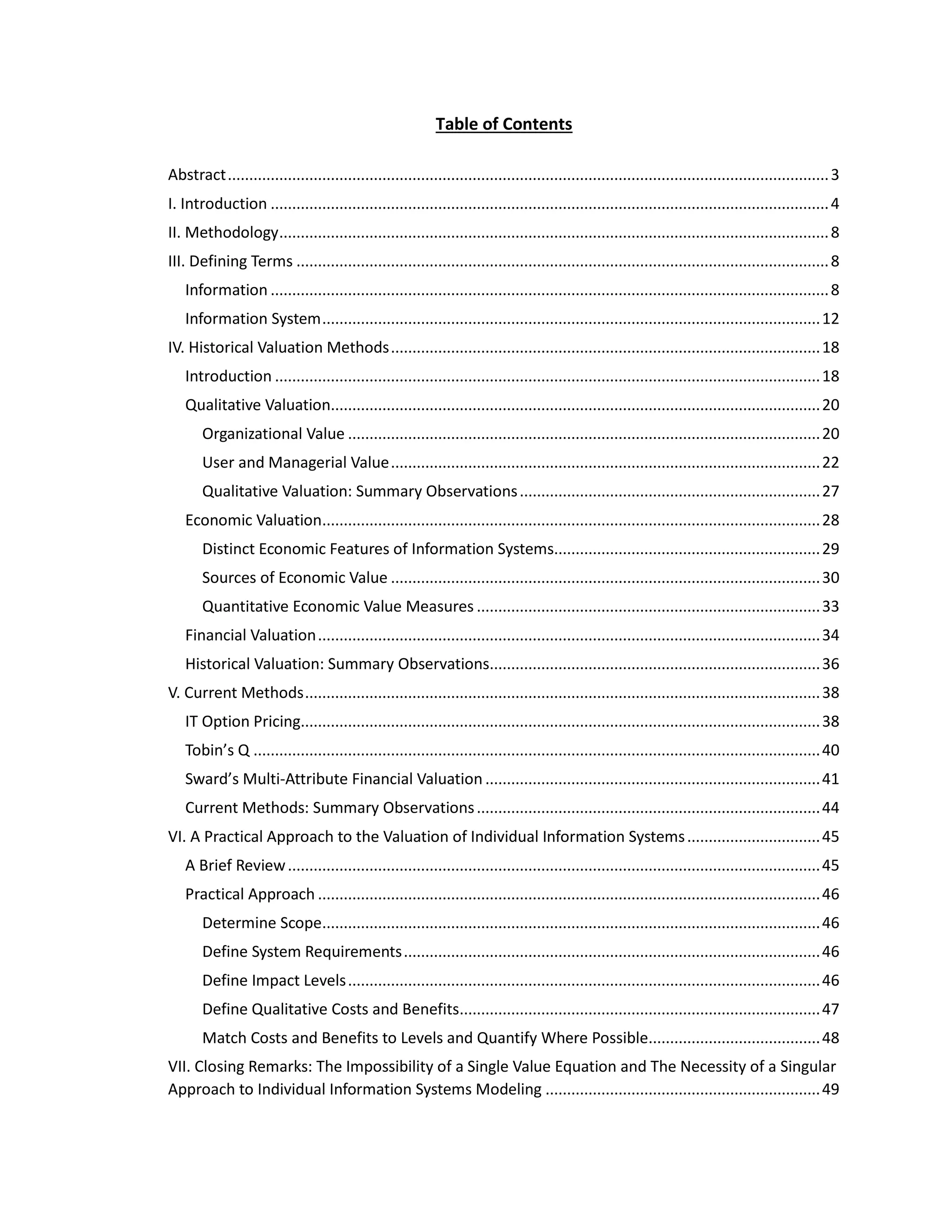

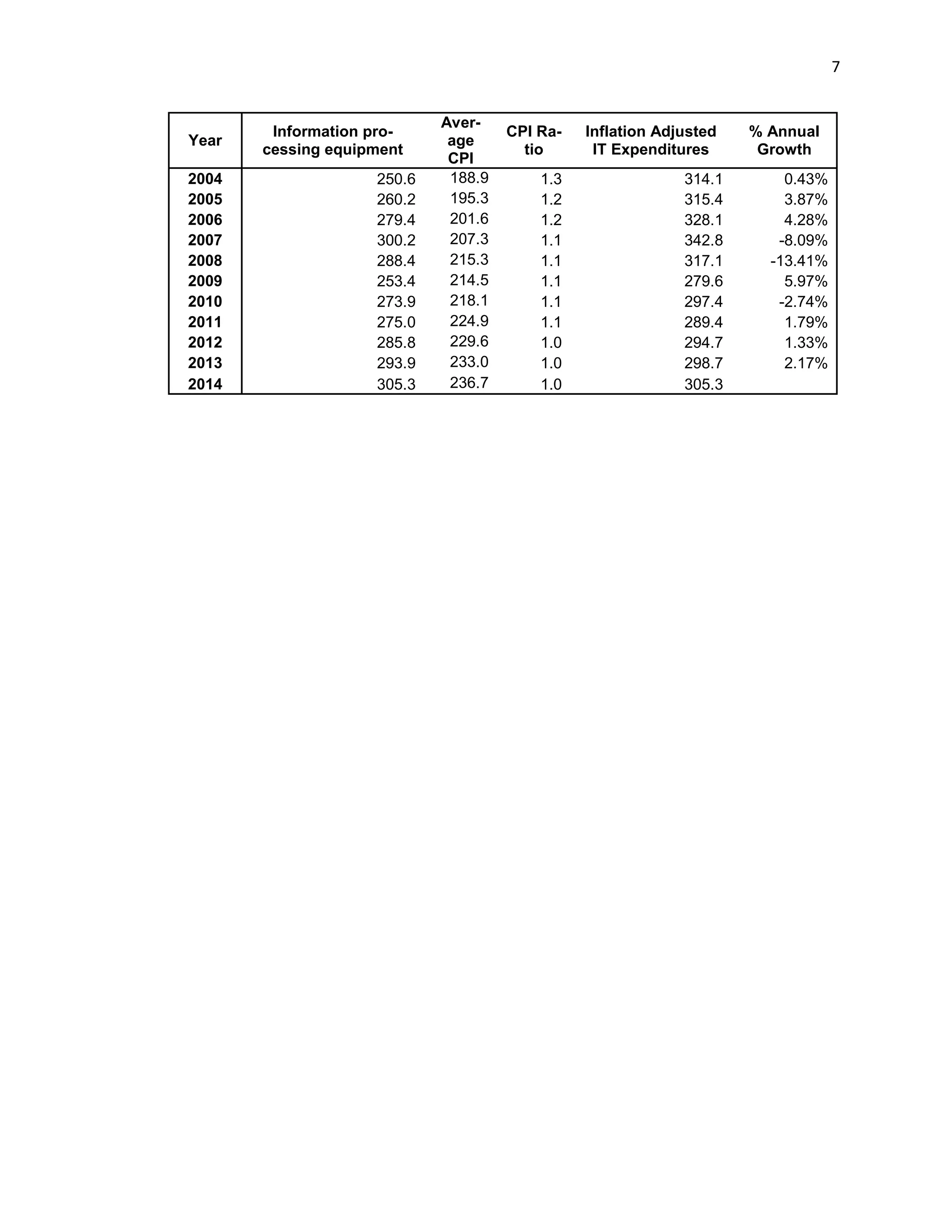

![6

Table 1 National Information Technology Expenditures (In Billions of Dollars)

Raw Data from US BEA [2], Average Annual CPI data from InflationData.com [3]

Year

Information pro-

cessing equipment

Aver-

age

CPI

CPI Ra-

tio

Inflation Adjusted

IT Expenditures

% Annual

Growth

1960 4.7 29.6 8.0 37.6 6.91%

1961 5.1 29.9 7.9 40.4 6.34%

1962 5.5 30.2 7.8 43.1 8.64%

1963 6.1 30.6 7.7 47.2 9.12%

1964 6.8 31.0 7.6 51.9 11.41%

1965 7.8 31.5 7.5 58.6 17.29%

1966 9.7 32.4 7.3 70.9 1.00%

1967 10.1 33.4 7.1 71.6 0.72%

1968 10.6 34.8 6.8 72.1 12.67%

1969 12.8 36.7 6.5 82.6 5.37%

1970 14.3 38.8 6.1 87.3 -0.18%

1971 14.9 40.5 5.8 87.1 7.91%

1972 16.7 41.8 5.7 94.6 10.86%

1973 19.9 44.4 5.3 106.1 4.35%

1974 23.1 49.3 4.8 110.9 -5.92%

1975 23.8 53.8 4.4 104.7 8.47%

1976 27.5 56.9 4.2 114.4 13.09%

1977 33.7 60.6 3.9 131.7 14.28%

1978 42.3 65.2 3.6 153.6 6.36%

1979 50.3 72.6 3.3 164.0 3.07%

1980 58.9 82.4 2.9 169.2 6.64%

1981 69.6 90.9 2.6 181.3 0.42%

1982 74.2 96.5 2.5 182.0 8.50%

1983 83.7 99.6 2.4 198.9 13.72%

1984 101.2 103.9 2.3 230.6 1.68%

1985 106.6 107.6 2.2 234.5 2.27%

1986 111.1 109.6 2.2 240.0 -2.63%

1987 112.2 113.6 2.1 233.8 3.28%

1988 120.8 118.3 2.0 241.7 3.12%

1989 130.7 124.0 1.9 249.5 -6.30%

1990 129.6 130.7 1.8 234.7 -4.53%

1991 129.2 136.2 1.7 224.6 6.01%

1992 141.6 140.3 1.7 238.9 4.56%

1993 152.8 144.5 1.6 250.3 5.82%

1994 166.4 148.2 1.6 265.8 8.84%

1995 187.7 152.4 1.6 291.6 5.23%

1996 203.9 156.9 1.5 307.7 6.26%

1997 222.5 160.5 1.5 328.2 5.61%

1998 239.4 163.0 1.5 347.7 5.38%

1999 258.6 166.6 1.4 367.5 8.56%

2000 292.3 172.2 1.4 401.8 -13.83%

2001 264.1 177.1 1.3 353.0 -14.39%

2002 234.5 179.9 1.3 308.6 -0.47%

2003 238.7 184.0 1.3 307.2 2.19%](https://image.slidesharecdn.com/4c50210b-939f-4c7a-aa9c-2c2e10faf755-160510070431/75/KNISH-EDWARD-Spring2016-6-2048.jpg)

![8

II. Methodology

In the pursuit of an answer to the question of information systems value, this research reviews

current and historical literature regarding information systems evaluation. The purpose of this research is

not to provide a comprehensive review of IT business value methods, rather I explore a sample of

methods correlating to leading categories of IT business value research in order to familiarize readers with

the ideas underlying IS valuation. The intent of this research lies in finding common themes among

researchers in an effort to provide a consolidated approach to IS valuation for current financial and IT

practitioners. I separate these techniques according to their place on the timeline of IS research in order

to show the foundations for these techniques and their evolution. After discussing and reviewing the

literature, I present a widely applicable, practical approach to measuring the business value of an

information system through individual modeling based on the common themes discovered during review. I

begin by defining the terms information and information systems.

III. Defining Terms

Information

Before moving into any models of evaluation for information systems, I need to explicitly define

the terms “information” and “information system.” Although the meaning of the word “information”

differs among scholars depending on their intellectual starting point, a full discussion of epistemology falls

well outside the scope of this paper. Fortunately, “in both the information systems textbooks and the

knowledge management literature, information is defined in terms of data, and is seen to be organized or

structured data” [3, p. 172]. Further consensus indicates that information consists of more than just

organized data and requires that the act of “processing [the data] lends the data relevance for a specific

purpose or context, and thereby makes it meaningful, valuable, useful and relevant” [3, p. 172]. So, when

individual data points undergo meaningful organization and processing through some medium, they

collectively become information. This research will provide very specific definitions for “information” and

“data;” however, on the surface level, this paper concurs with Paige Balztan’s simpler definitions for these](https://image.slidesharecdn.com/4c50210b-939f-4c7a-aa9c-2c2e10faf755-160510070431/75/KNISH-EDWARD-Spring2016-8-2048.jpg)

![9

terms. In essence, “data are facts” and information is “data converted into a meaningful and useful

context” [4].

This conceptualization of information lies in a larger structure informally referred to as the DIKW

(Data, Information, Knowledge, Wisdom) pyramid shown in Figure 2 [5]. In this model, data serves as the

foundation for information, which becomes the foundation for knowledge, which serves as a basis for

wisdom [3, p. 166]. Starting with data (a collection of datum), each additional level of this pyramid arises

from the further organization and contextual analysis of groupings of the level that preceded it. For

example, many datum can be analyzed in tandem to produce a single piece of information and many

pieces of information can be meaningfully organized to create an instance of knowledge.

Chaim Zins reports at length on the varying definitions of data, information, and knowledge in

the context of this DIKW pyramid [5, pp. 486-487]. He provides a useful framework for analyzing these

ideas by starting with the three general types of knowledge defined in classical epistemology: procedural

knowledge, acquaintance knowledge, and propositional knowledge [5, p. 486]. The last of these,

propositional knowledge, “is the reflective and/or the expressed content of what a person thinks that he

or she knows” [5, p. 486]. To explain further, “a proposition is something which can be expressed by a

declarative sentence, and which purports to describe a fact or a state of affairs,” such as a math equation

[7]. In epistemology, the proposition “2 + 3 = 5” becomes propositional knowledge simply by a subject

being able to produce that statement in thought or speech from their internal memory. Propositional

knowledge can be further broken down into two subtypes: inferential and non-inferential propositional

knowledge [5, p. 486].

As Zins explains, “non-inferential propositional knowledge refers to direct intuitive understanding

of phenomena (e.g., ‘This is a true love’)” while “Inferential knowledge is a product of inferences, such as

induction and deduction,” much like the math equation mentioned earlier [5, p. 486]. Because a single

instance of propositional knowledge is merely a declarative sentence known by a subject, propositional

knowledge does not fall under the category of “knowledge” in all: the DIKW hierarchy, Zins’ conception of

information science, and this paper’s approach to a cohesive definition of information and information](https://image.slidesharecdn.com/4c50210b-939f-4c7a-aa9c-2c2e10faf755-160510070431/75/KNISH-EDWARD-Spring2016-9-2048.jpg)

![10

Figure 2 – The DIKW Pyramid [5]](https://image.slidesharecdn.com/4c50210b-939f-4c7a-aa9c-2c2e10faf755-160510070431/75/KNISH-EDWARD-Spring2016-10-2048.jpg)

![11

systems. Instead, I assert that only instances of inferential, propositional knowledge can collectively

belong to the bottom rung of the DIKW framework as data. Accordingly, information in the context of this

paper is defined as the enhanced explanation of real-world phenomena created by the synthesis and

meaningful analysis of a collection of instances of inferential propositional knowledge.

This working definition of information importantly departs from classical epistemology in another

way: the nature of propositions. Classical epistemology holds that “a proposition may be true or false; that

is, it need not actually express a fact” and this conception of a proposition arises from epistemology’s

acceptance of any proposition, regardless of its origin [7]. However, Zins describes two domains from

which data (i.e. propositional knowledge) and information may arise: the subjective domain and the

objective domain [5, p. 486]. Generally, in the information systems field, “data are characterized as

phenomena in the universal domain” [5, p. 488] and I accept this as a necessary part of this paper’s

definition of a proposition, and hence, data. In other words, this discussion of the value of information

systems assumes that the data and its resulting information entered into the system are objectively true.

Example 1A, Financial Analysis: When trying to determine the value of a company’s equity,

financial practitioners oftentimes turn first to the target company’s financial statements. Looking at

hypothetical example Company A’s income statement, a student of finance, John, first sees the line item

“revenue.” So is he looking at a piece of data or information? The answer lies in the composition of this

item. In order for Company A to accurately determine the amount of revenue they collected, individual

pieces of sales data had to be captured. These revenue data points would individually be written as “sold

one Unit X for $Y.” This $Y sale is an instance of true, objective, inferential knowledge with a transaction

processing system likely being the entity that ‘knows’ this fact. On the financial statement being read by

John, the amount corresponding to revenue is the sum total of these data. Consequently, in the

framework of this paper, the line item “revenue” is considered a piece of information because many

pieces of sales data were meaningfully organized in order to create a higher understanding of Company

A’s sales over the period of time covered by the income statement.](https://image.slidesharecdn.com/4c50210b-939f-4c7a-aa9c-2c2e10faf755-160510070431/75/KNISH-EDWARD-Spring2016-11-2048.jpg)

![12

Although it may seem appropriate to expound on the definitions and implications of knowledge

and wisdom in information science following the above discussion on the meaning of data and

information within the DIKW framework, this paper will not address these issues. Indeed, a full analysis of

these items largely lies outside of the scope of this paper but I explore them here briefly. As mentioned

above, knowledge is, at its most basic level, a meaningfully organized grouping of information. However, in

information science it differs significantly from data and information in that “knowledge is characterized as

phenomena in the subjective domain,” rather than in the objective domain [5, p. 488]. Similarly, I define

wisdom as a meaningfully organized grouping of knowledge, although this assertion significantly lacks the

depth required to understand the nature of wisdom.

These intangibles, wisdom and knowledge, do not differ in their construction but rather in the

manner in which the levels preceding them are processed. Some experts view knowledge as “belief

structuring” [3, p. 173] and in her review of the relevant literature, Jennifer Rowley notes that the general

consensus surrounding knowledge is that it is “a mix of information, understanding, capability, experience,

skills and values” [3, p. 174]. As for wisdom, the degree of abstraction and variability in its definitions

brought Robert Sternberg to acknowledge humorously that “the recognition that total understanding [of

wisdom] will always elude us is itself a sign of wisdom” [8, p. 1]. Rowley echoes this difficulty in confirming

that IS literature has paid “limited attention to discussions of the nature of wisdom and how it can be

cultivated in the wider information systems, knowledge management and management literatures” [3, p.

12]. Knowledge and wisdom can be conceptualized as potential, measurable system benefits, but their

exact definitions will not be explicitly defined within this paper. The reason for not defining these terms

lies in the fact that knowledge management systems are not considered in this paper and the IS field has

barely attempted to define wisdom as it applies to information systems.

Information System

With this stipulated definition of information, the idea of an information system becomes more

accessible. In its simplest form, “an information system is a set of interrelated computer components that

collects, processes, stores . . . and provides as output the information needed to complete business tasks”](https://image.slidesharecdn.com/4c50210b-939f-4c7a-aa9c-2c2e10faf755-160510070431/75/KNISH-EDWARD-Spring2016-12-2048.jpg)

![13

and “may include . . . the related manual processes” [9, p. 4]. The uncertain inclusion of “related manual

processes” introduced by “may include” in Satzinger’s definition of an information system underscores the

general debate surrounding the exact nature of information systems and the difficulty of reaching a single

definition. This topic divides researchers into two main schools of thought: one group argues that only the

“IT artifact” and its immediate related processes constitute an information system, whereas the other

group views an information system as a broader system that not only includes the “IT artifact” and its

direct counterparts but also the work systems and end users that it supports [10, p. 186]. In short, the

main source of divergence in the definition of an information system resides in its scope rather than its

function.

Benbasat and Zmud’s narrow definition of an information system serves as a good starting point

to discuss the meaning of information systems in this paper. They argue that the breadth of IS systems

research ought to remain “discipline-specific” and “conceptualize the IT artifact… as the application of IT

to enable or support some task(s) embedded within a structure(s) that itself is embedded within a

context(s)” [10, pp. 184-186]. In their definition, only the managerial practices and capabilities involved in

the creation and use of the IT artifact, the human behaviors “reflected within, and induced” by the

creation and use of these artifacts, and the impact of this usage on the immediate users and organizations

involved with the IT artifact comprise the information system [10, p. 186]. They further emphasize that

“the constructs involved are intimately related to the IT artifact” and state firmly throughout the essay

that anything not directly related to the IT artifact ought not to be researched as an IS discipline [10, p.

186]. This narrow view of an information system is presented in Figure 3 but some experts, such as Steven

Alter [11], argue that this representation is inappropriately restrictive.](https://image.slidesharecdn.com/4c50210b-939f-4c7a-aa9c-2c2e10faf755-160510070431/75/KNISH-EDWARD-Spring2016-13-2048.jpg)

![14

Figure 3 [10, p. 187]](https://image.slidesharecdn.com/4c50210b-939f-4c7a-aa9c-2c2e10faf755-160510070431/75/KNISH-EDWARD-Spring2016-14-2048.jpg)

![15

As opposed to examining an information system as an IT artifact and its direct users and

consequences, Steven Alter contends that an information system is merely a specific type of work system

[11, p. 95]. His “work system method” defines a standard work system as “a system in which human

participants and/or machines perform business processes using information, technologies, and other

resources to produce products and/or services for internal or external customers” [11, p. 92]. In this view,

the information system and its larger work system are inextricable from one another, meaning that an

information system’s success cannot be determined without first analyzing the broader work system [11,

p. 97]. Alter shows that a work system (Figure 4) encompasses the participants, information, technologies,

business processes, products & services, infrastructure, environment, and strategies that drive and affect

the work being done [11, p. 93]. These two approaches to information systems, the IT artifact centered

view and the work system view, differ in their scope and are the main source of contention among IS

researchers.

In this paper, I approach an information system in an even narrower context than either Benbasat

and Zmud, or Alter. This paper concurs with MIT’s Wil Van Der Alast and Chritian Stahl in their distillation

of both of these views. They define an information system as “a software system to capture, transmit,

store, retrieve, manipulate, or display information, thereby supporting people, organizations, or other

software systems” [12, p. 4]. This definition combines the idea of an IT artifact (software), applies it to

Alter’s six information system business process activities [11, p. 96] and limits the scope of an information

system to precisely that and nothing more. However, a slight problem exists with Alast and Stahl’s

information systems definition in that they do “not require the existence of a business process” within

which an information system operates [12, p. 4] whereas this paper requires at least one. Note that in this

perspective, “a business process consists of a set of activities that is performed in an organizational and

technical environment” and that “these activities are coordinated to jointly realize a business goal” [12, p.

4].](https://image.slidesharecdn.com/4c50210b-939f-4c7a-aa9c-2c2e10faf755-160510070431/75/KNISH-EDWARD-Spring2016-15-2048.jpg)

![16

Figure 4 [11, p. 93]](https://image.slidesharecdn.com/4c50210b-939f-4c7a-aa9c-2c2e10faf755-160510070431/75/KNISH-EDWARD-Spring2016-16-2048.jpg)

![17

In not requiring an information system either to support an existing business process or create a

new one in which to exist, Alast and Stahl allow for something as simple as a “text editor” to fall under this

definition [12, p. 4]. Interestingly, this simplicity forces their definition to be unnecessarily broad and

include systems that do not add distinguishable, intrinsic monetary value to an entity when viewed in

isolation.

To better explain why business processes cannot be excluded from an information system, I must

emphasize that this paper combines the disciplines of both finance and information science. From a

financial perspective, it is impossible to perform meaningful analysis of a system that does not affect an

entity’s monetary position or indicators in an observable manner. Significantly, finance relies on concrete

information such as net income or total assets and attempts to make informed decisions based on the

manipulation and study of these and other metrics. If a new system does not have the ability to affect

these types of input in a meaningful way, then a financial analysis of the system is a fruitless endeavor.

Thus I depart slightly from Alast and Stahl and require that in order to be considered an information

system, the software system must perform activities within one or more business processes. Finally, it is

important to note that this paper deals exclusively with systems that aid businesses, nothing else. Within

this framework, I stipulate my definition:

Information System: a software system that captures, transmits, stores, retrieves, manipulates, or

displays meaningfully organized instances of inferential propositional knowledge in order to support one or

more business processes within an organization.

So defined, this paper's scope enlarges to cover some of the original, historical methods used to

ascribe value to information systems.](https://image.slidesharecdn.com/4c50210b-939f-4c7a-aa9c-2c2e10faf755-160510070431/75/KNISH-EDWARD-Spring2016-17-2048.jpg)

![18

IV. Historical Valuation Methods

Introduction

Unlike other long-standing academic disciplines with centuries of study and discussion,

information technology and IT business value research can only trace their origins back to around the

early 1960’s [13, p. 194]. Owing to the nascent nature of these fields, when this paper expounds on

“historical valuation methods,” it refers to the valuation methods described by information systems

researchers before the late 1990’s. The cutoff point coincides with the beginning of Hirschheim and Klein’s

“fourth era” [13, p. 196] of the information systems field. The reason this paper separates IT business

value research into “historical” methods from before the late 1990’s and “current” (post-late-1990’s)

methods arises from the differences in the technologies, information depth, and intellectual approaches

used during these two periods. This section briefly focuses on these differences and their significance to

this research.

The information systems eras described by Hirschheim and Klein differ according to each era’s

information technology in use, depth of information describing the field, and the intellectual approaches

to the field as a whole. The relative newness of modern information technology created the information

depth disparities among these time periods. Over the last five decades, as the field grew in relevance, so

too did its body of information and research. The technology in use also differs dramatically among eras.

Indeed, “mainframes were the dominant computers used in organizations” [13, p. 197] during the first era

(mid 1960’s to mid 1970’s) but continuous technological evolution caused by rapid innovation culminated

in the present day, fourth era, where “laptop computers, netbooks, mobile phones, tablets” [13, p. 214]

permeate corporate structures and information systems. This combination of ever-increasing information

depth and evolving technology produced different approaches to information systems and their proper

evaluation in each era [13, p. 195]. This paper condenses the first three eras into one “historic era” and

collectively analyzes their respective methods of valuation in order to provide the proper foundations and

context for the discussion of current IT business valuation methods.](https://image.slidesharecdn.com/4c50210b-939f-4c7a-aa9c-2c2e10faf755-160510070431/75/KNISH-EDWARD-Spring2016-18-2048.jpg)

![19

This paper’s separation of IS financial analyses into “historical” and “current” methods does not

indicate that the eras described by Hirschheim and Klein have clear definition. Instead, Hirschheim and

Klein emphasize that these eras “do not have well defined boundaries” and they view “these eras as

development periods of the field . . . complexity-reducing structure[s] or simplifying vehicle[s] that

attempt to organize what would otherwise be a stream of consciousness exercise” [13, p. 194].

Accordingly, this research places little emphasis on the exact timing of the historical methods under

review. Rather, it describes them within the context of where they fall in the evolution of thought about

and the availability of information to the IS field. Examining this timeline of the information systems field

reveals a few prominent trends in the manner in which researchers analyze and define information

systems and their values. These trends include the shift from theoretical to practical approaches, the

increasing emphasis on quantitative rather than just qualitative analysis, and the growth in consensus that

information systems create value for firms. This last trend has led researchers to study how valuable a

system is rather than whether or not it is valuable in the first place.

This section further breaks out these historical methods into three distinct, yet sometimes

overlapping, categories according to the bases they use to measure the value of information systems. The

three broad categories of historical information system valuation include qualitative valuation methods,

economic valuation methods, and financial valuation methods. These categories all crucially contribute to

precise information systems value measures: one category cannot exhaustively capture the extent of the

costs and benefits associated with an individual IS. This distinction is important because although the

overarching goal of this paper is to provide financial practitioners with a means of determining the

intrinsic value of an IS, qualitative traits, not normally considered valid inputs for finance-based value

computation, are inextricable from the valuation of an IS. The introduction to the qualitative valuation

section later will cover in-depth the reasons for the necessary inclusion of qualitative traits in these

methods.](https://image.slidesharecdn.com/4c50210b-939f-4c7a-aa9c-2c2e10faf755-160510070431/75/KNISH-EDWARD-Spring2016-19-2048.jpg)

![20

Further, two stipulations are warranted at this point. First, the valuation methods described often

do not define “value” in the exact same way as their counterparts. To address this issue, this paper will

explain the different meanings of value as the models are discussed. Second, this review of historical

valuation methods is not in any way exhaustive. Rather, since its purpose lies in introducing the larger

foundations for current valuation methods, this review covers the broader theoretical approaches to

valuation and provides distinct examples of some of the methods inspired by these theoretical

approaches. Now, knowing that each category of IS valuation studied here will remain important to

proper intrinsic valuation and that their individual conceptions of value often differ, the focus shifts to the

historical models themselves, starting with qualitative methods.

Qualitative Valuation

The indivisibility of qualitative traits from a precise IS valuation approach stems from the nature

and role of information systems. Imagine a simple physical machine that accepts raw materials A and B

and transforms them into finished product C. An analyst can easily calculate this machine’s value as the

difference between the value, in dollars, it creates per period and the costs associated with the machine’s

creation and maintenance. In other words, it has direct, measurable costs that one can match with direct,

measurable benefits. In contrast, “IT creates impacts at several levels in the organization, and some only

indirectly contribute to profitability” [14]. Thus, the “intangible costs and especially benefits of

information systems are difficult to recognize and to convert to their monetary equivalent,” [15] a

complexity that drives the need for and applicability of non-financial value measures. The following

qualitative methods approach the idea of IS value in two general ways: IS’s as creators of organizational

value and IS value as a function of user and managerial utility.

Organizational Value

One of the largest contributors to the study of organizational value is Michael E. Porter, whom

many may recognize as the creator of Porter’s five forces. In his book, Competitive Advantage: Creating

and Sustaining Superior Performance, Porter explores how, under certain conditions, the proper use of

technology and information may provide individual companies with competitive advantage [16, pp. 164-](https://image.slidesharecdn.com/4c50210b-939f-4c7a-aa9c-2c2e10faf755-160510070431/75/KNISH-EDWARD-Spring2016-20-2048.jpg)

![21

200]. He explains that “technology is embodied in every value activity in a firm, and technological change

can affect competition through its impact on virtually any activity” [16, p. 166]. While it is possible to

measure the broad idea of competitive advantage in certain situations, oftentimes, managers and

companies cannot adequately define the monetary benefits or even say with certainty that a collection of

strategies will produce competitive advantage. Extending the organizational value of IT beyond just

competitive advantage, in their July 1985 Article, “How Information Gives You Competitive Advantage,”

Porter and Millar add that IT also provides organizational value in that it “changes industry structure and,

in so doing, alters the rules of competition” and “spawns whole new businesses, often from within a

company’s existing operations” [17]. These ideas form the foundation of the organizational value of IT.

While writers such as Porter and Millar provide a solid foundation for examining the firm effects

of an IS, the benefits they describe remain broad, highly theoretical, and difficult to measure. Eric K.

Clemons takes these ideas a step further while outlining his seven lessons for valuing an information

system. His article, “Evaluation of Strategic Investments in Information Technology” provides a few ways to

explain and qualify IT-driven, competitive advantage gains and risks. The first method of qualitative

evaluation mentioned by Clemons involves judging the value of an IS based on the analysis of probable,

descriptive outcomes of selling the information system at hand [18, pp. 26-28]. As a mode of evaluation,

Clemons proposes developing a probabilistic decision tree in which each outcome is measured in terms of

how relatively affected the broad financial categories of the company will be if the outcome is realized [18,

pp. 26, 28].

He notes that in the case of Merrill Lynch’s decision of whether to sell Bloomberg software,

“determining the NPV [for each possible outcome] require[d] at least fourteen estimates: four

probabilities, four estimates of $soft, and three estimates of $margin, and $comp” and that “it is virtually

impossible to get an accurate prediction for any of these numbers” [18, p. 27]. So instead of using

quantitative methods to produce educated, yet unreliable, dollar figures for the impacts that the sale of

Bloomberg may have had on the value of “Merrill’s partial ownership of Bloomberg” ($soft), Merrill’s

profit margin ($margin), and Merrill’s “potential loss in trading income” ($comp), Clemons merely set the](https://image.slidesharecdn.com/4c50210b-939f-4c7a-aa9c-2c2e10faf755-160510070431/75/KNISH-EDWARD-Spring2016-21-2048.jpg)

![22

level and direction of these figures under each possible outcome [18, p. 27]. This method produces useful,

qualitative values for traditionally quantitative measures and allows an analyst to determine an IS’s value

when faced with uncertain financial or economic outcomes.

Clemons recommends an additional way to approach the value of an information system by first

describing what he calls “the trap of the vanishing status quo” [18, p. 27]. This trap occurs when

“executives spend too little time considering the alternative to undertaking a strategic venture” [18, p. 27].

In Clemons’ context, managers oftentimes fail to realize that the initiatives of their competitors can and do

change the competitive environment as a whole [18, p. 35]. He shows that when an industry’s

environment is changing at a pace that upsets the core of the industry, “rapid and flexible organizational

response becomes essential” and that while “the value of an architectural investment to obtain this

flexibility is difficult to express quantitatively, it can be explained as buying an option that may be

necessary to ensure the firm's survival” [18, p. 32]. Under these relatively common circumstances, an

information system becomes a “strategic necessity” [18, p. 32] whose most accurate and important value

requires little derivation: must buy. Clemons’ synthesis of Porter and Millar’s broad IS organizational value

measures into a means to derive finance-specific and strategic qualitative values lends a lot of power to

valuing an IS in terms of its value as a potential organizational weapon.

User and Managerial Value

While information systems certainly possess a large degree of potential organizational value,

examining the organization as a whole without recognizing it as the sum of many human parts can lead

managers to incomplete and possibly erroneous analyses. As Pearson and Bailey note, “it has been argued

that user satisfaction is correlated to information system utilization and systems success” by many

information systems researchers [19, p. 530]. While some of the studies cited by Bailey and Pearson may

not have effectively controlled for external variables in reaching this assertion, this paper accepts that user

and management attitudes serve as acceptable proxy measurements of system usefulness. Adding to this,

a system’s value logically cannot be uncorrelated from its usefulness to the organization it serves.

Ultimately, the way users and management interact with the system can indirectly indicate the system’s](https://image.slidesharecdn.com/4c50210b-939f-4c7a-aa9c-2c2e10faf755-160510070431/75/KNISH-EDWARD-Spring2016-22-2048.jpg)

![23

overall value. This section explores two different methods of measuring system value through its utility to

the people that interact with it: Ahituv’s problem-specific efficiency frontier and Pearson and Bailey’s user

satisfaction measures.

The main difference between Ahituv’s efficient frontier method of measuring system usefulness

and Pearson and Bailey’s method emerges from the timing and content of their respective questionnaires.

The efficient frontier method starts by having management decide on attributes that the ideal system

must have and then acquiring price proposals for suitable systems [20, p. 71]. Next, each decision maker

reviews all of the relevant system proposals and provides a non-exclusive, qualitative rank for each of the

aforementioned attributes for each individual system. In the example provided by Ahituv, for all the

proposed systems, each analyst provided a score of “Superior (S),” “Average (A),” or “Inferior (I)” for six

predetermined attributes [20, p. 71]. To make these scores meaningful, “The ‘linearity’ approach was then

used to rank order the various proposals, by associating three points for ‘S,’ two points for ‘A,’ and one

point for ‘I’” [20, p. 71]. Each system then received an overall qualitative score by multiplying the number

of occurrences of each S, A, or I score they received by the number of points assigned to the respective S,

A, and I scores. Finally, as seen in Figure 5, these individual system scores were plotted on a graph with

“Price,” on the x-axis and “Quality” on the y-axis. A line drawn through each system that corresponds to

the optimal quality/price mixtures represents an “efficient frontier” and “each proposed system which

does not belong to the efficient frontier can be eliminated” [20, p. 71]. Analysts can apply this simple

qualitative method to any number of proposed systems in order to arrive at a system value measured by

appropriate fit.

In contrast to Ahituv’s approach of measuring system utility by the level of attribute quality and

price, Pearson and Bailey focus purely on user attitudes toward a specific information system. Their paper,

“Development of a Tool for Measuring and Analyzing Computer User Satisfaction,” defines satisfaction as

“the sum of the user's weighted reactions to a set of factors” given by the equation “ 𝑆𝑖 = ∑ 𝑅𝑖𝑗 𝑊𝑖𝑗

𝑛

𝑗=1

where Rij = The reaction to factor j by individual i [and] Wij = The importance of factor j to individual i”

[19, p. 531]. In order to define j, or a complete list of important IS factors, the authors compiled](https://image.slidesharecdn.com/4c50210b-939f-4c7a-aa9c-2c2e10faf755-160510070431/75/KNISH-EDWARD-Spring2016-23-2048.jpg)

![24

Figure 5 [20, p. 72]](https://image.slidesharecdn.com/4c50210b-939f-4c7a-aa9c-2c2e10faf755-160510070431/75/KNISH-EDWARD-Spring2016-24-2048.jpg)

![25

suggestions by reviewing 22 different IS satisfaction studies [19, p. 531]. After interviewing data

technicians and performing rigorous statistical analysis, Pearson and Bailey managed to produce a list of

39 statistically important IS user satisfaction attributes shown in Table 2 [19, pp. 531-533].

Because their model depends on user input, Pearson and Bailey decided to use questionnaires as

a means of measuring users’ reactions to each factor (Rij). Wanting to ensure that the measurement scale

used on the questionnaires accurately captured Rij, the researchers used the “semantic differential

technique” in formatting acceptable responses to each factor [19, p. 533]. In short, “the Semantic

Differential (SD) measures people's reactions to stimulus words and concepts in terms of ratings on

bipolar scales defined with contrasting adjectives at each end” [21]. An everyday example of the SD

technique would be a survey asking someone to rate their experience at a restaurant. One of the line

items on the survey might read “customer service” and allow the respondent to mark either bad, below

average, fair, good, or exceptional as a response. This range of values corresponding to the levels of the

bipolar adjectives bad and exceptional represents a semantic differential. On the questionnaire, Pearson

and Bailey provided six different SD scales for each attribute; four of these fully measured user perception

of the attribute and the other two served as satisfaction and relative importance measures [19, pp. 533-

534].

Each SD scale in this questionnaire had seven intervals ranging from very negative, to neutral, to

very positive. Starting from the very negative end of the scale and in order of increasing positivity, Pearson

and Bailey assigned the values -3, -2, -1, 0, 1, 2 and 3 to each interval as a means of quantifying Rij [19, p.

534]. The only scale that did not use these values was the importance scale whose beginning value was

0.10 and increased in increments of 0.15 up to 1 for the seventh interval [19, p. 534]. Having quantified all

relevant factors, users completed their questionnaires and the overall satisfaction for the user was defined

by the equation: 𝑆𝑖 = ∑

𝑊𝑖𝑗

4

∗ ∑ 𝐼𝑖,𝑗,𝑘

4

𝑘=1

39

𝑗=1 where the additional factor, “Ii,j,k = the numeric

response of user i to adjective pair k of factor j” [19, p. 534]. In their paper, Pearson and Bailey provide a

method of ‘normalizing’ these scores so that they fall on a scale between -1 and 1 [19, p. 534]. This ending](https://image.slidesharecdn.com/4c50210b-939f-4c7a-aa9c-2c2e10faf755-160510070431/75/KNISH-EDWARD-Spring2016-25-2048.jpg)

![26

Table 2 - Pearson and Bailey’s 39 Factors [19, p. 532]

Flexibility Communication with the EDP Staff

Accuracy Relationship with the EDP staff

Timeliness Understanding of Systems

Reliability Degree of Training

Completeness Job Effects

Confidence in Systems Top Management Involvement

Relevancy Feeling of Control

Precision Schedule of Products and Services

Technical Competence of EDP Staff Format of Output

Currency Mode of Interface

Priorities Determination Security of Data

Error Recovery Expectations

Response / Turnaround Time Organizational Position of the EDP Function

Convenience of Access Volume of Output

Attitude of the EDP staff Language

Time Required for New Development Charge-Back Method of Payment for

Services

Perceived Utility Organizational Competition with the EDP

Unit

Documentation Vendor Support

Feeling of Participation Integration of the System

Processing of Change Requests](https://image.slidesharecdn.com/4c50210b-939f-4c7a-aa9c-2c2e10faf755-160510070431/75/KNISH-EDWARD-Spring2016-26-2048.jpg)

![27

score represents another qualitative value measure for an IS. However, rather than measuring the

appropriate fit of the system as Ahituv’s method allows, this score enables analysts to determine the value

of an IS in terms of whether the system is a burden or an asset. According to Pearson and Bailey, negative

scores represent levels of dissatisfaction, zero represents indifference, and positive scores represent levels

of satisfaction [19, p. 535]. This paper interprets these numbers so that a system whose score is negative

can be valued as a burden and a system whose score is positive can be valued as an asset.

Qualitative Valuation: Summary Observations

Although historical qualitative IS valuation techniques may not produce values that contain the

evaluative rigor generally demanded by financial analysts, any IS valuation procedure that ignores or fails

to capture the intangible effects of an IS similarly lacks thoroughness. Many times, qualitative approaches

provide the only way to reliably measure these intangible effects and hence ought to be included in any

comprehensive approach to the evaluation of an information system. These approaches can be roughly

split between measuring IS organizational value and measuring IS human value.

This paper has examined some of the values that can be discerned from this type of approach by

setting the value of an IS as competitively advantageous/disadvantageous, strategically necessary,

valuable considering all alternatives, appropriately fit, and/or useful. Some of the measurement units

discussed include qualitative levels of financial indicators [18, p. 27], descriptive market characteristics

[18, p. 32], position on efficiency frontiers [20, p. 71], and normalized satisfaction scores [19, p. 534].

DeLone and McLean provide an exhaustive review of many historical qualitative measures in their study

“Information Systems Success: The Quest for the Dependent Variable” and further separate these

methods into six dimensions of success: “System Quality, Information Quality, Use, User Satisfaction,

Individual Impact, and Organizational Impact” [22, p. 60]. These categories all have extensive literature

and a wealth of different models but an immersive, comprehensive review of each model falls well outside

the scope of this paper. Having reviewed the extent, purpose, importance, and range of historical

qualitative valuation methods, this paper pivots to the examination of historical economic IS valuation

methods.](https://image.slidesharecdn.com/4c50210b-939f-4c7a-aa9c-2c2e10faf755-160510070431/75/KNISH-EDWARD-Spring2016-27-2048.jpg)

![28

Economic Valuation

In contrast to qualitative information system values such as strategic necessity and usefulness

that provide actionable insight to business managers, the economic values of an IS tend to pinpoint the

sources of IS value rather than supply prescriptive or quantifiable measurements. In essence, “the

underlying discipline for the concept of ‘business value’ is economics [because] business value subsumes

goal attainment, relative scarcity (or effort) and economic worth” [23, p. 2]. In other words, the benefits

and costs of an IS described by categorically different (non-economic) measures are simply concrete

measurements of the same underlying economic value created by an information system. This assertion

does not imply that analysts cannot or should not use economic value measures in final system evaluation

or decision-making because, depending on the type and depth of information available, economic

valuation may indeed produce powerful and precise measurements. Rather, the conception of economic

value as the common source of all other value measures illustrates the possibility of overstating total

system value when using a combination of economic and other classes of value. For instance, imagine an

analyst who performs both an economic calculation that shows increasing productivity and then performs

a financial calculation that shows decreasing labor-intensity. If he or she decided to label these calculated

gains as separate indicators of value, both the analyst and management would be misled because

decreasing labor intensity is likely just a different measurement of economic productivity gains. The

valuation would lose its precision since the same value would be counted twice by different measures.

While economic IS valuation may, in certain cases, prove to be the most prudent technique for

overall system valuation, this paper prefers to treat these historical methods as theoretical, yet

empirically-analyzed explanations of how an information system creates value. The following section

begins by addressing some of the unique economic features of information systems. The discussion then

turns to a few theories regarding the way in which information systems may create economic value for

individual firms based on items such as production economics and transaction cost theory. Finally, the

difficulties associated with developing concrete economic valuation models are explored and qualified. As](https://image.slidesharecdn.com/4c50210b-939f-4c7a-aa9c-2c2e10faf755-160510070431/75/KNISH-EDWARD-Spring2016-28-2048.jpg)

![29

this analysis will show, economic examination of information system value often creates more problems

than it solves.

Distinct Economic Features of Information Systems

As an economic entity, an information system falls under the broad category of “capital

investments” [24, p. 386]. In their article, “Recent Applications of Economic Theory in Information

Technology Research” Bakos and Kermerer perform a massive review and categorization of all economics-

based IT research performed up through 1991 [24, p. 385]. They begin their analysis by first defining five

economic characteristics common to all IT investments [24, p. 388]. These characteristics provide IT with a

uniqueness that this paper accepts as one of the root difficulties associated with economic IT valuation.

The first characteristic of information systems is that they “typically require large capital investments and

they offer substantial economies of scale and scope” [24, p. 387]. This refers to the large initial costs of an

IS that drive relatively tiny post-implementation marginal investments to use and extend the system (an

economy of scale). The economies of scope mentioned by Bakos and Kermerer arise from the extensibility

of the technological and organizational assets provided by an IS [24, p. 387].

While economies of scale and economies of scope never lose their desirability from the

perspective of the firm who achieves them, the remaining four distinctive economic characteristics of IT

seem almost to overshadow these advantages. For instance, the second characteristic where “the benefits

realized by individual users of information technology increase as more users adopt compatible systems”

can benefit certain firms by conferring “first mover advantages [to] technology vendors” [24, p. 387].

However, the broader effect of this situation springs from the fact that IS’s in this sense generate “network

externalities” [24, p. 387] that add multiple layers of complexity to the effective economic measurement

and management of an IS. The third characteristic of IT, that “potential adopters of information technology

face substantial uncertainty regarding the actual benefits of this technology,” often causes delays in IT

adoption, which translates to lost economic value if the system itself is valuable despite the uncertainties

[24, p. 387]. The last two unique economic characteristics of IS’s, that they “can impose significant

switching costs on their participants” [24, p. 387] and “reduce customers’ costs of obtaining information”](https://image.slidesharecdn.com/4c50210b-939f-4c7a-aa9c-2c2e10faf755-160510070431/75/KNISH-EDWARD-Spring2016-29-2048.jpg)

![30

do not bode well for the firm implementing the IS. High switching costs can cause economic inefficiencies

and a lower cost of information to consumers erodes firm pricing power. Given this seemingly negative set

of traits that distinguishes information systems from most other capital investments, this research now

explores the question of how an IS can possibly create economic value.

Sources of Economic Value

IT economic value research found its humble beginnings at the intersection of the rapid increase

in information systems expenditures in 1970-1980 and the theory of production economics. As the field of

information systems became more accepted and refined, researchers began trying to determine the actual

level of returns promised by the IT revolution [13, p. 209]. Traditional thinking prompted many researchers

to approach IT value through the theory of production which “posits that firms possess a method for

transforming various inputs into output, represented by a production function” [25, p. 123]. By producing

a general model of the specific production function, “it is possible to econometrically estimate the

contribution of each input to total output in terms of the gross marginal product” [25, p. 123]. Kauffman

and Kriebel provide an excellent illustration (Figure 6) of how to carry out economic production analysis by

measuring efficiency [23, p. 5].

According to Kauffman and Kirebel, Figure 6 “is an abstract and oversimplified characterization of

a production process; it depicts physical output (production) in terms of two required inputs to the

process” [23, p. 4]. This analysis holds output constant where points A, B, and C all denote the same level

of output and the curve (X-X’) “represents possible tradeoffs between the two inputs to produce the same

level of output with the known production technology” [23, p. 4]. Lastly, the line (a-b) represents the

production costs associated with the various mixes of input levels [23, p. 5]. Point B represents the most

efficient mix of inputs as this is the point where both cost and inputs required are minimized [23, p. 5].

Point C, on the other hand, denotes a very inefficient use of resources given the output level [23, p. 5].

Information systems researchers began analyzing IT in this manner as an input into production processes

because theory held that this was the best way to empirically see the benefits associated with IS usage.](https://image.slidesharecdn.com/4c50210b-939f-4c7a-aa9c-2c2e10faf755-160510070431/75/KNISH-EDWARD-Spring2016-30-2048.jpg)

![31

Figure 6 - [23, p. 5]](https://image.slidesharecdn.com/4c50210b-939f-4c7a-aa9c-2c2e10faf755-160510070431/75/KNISH-EDWARD-Spring2016-31-2048.jpg)

![32

To the surprise of many, “the majority of studies in this area report[ed] little or no impact of IT on

firm performance” [26, p. 137]. This situation, that “business organizations demonstrate ever higher levels

of investment in IT in the absence of measured productivity gains,” has become a highly contested issue in

the IS field widely known as the “productivity paradox” [27, p. 18]. While the vast majority of studies

conducted in the 1980’s found little or negative IT-driven productivity impacts, after adjusting their

models, some researchers in the late 1980’s and early 1990’s began observing positive IT productivity

gains [28, p. 4]. The debate over the productivity paradox remains unresolved to this day. Owing to the

continued inconclusiveness of empirical evidence regarding IT’s impact on economic productivity, this

research accepts that IT may possibly contribute to economic productivity but defers judgment to future

research.

While productivity measures have certainly taken center stage in the debate over the economic

value of an IS, this paper explains two other possible sources of IT economic value: organizational

flexibility and cooperation incentives. Simply put, organizational flexibility refers to “the ability [of an

organization] to adapt to change and respond quickly to market forces and uncertainty in its environment

[29, p. 2]. Lucas and Olson explain that IT, by “changing boundaries on where tasks are accomplished . . .

removing constraints on when tasks are performed . . . speed[ing] up the processing of information . . .

[and] enable[ing] the firm to respond quickly to changing market conditions” profoundly alters the

flexibility of an organization [29, pp. 3-4]. Donald Sull, who uses the term “operational agility” instead of

organizational flexibility, explains that the economic benefit of increasing flexibility lies in the

organization’s increased ability to act on market opportunities and establish market share early [30]. This

theoretically increases potential demand for the organization and represents another area of economic

value that a non-economic IS valuation method may unintentionally capture.

In addition to its potential effect on productivity and flexibility, information technology also

encourages inter-business cooperation. The basis of this theory lies in transaction cost economics which,

as a discipline, “investigates how interactions among economic activities are organized, explicitly

recognizing the costs of managing the interaction” [31, p. 10]. In order to explain how IT can encourage](https://image.slidesharecdn.com/4c50210b-939f-4c7a-aa9c-2c2e10faf755-160510070431/75/KNISH-EDWARD-Spring2016-32-2048.jpg)

![33

cooperation, Clemons and Row define transaction costs as the product of coordination costs, or “the

direct costs of integrating decisions between economic activities,” and transaction risk, “the cost

associated with the exposure to being exploited in [an economic] relationship” [31, p. 11]. They point out

that while IT certainly reduces coordination costs [31, p. 18], “a reduction in unit coordination costs will

not lead to an increase in explicit coordination if transaction risk is increased proportionately” [31, p. 11].

IT separates itself from other economic assets because in addition to reducing the explicit costs

of coordination, it also “reduce[s] the level of transaction-specificity in investments in explicit

coordination. . . reduce[s] the costs of performance monitoring, and provide[s] information needed to

structure more incentive-compatible reward mechanisms” [31, p. 26]. These effects, in turn, lower the

overall risk associated with inter-organizational cooperation and when combined with lower explicit

transaction costs, ultimately erode barriers to cooperation. This IT-driven increase in cooperation creates

economic value by improving resource utilization and exposing the company to previously unserved

markets. The three possible sources of IT economic value mentioned in this section: productivity

increases, gains in organizational flexibility, and cooperation incentives provide a strong introduction to

how IT may serve the economic interests of a firm. However, they fall short of representing a

comprehensive review of IT economic research and in the absence of consensus among researchers

regarding exactly how IT creates economic value, this paper moves on to how IT, as an economic entity,

often escapes explicit valuation.

Quantitative Economic Value Measures

As is the common theme for IT business value research, the rich theoretical background that

supports the idea that IT creates economic value fails to produce any direct quantitative methods of

measuring this value. In his paper, “The Productivity Paradox of Information Technology: Review and

Assessment,” Brynjolfsson posits that four factors have prevented researchers from developing reliable

and powerful quantitative economic models. The first of these factors “mismeasurement of outputs and

inputs,” refers to the non-standardized way in which institutions capture and define IT economic indicators

and the difficulty associated with measuring the appreciation in the value of information itself [32, p. 74].](https://image.slidesharecdn.com/4c50210b-939f-4c7a-aa9c-2c2e10faf755-160510070431/75/KNISH-EDWARD-Spring2016-33-2048.jpg)

![34

Second, Brynjolfsson explains that “the benefits from IT can take several years to show results” and these

lags have the potential to understate the economic benefits of IT and obfuscate value indicators [32, p.

75]. Additionally, information technology investments may have little effect on aggregate economic gauges

owing to the possibility that value gains to an individual firm from IT may be redistributions of economic

value rather than new value creations [32, p. 75]. Finally, Brynjolfsson argues that the value of IT may

depend so heavily on its management that many of the expected economic benefits of IT are locked in

behind inefficient managers [32, p. 75].

Economic Valuation: Summary Observations

Despite these limitations, many researchers have attempted to develop robust quantitative

economic valuation methods for information technology. Kauffman and Kriebel expended tremendous

effort in applying Data Envelopment Analysis to IT [23] and Barua, Kriebel and Mukhopadhyay went to

great lengths to value a simple hypothetical duopooly in the search for the economic value of information

systems [33]. While these efforts deserve praise and recognition from the IS research community, the lack

of consensus and empirical evidence surrounding the economic value of IT pushes the examination of

specific valuation models beyond the scope of this paper. In summary, historical, economic IT valuation

methods prove useful in identifying the sources of IT value but do not satisfactorily capture the levels of

value created. Offering a reminder that using economic methods in combination with other value

measures may result in the overstatement of true IT value, this paper turns its focus to the last category of

historical valuation techniques: financial valuation methods.

Financial Valuation

Before the fourth era of the information systems discipline, researchers thought little about

financial, or as commonly referred to in IT literature, traditional, approaches to system valuation. The

researchers who did address them deemed traditional approaches “inappropriate” because “IT involves a

wide range of strategic benefits that are hard to quantify; and any circumstances surrounding IT

investment criteria are subject to increasingly rapid change” [34]. Owing to this view of traditional

methods as inappropriate, historical methods for financial IT business value exist almost completely in the](https://image.slidesharecdn.com/4c50210b-939f-4c7a-aa9c-2c2e10faf755-160510070431/75/KNISH-EDWARD-Spring2016-34-2048.jpg)

![36

(mainframes, minicomputers and supercomputers) as well as the value of all PCs currently owned by the

firm,” and IS Labor, “which is the labor portion of the central IS budget” [25]. This brief review of financial

calculations concludes this paper’s discussion of historical financial methods because traditional

approaches were not taken seriously until well into the fourth era of the IS research field.

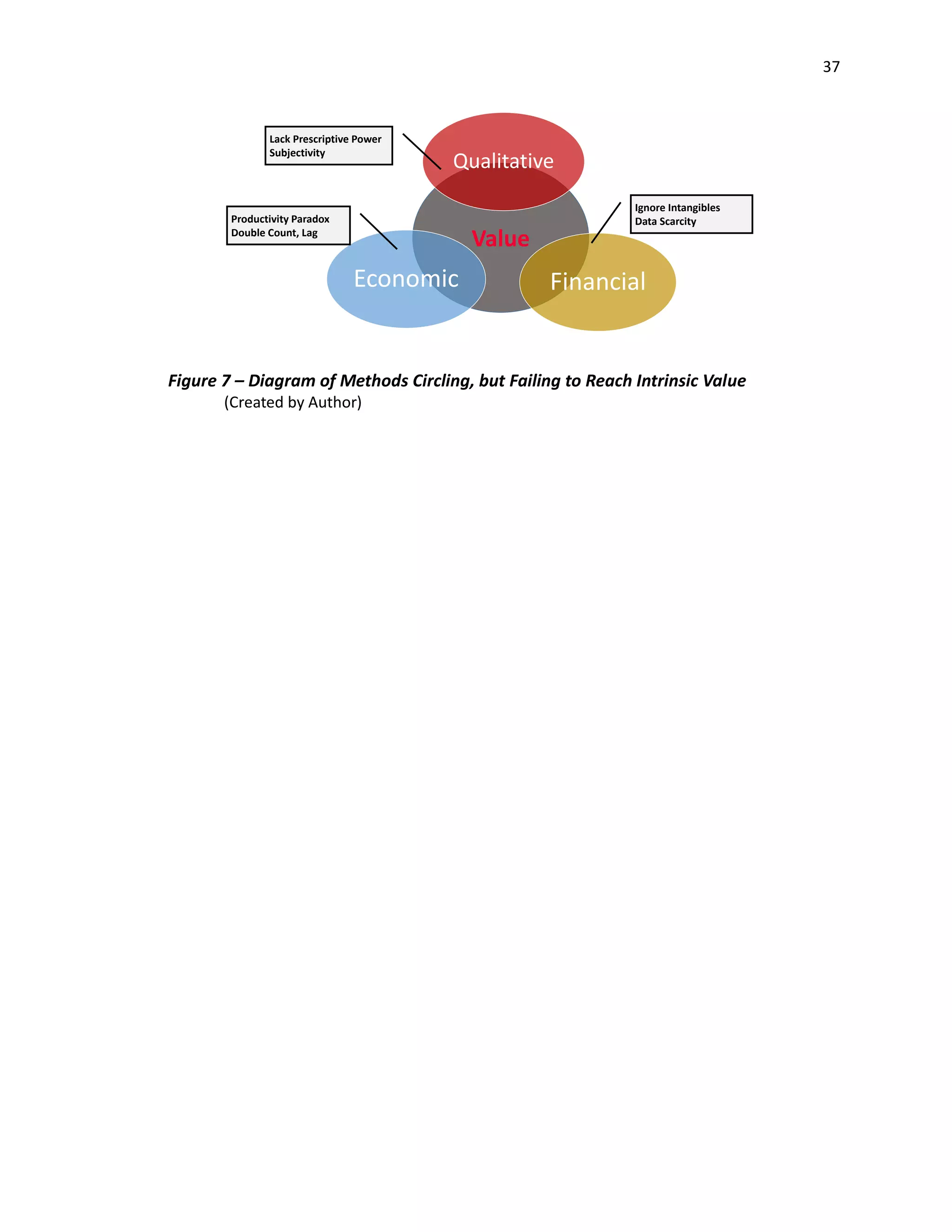

Historical Valuation: Summary Observations

This historical valuation section has examined three broad categories of information system

valuation common among researchers from the mid 1960’s all the way through the mid 1990’s. Whether

trying to determine the qualitative, economic, or financial characteristics of an information system, one

idea is clear: a system evaluation that fails to address any one of these areas importantly lacks in precision

and due diligence. This section has expressed another truth about systems evaluation in that unlike typical

business assets, IT assets often do not provide concrete, direct benefits. This problem of measurement has

confounded researchers since IT’s rise in popularity nearly 60 years ago and continues into this day. IT

business value arises from IT’s ability to alter productivity, market characteristics, competitor behavior and

a host of other economic indicators but no single method can fully capture this value (Figure 7) because of

the diverse effects IT has on a corporation. Having demonstrated that the effects of these changes can be

captured by economic, qualitative and financial indicators, the focus shifts to current methods and

extensions of these theories to provide practitioners with guidance on the most recent ways that the field

has begun determining IT business value.](https://image.slidesharecdn.com/4c50210b-939f-4c7a-aa9c-2c2e10faf755-160510070431/75/KNISH-EDWARD-Spring2016-36-2048.jpg)

![38

V. Current Methods

Having reviewed the historical foundations for IT business value, one might think that this wide

body of research has coalesced into a few concise methods for determining the value of an information

system; however, this has not yet occurred. While many researchers have found promising empirical

evidence that certain alterations to the aforementioned methods produce more precise measures of IT

value [25, 34], consensus remains far out of reach for the field. As this paper intends to provide guidance

for current practitioners, comparing the strengths and weaknesses of all current methods is not

appropriate in this context. Instead I present three recent approaches to determining IS value that stand

out as particularly applicable and powerful in aiding individuals evaluating current systems. These

approaches include valuing an information system using option-pricing, using Tobin’s Q as a proxy for IS

intangible value, and Intel’s comprehensive method of determining IS value.

IT Option Pricing

Following from the theory that the value of an information system partially derives from the

opportunities IT creates for a firm later in time, Michael Benroach and Robert Kauffman argue that valuing

an IS as a stock option appropriately captures IT value. Citing recent research, Benroach and Kauffman

argue that an IT project “embeds a real option when it offers management the opportunity to take some

future action” [35, p. 2]. They further note precedence for the non-equity specific implementation of

option pricing in the financial field where “these models and their extensions have also been used in a

variety of evaluative settings involving capital budgeting investments embedding real options” [35, p. 2].

The attractiveness of this option pricing approach, they argue, lies in the fact that it “take[s] into account

the fact that changes in revenue expectations will occur as time passes” which traditional measures such

as NPV and IRR fail to do [35, p. 5].

The authors further demonstrate that the risk assumptions and acceptance of skewed outcome

distributions inherent in the Black-Scholes option pricing model line up well with IS valuation [35, p. 4].

The authors explain the Black-Scholes model in the following manner:](https://image.slidesharecdn.com/4c50210b-939f-4c7a-aa9c-2c2e10faf755-160510070431/75/KNISH-EDWARD-Spring2016-38-2048.jpg)

![39

The value of a call option is its discounted expected terminal value, E[CT]. The

current value of a call option is given by 𝐶 = 𝑒−𝑟 𝑓 𝑇

𝐸[𝐶 𝑇], where 𝑒−𝑟 𝑓 𝑇

is

the present value factor for risk-neutral investors. A risk-neutral investor is

indifferent between an investment with a certain rate of return and an

investment with an uncertain rate of return whose expected value matches

that of the investment with the certain rate of return. Given that 𝐶 𝑇 =

𝑚𝑎𝑥[0, 𝐴 𝑇 − 𝑋] and assuming that 𝐴 𝑇 is log-normally distributed, it can be

shown that:

𝐶 = 𝐴𝑁(𝑑1) − 𝑒−𝑟 𝑓 𝑇

𝑋𝑁(𝑑2),

𝑑1 =

𝑙𝑛(

𝐴

𝑥

)𝑟𝑡 𝑓

𝜎√ 𝑇

+

1

2

𝜎√𝑇, 𝑑2 = 𝑑1 − 𝜎√𝑇

where N() is the cumulative normal distribution. Call option value, C,

calculated using the BlackScholes model, denoted 𝐶 𝐵𝑆

, can also be written as

the implicit function 𝐶 𝐵𝑆

= 𝐶 𝐵𝑆

𝐵𝑆 (𝐴, 𝜎, 𝑋, 𝑇, 𝑟𝑓) [35, p. 6].

The variables in these equations are defined as follows:

C — value of a call option;

A — value of option's underlying risky asset (stated in terms of the present

value of expected revenues from the operational project);

µ — rate of return expected on A (growth rate of A over time);

σ — volatility, the standard deviation of the expected rate of return on A;

X — option's exercise price (cost of converting the investment opportunity

into the option's underlying asset, i.e., the operational project);](https://image.slidesharecdn.com/4c50210b-939f-4c7a-aa9c-2c2e10faf755-160510070431/75/KNISH-EDWARD-Spring2016-39-2048.jpg)

![40

rf — the risk-free interest rate (usually implemented as the rate of return on

U.S. Treasury Bills);

r — 1+rf ;

T — option's time to maturity or expiration (i.e., the maximum length of the

deferral period).

Black Scholes, just like any other financial model, requires concrete financial values. Benroach

and Kauffman rely on the time-tested, albeit not entirely precise, method of asking decision-makers for

approximations to determine the financial outcomes needed to use this model [35, p. 9]. Benroach and

Kauffmman explain in detail how they applied this method to evaluate Yankee 24’s decision of if and when

to offer debit card services to member firms [35, p. 3]; however, a full review of how to use the Black-

Scholes model is not appropriate for this paper. Rather, this section addresses this approach since it

represents a new, and arguably more extensible method of determining IS value for current practitioners.

In summary, applying option pricing models to the evaluation of an IS addresses the timing and volatility

issues ignored by NPV and IRR calculations. One of the largest problems with evaluating IT, intangible

benefit measurement, is discussed next through the lens of Tobin’s Q.

Tobin’s Q

The second current IS valuation approach that practitioners ought to be made aware of given its

power and unique take on addressing the intangible value of IT assets lies in an older financial measure

known as Tobin’s Q Ratio. As explained by Bharadwaj, Bharadwaj, and Konsynski, Tobin’s Q is “defined as

the capital market value of the firm divided by the replacement value of its assets” [36, p. 1009]. While

these researchers certainly did not develop this method, they note that it has been used extensively in a

variety of value applications [36, p. 1010] and is useful to IT because it “incorporates a market measure of

firm value which is forward-looking, risk-adjusted, and less susceptible to changes in accounting practices”

[36, p. 1009]. As mentioned in this paper’s section on historical financial valuation measures, researchers](https://image.slidesharecdn.com/4c50210b-939f-4c7a-aa9c-2c2e10faf755-160510070431/75/KNISH-EDWARD-Spring2016-40-2048.jpg)

![41

have long derided traditional valuation approaches because accounting numbers fail to measure

intangible benefits. The authors further criticize these methods because “they typically only reflect past

information” and hence, lack applicability to new information systems projects and future managerial

performance.

In order to study whether or not investments in information technology correlated with Tobin’s Q

Ratio, the researchers studied 631 firms over a 5 year period (1989-1993) [36, p. 1013]. They specifically

chose Chung and Pruitt’s simplified Q formulation to carry out their analysis which defines Tobin’s Q as:

𝑇𝑜𝑏𝑖𝑛′

𝑠 𝑄 = (𝑀𝑉𝐸 + 𝑃𝑆 + 𝐷𝐸𝐵𝑇)/𝑇𝐴

“Where: MVE = (Closing price of share at the end of the financial year)*(Number of common shares

outstanding); PS = Liquidating value of the firm's outstanding preferred stock; DEBT = (Current liabilities -

Current assets) + (Book value of inventories) + (Long term debt), and TA = Book value of total assets.” [36,

p. 1014]. After running a statistical analysis of five different proposed influences of Tobin’s Q [36, p. 1016],

it was shown that “the inclusion of the IT expenditure variable in the model increased the variance

explained in q significantly” and that “IT had a statistically significant positive association with Tobin's q”

[36, p. 1017]. The authors note that while Tobin’s Q helps analysts capture the intangible benefits of IT, “q

is only an aggregate measure of the intangible value of a firm, and further research is needed to unbundle

the various sources of intangible value” [36, p. 1019]. This IT contribution to a firm’s Q may be quantified

and used as a proxy for IT intangible value once the method for uncoupling the various intangible benefits

is fleshed out but for this paper, it is important for IT and financial practitioners to be aware that this

promising method exists. As a final note on current valuation methods, this paper turns its attention to

David Sward’s method of system evaluation.

Sward’s Multi-Attribute Financial Valuation

The final method this paper reviews comes from David Sward’s comprehensive guide to valuing

information systems projects found in his book “Measuring the Business Value of Information

Technology.” Not only does Sward provide a quantitative-based approach to system valuation, he extends](https://image.slidesharecdn.com/4c50210b-939f-4c7a-aa9c-2c2e10faf755-160510070431/75/KNISH-EDWARD-Spring2016-41-2048.jpg)

![42

the calculation portion into a full method for any company or individual hoping to evaluate an information

system. For practitioners looking for step-by-step guidance in designing a systems analysis method that

also explains the technical aspects of financial valuation in detail, I highly recommend reading Sward’s 280

page guide to information systems evaluation. However, as this thesis is dedicated to a concise, practical

approach for practitioners hoping to evaluate an IS, Sward’s method is briefly explained in this section

before moving on to the final section: a practical approach to information system valuation.

Sward bases much of his method on his experience in developing an IT business value system for

Intel. He notes that at Intel, they develop “business value dials” which, are “standardized indicator[s] of

business value” and that “when deploying IT solutions, [Intel’s] intention is to influence these business

values dials” [1, p. 20]. Interestingly, these dials (Figure 8) ought to be developed by management and

stated in qualitative terms initially such as “faster time to market” or “improvements in employee

productivity” [1, pp. 19-21]. After this initial assessment is complete, Sward insists that “study designers

should prepare an inventory of all information and data available for the IT solution” and that, if data

cannot be collected for a certain dial, then “more data and more work will be required” [1, pp. 114-115].

Obviously, this approach depends fully on quantifiable impacts which this paper sees as a shortcoming of

the model but this does not mean Sward’s approach loses its adaptability.

Sward aids readers tremendously in identifying four broad categories of IT that affect a firm’s

bottom line including headcount management, expense avoidance, working capital, and revenue increases

[1, p. 22]. Sward then breaks each section out and lists in detail what types of concrete financial indicators

measure these categories, how they are calculated, and how they influence firm value [1, pp. 23-43].

Sward’s contribution to IT business value research comes from his approach to translating qualitative IT

impacts into quantitative measurements that can be determined by most financial practitioners. He offers

a concrete method for developing an individual approach to measuring the financial value of IT and his

work ought to be examined by IT and finance professionals looking for stepwise instructions regarding this

matter.](https://image.slidesharecdn.com/4c50210b-939f-4c7a-aa9c-2c2e10faf755-160510070431/75/KNISH-EDWARD-Spring2016-42-2048.jpg)

![43

Figure 8 [1, p. 20]](https://image.slidesharecdn.com/4c50210b-939f-4c7a-aa9c-2c2e10faf755-160510070431/75/KNISH-EDWARD-Spring2016-43-2048.jpg)

![44

Commodity Information Systems

While not an approach to IT valuation, an important conception of IT has gained traction in

recent years and needs to be addressed. This new idea asserts that “the growing ubiquity of IT means that

its strategic importance is diminishing and that IT is, in fact, becoming merely a commodity” [36].

Commodities, by nature, have definite values and definite attributes and certain classes of systems such as

CRM systems offered by companies like Salesforce have arguably reached a degree of standardization and

ubiquity where their intrinsic values and attributes are easy to measure and describe. This paper will not

explore this concept or these types of systems since they importantly lack any applicable valuation

approaches to IT as a commodity.

Current Methods: Summary Observations

The current methods discussed in this section represent reliable, and potentially powerful