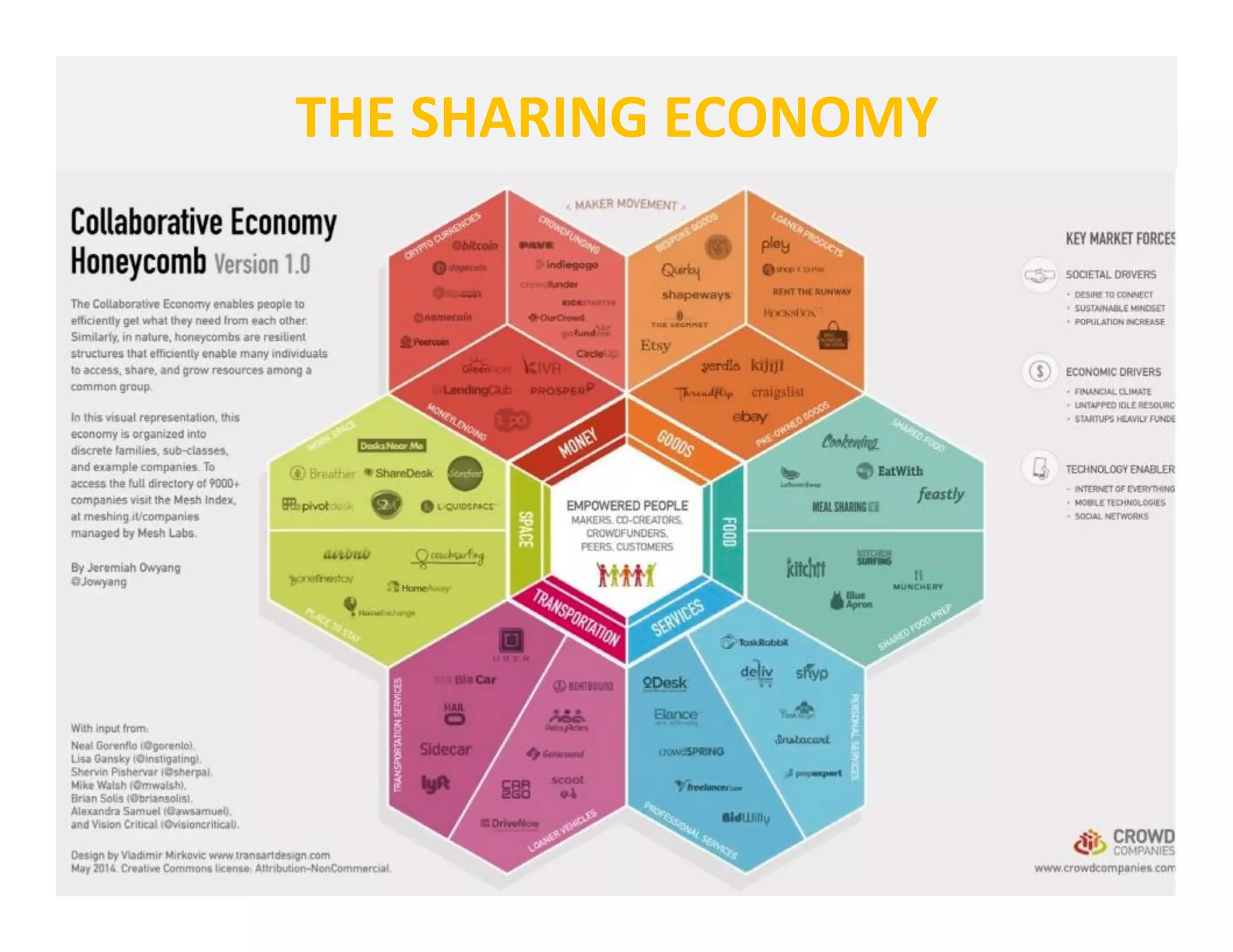

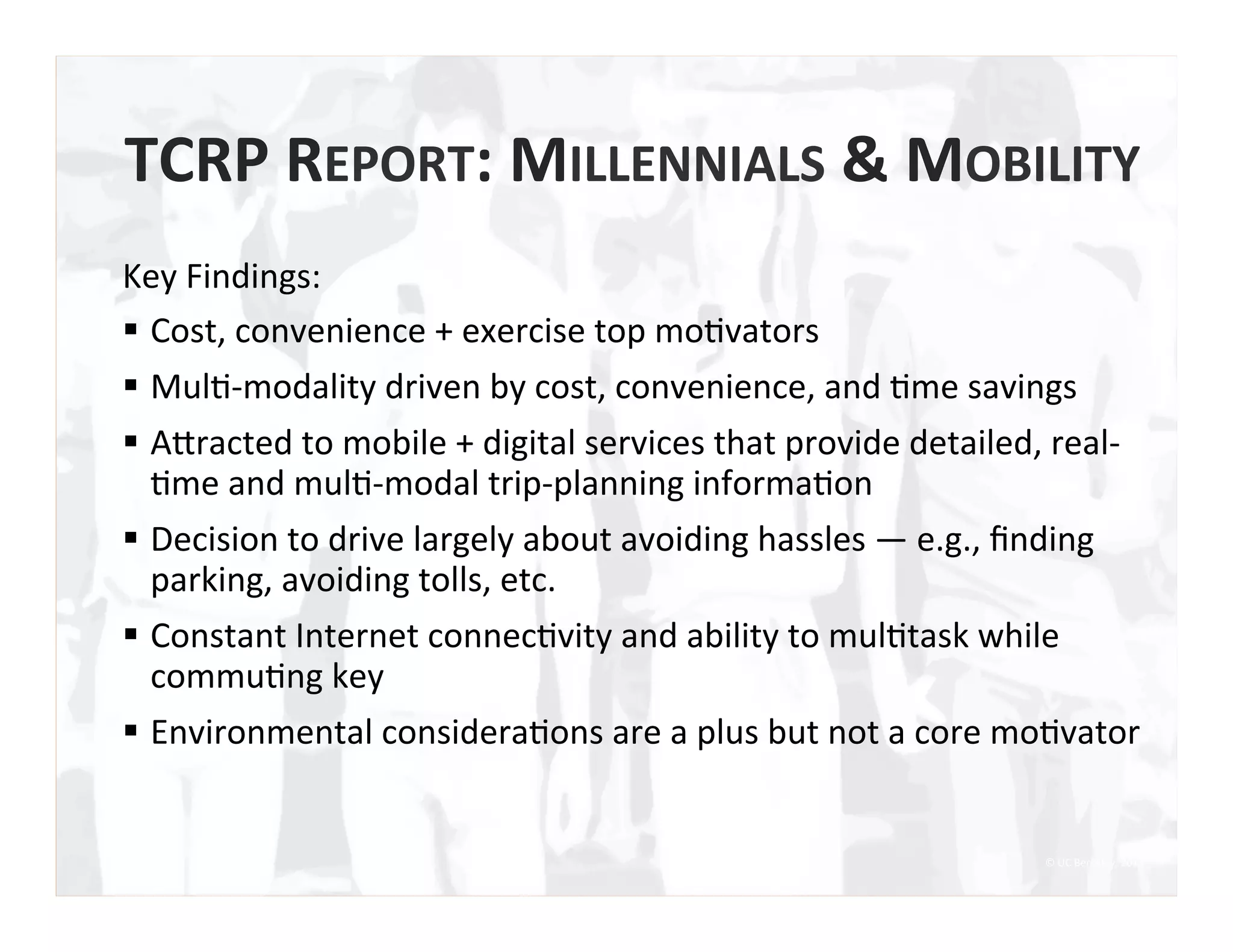

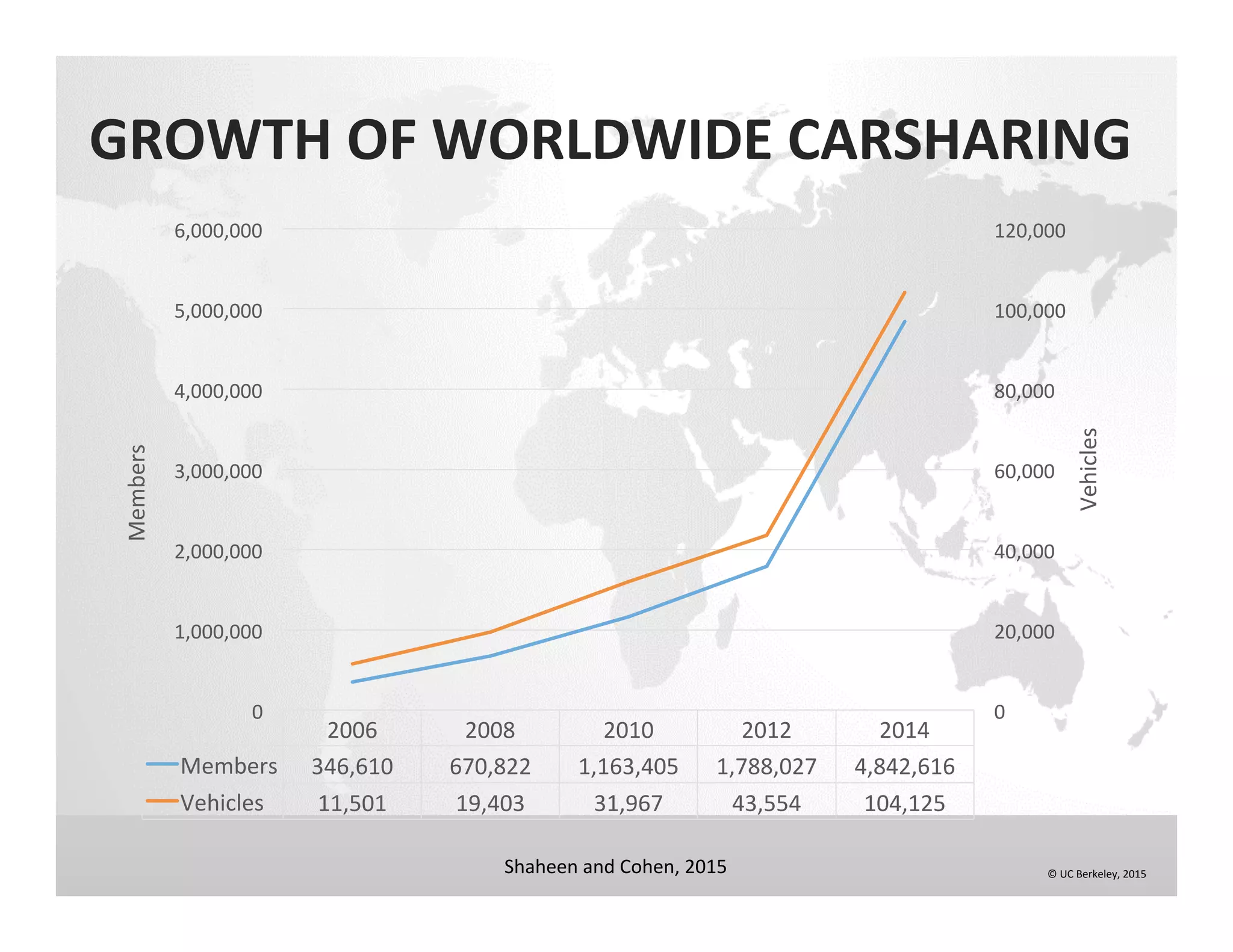

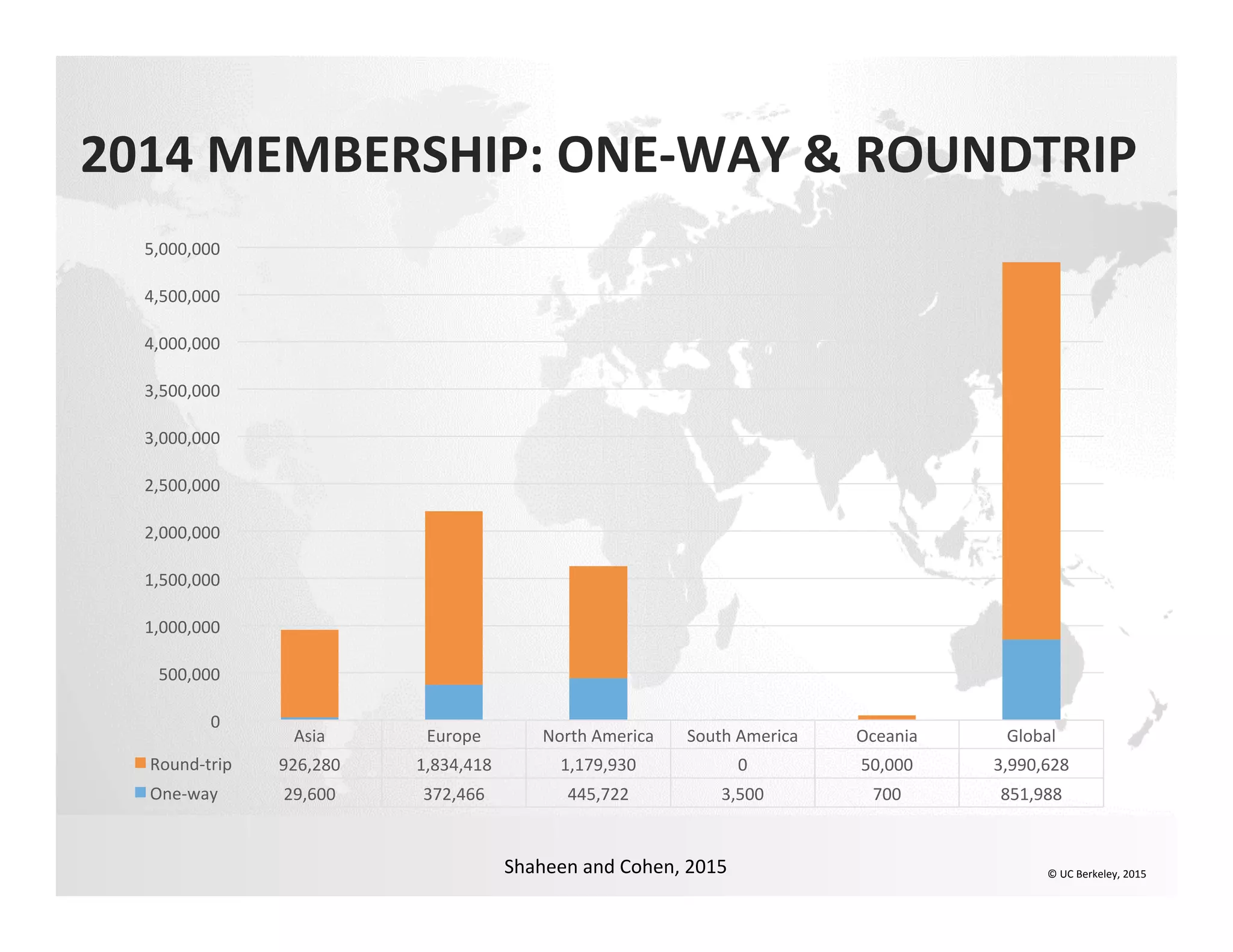

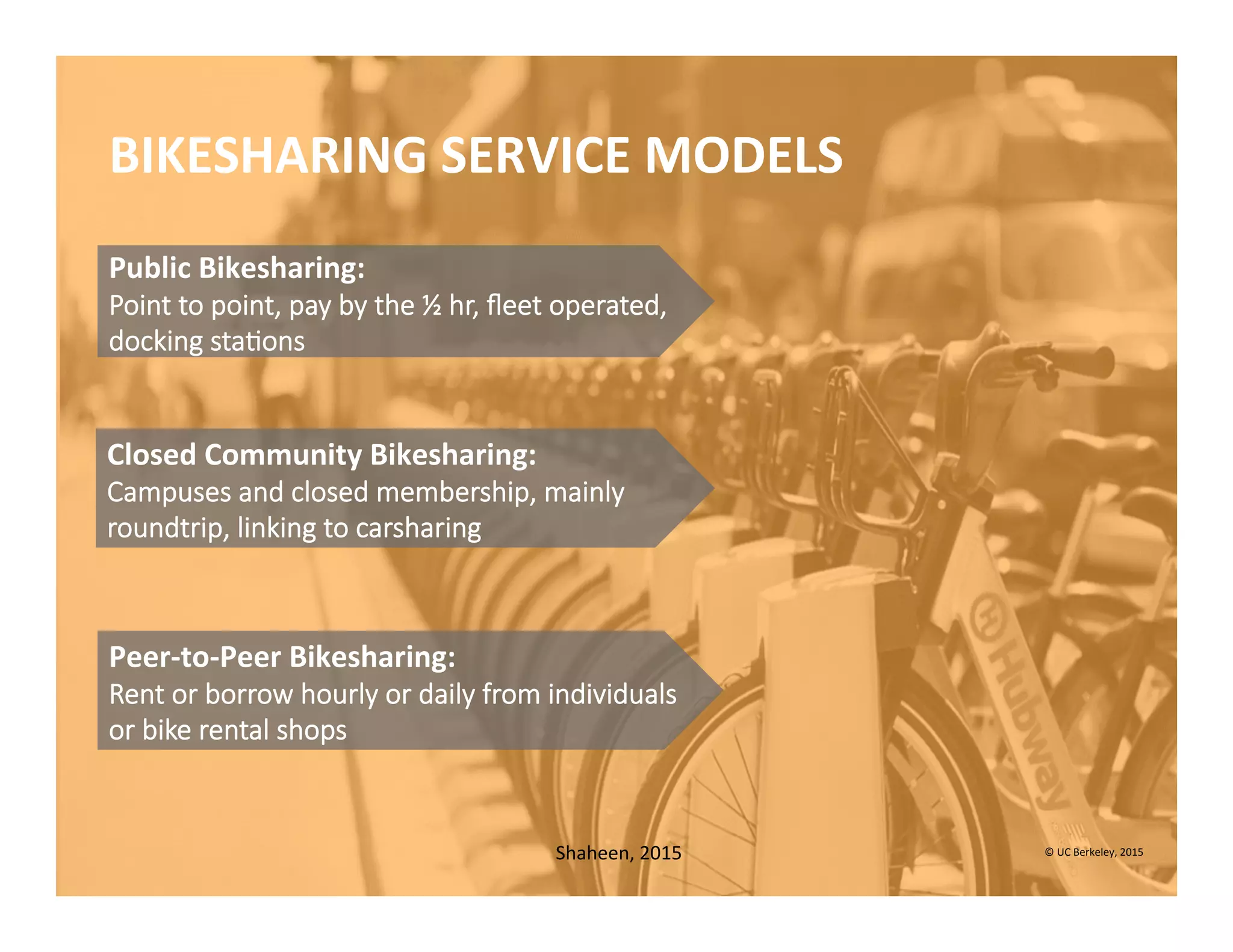

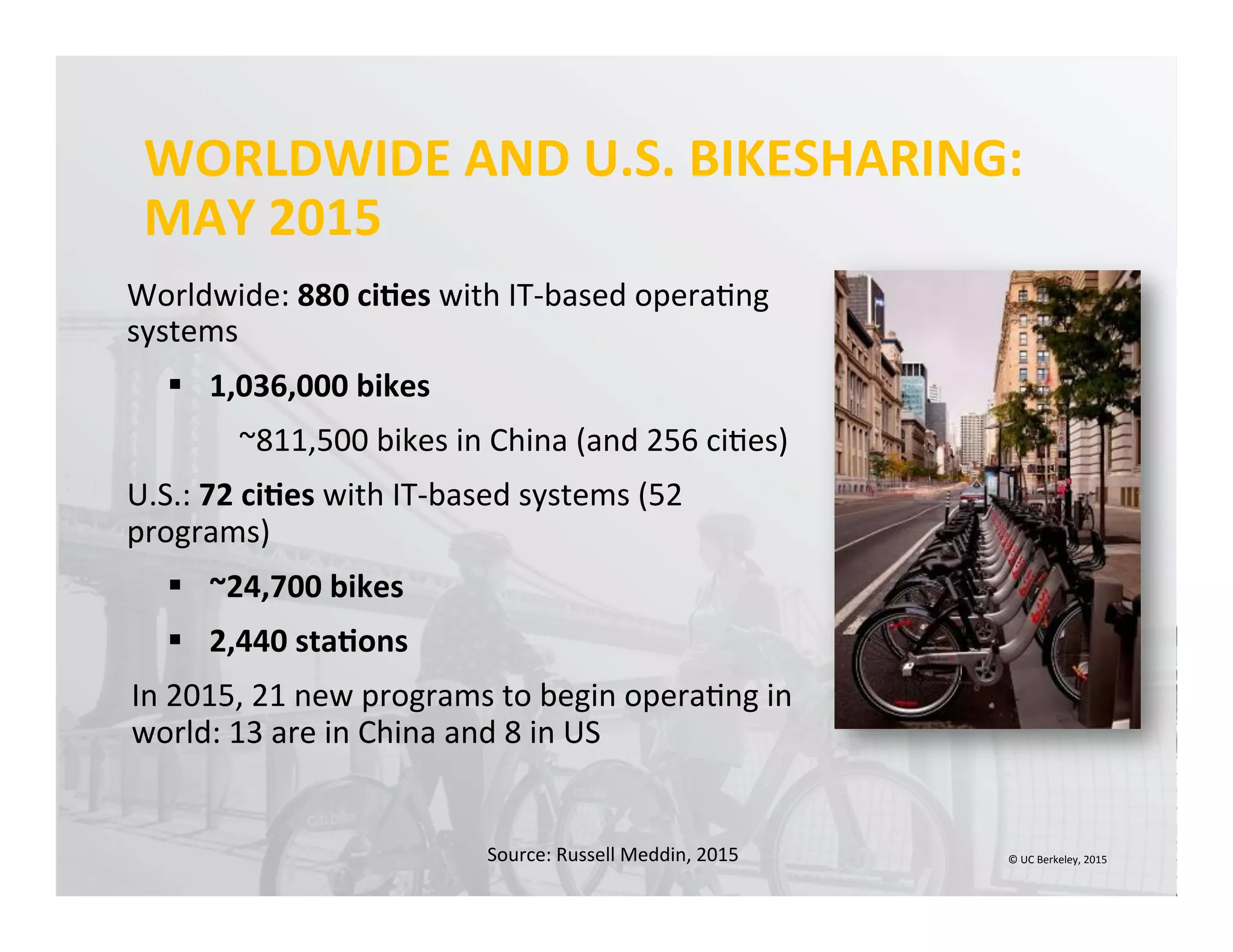

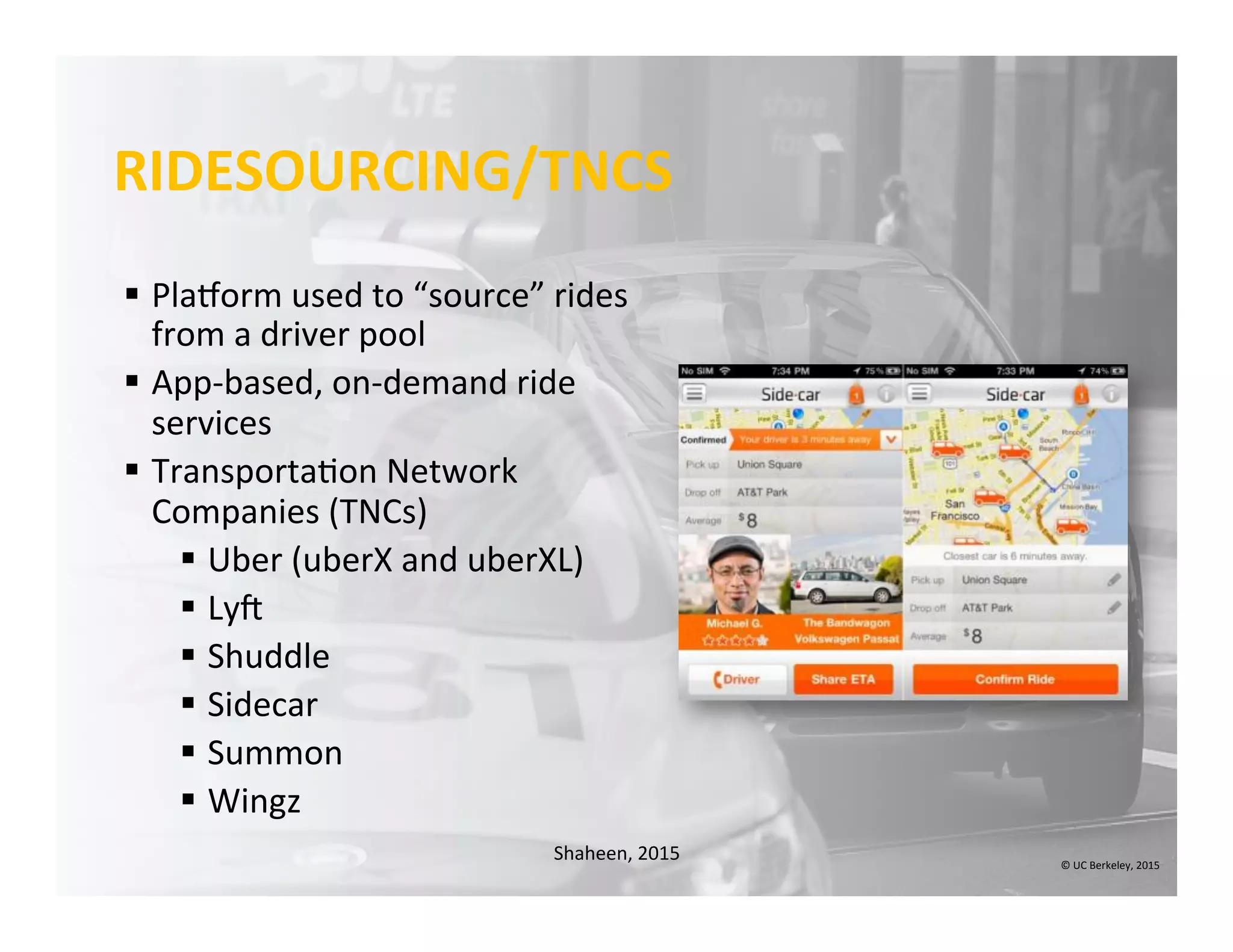

The document discusses the evolution and growing impact of shared mobility within the sharing economy, emphasizing that access to transportation options is increasingly valued over ownership. It reviews historical trends, current market dynamics, and future developments in areas like carsharing, bikesharing, and ridesourcing. It concludes that shared mobility is transforming transportation behaviors and is expected to converge with electric and autonomous vehicles.