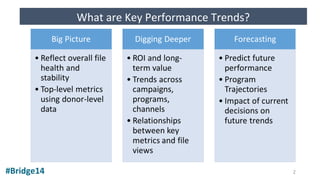

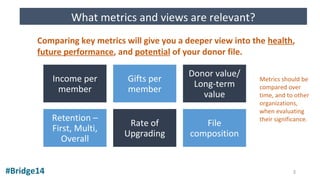

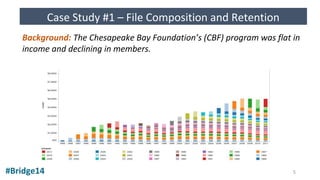

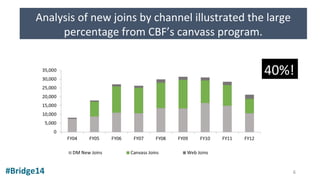

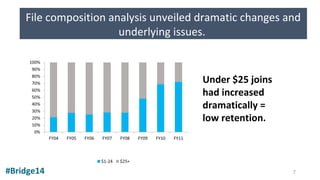

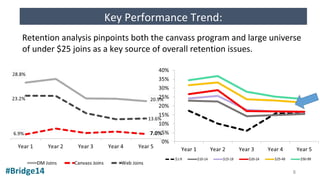

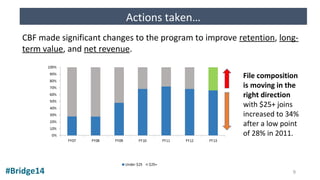

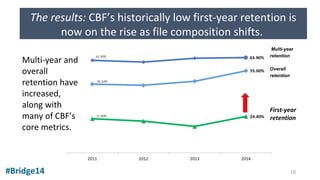

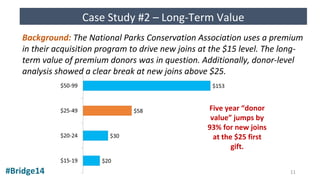

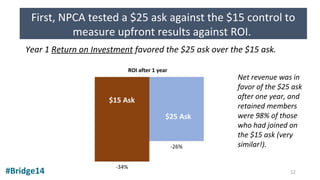

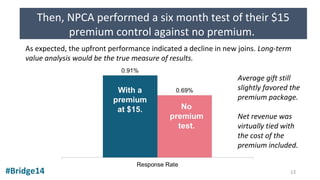

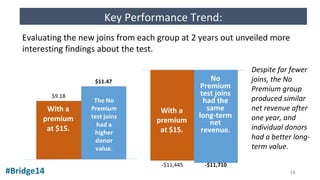

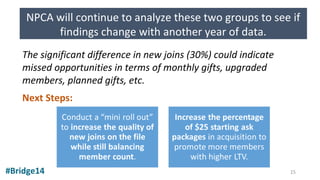

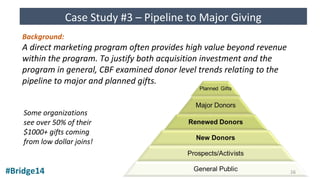

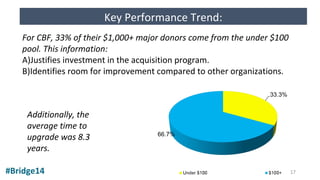

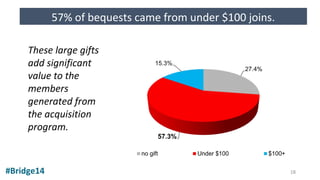

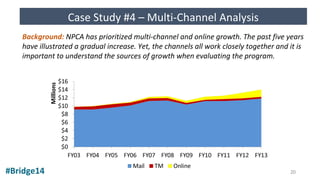

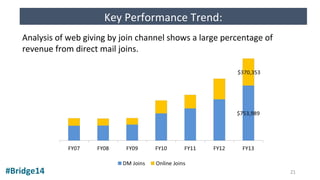

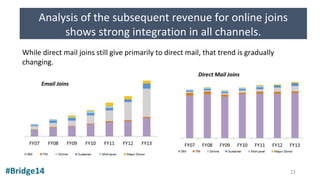

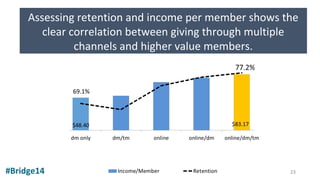

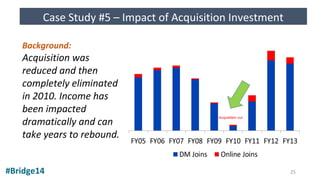

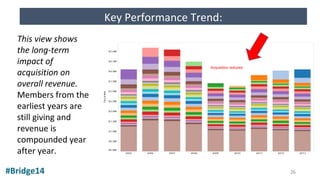

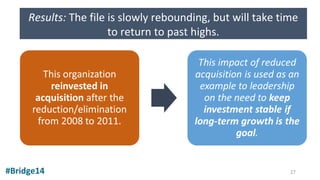

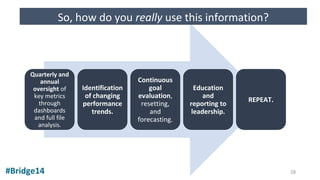

This document discusses key performance trends found through donor file analysis. It provides 5 case studies analyzing donor data from the Chesapeake Bay Foundation and National Parks Conservation Association. The case studies examine trends in file composition and retention, long-term donor value, the pipeline to major giving, multi-channel relationships, and the impact of reducing acquisition investment. Analyzing metrics over time through donor file analysis provides critical insights into performance and opportunities for improvement.