Embed presentation

Download to read offline

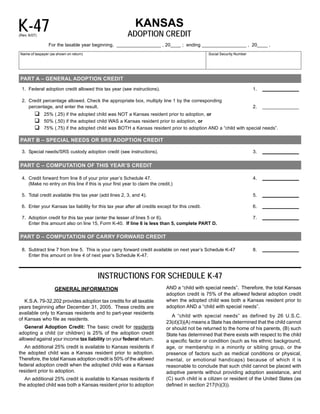

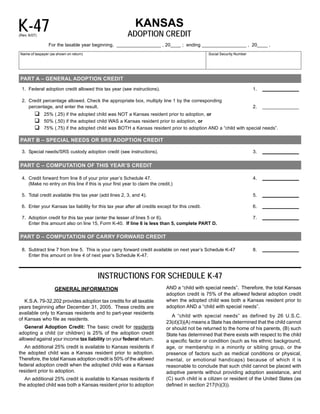

This document provides instructions for completing the Kansas Adoption Credit Schedule (Schedule K-47). It outlines how to calculate state adoption tax credits based on the federal adoption credit and the status of the adopted child as a Kansas resident or special needs child. Taxpayers can claim a 25%, 50%, or 75% credit depending on the child's status. Any unused credit can be carried forward to future tax years.