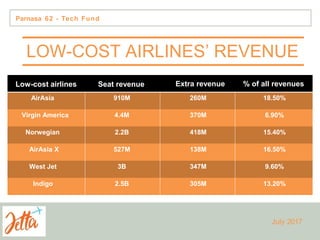

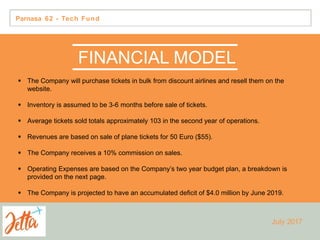

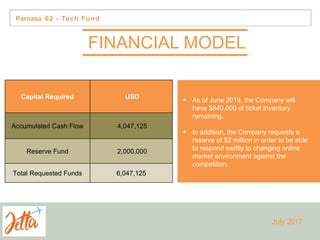

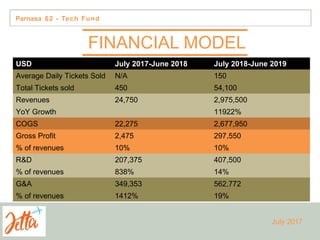

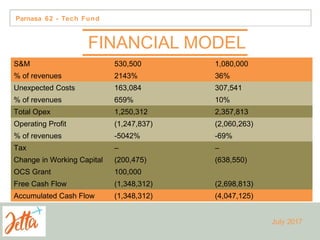

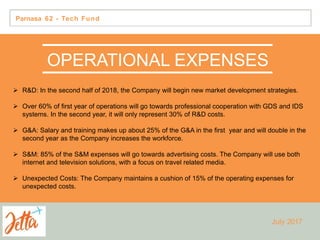

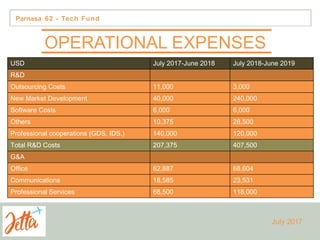

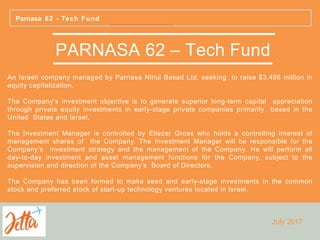

This document provides information on JettaPlus, an online marketplace for unused plane tickets. It discusses JettaPlus' mission to become a leading marketplace for €50 plane tickets. It outlines how JettaPlus launched in Israel in 2016 and became a competitive player with over 1 million visitors and 1000 ticket sales totaling over $250,000. The document also discusses opportunities in the airline industry with increasing travelers and unused tickets each year, as well as JettaPlus' experience working with airlines, travel companies, and insurance companies. Financial projections show JettaPlus requesting $6 million in funding to launch in May 2018 and continue growing through June 2019.