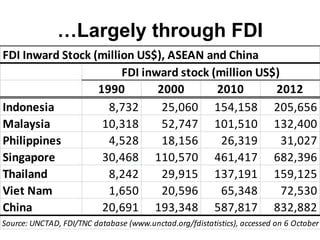

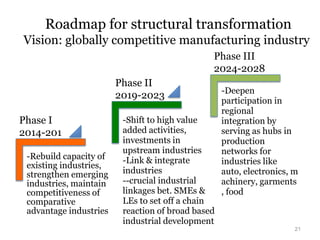

The document discusses the challenges and opportunities for the manufacturing sector in the Philippines under the ASEAN Economic Community (AEC). It highlights the potential for inclusive growth through enhanced foreign direct investment (FDI) and improved regional production networks, while identifying critical constraints such as infrastructure and governance. The proposed roadmap emphasizes structural transformation and a strategic action plan to strengthen the manufacturing industry for greater competitiveness and job creation.

![Lack of Economic Transformation

Share of Manufacturing in GDP (%)

1980

1990

China

43.9

36.5

Indonesia

13.5

23.0

Malaysia

21.6

22.7

Philippines

27.7

26.8

Thailand

21.5

24.9

Viet Nam

16.1

12.3

2000

40.4

27.7

29.9

24.5

33.6

18.6

2006

32.9

27.5

28.8

23.6

35.0

21.2

2011

32.2

24.3

24.6

21.1

29.9

19.4

Source: UN Statistics Division [http://unstats.un.org/unsd/dnlList.asp; accessed, 6 October 2013]](https://image.slidesharecdn.com/jyapaseanusoct212013revised-131113042948-phpapp02/85/J-yap-asean_us_oct21_2013_revised-3-320.jpg)