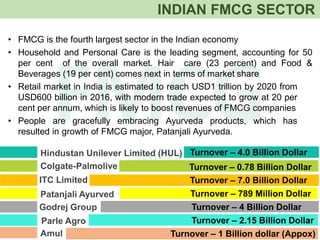

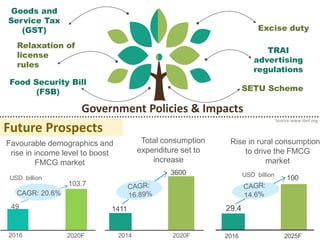

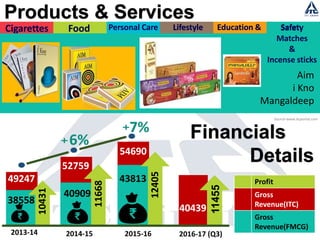

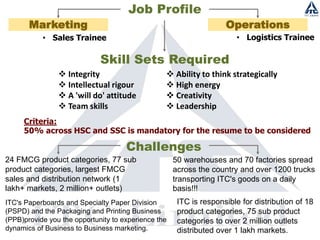

The Indian FMCG sector, valued at approximately USD 7 billion for major companies like Hindustan Unilever and ITC, is experiencing significant growth, driven by rising income levels and expanded rural markets. Households and personal care dominate the market, while challenges include low export levels and stringent government regulations. The sector is expected to reach a retail market valuation of USD 1 trillion by 2020, with organization reforms benefiting established players.