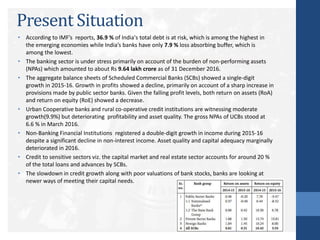

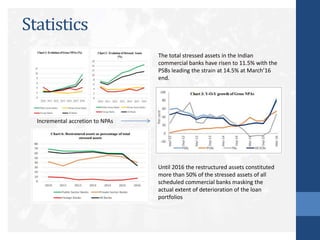

The banking sector in India faces significant challenges including high levels of non-performing assets (NPAs) totaling around Rs. 9.64 lakh crore as of December 2016. Public sector banks have an NPA ratio of 14.5% while overall stressed assets account for 11.5% of total assets. Reasons for rising NPAs include risky lending during periods of strong growth, increased corporate leverage, and deferred provisioning. The government and RBI have introduced policies like the Insolvency and Bankruptcy Code 2016 and Asset Quality Review to address NPAs, but challenges around capital adequacy, technology integration, and HR issues remain. Remedies proposed include credit rating agencies, efficient policy implementation, improving operational efficiency