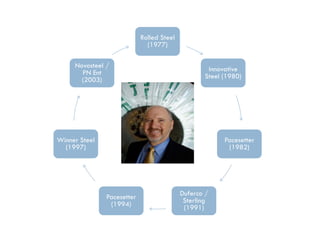

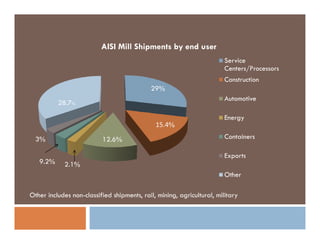

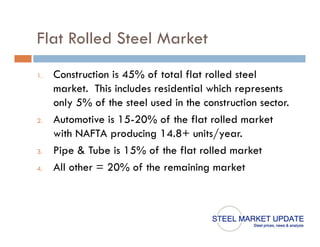

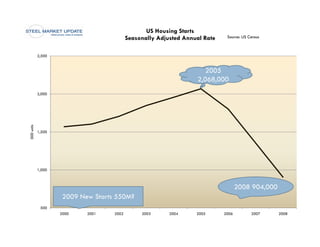

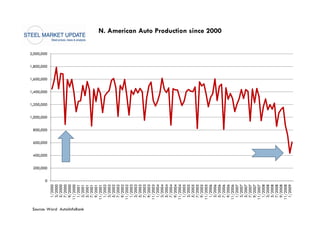

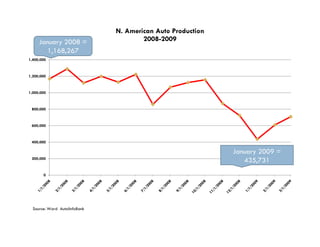

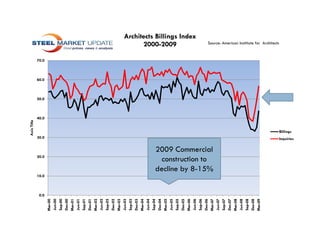

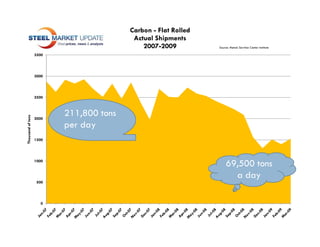

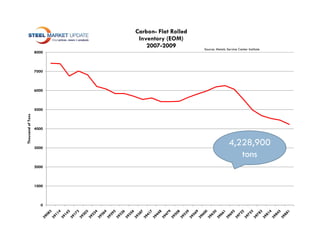

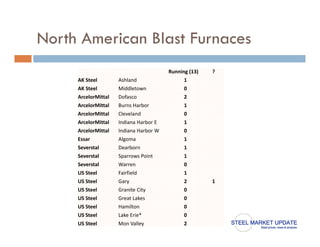

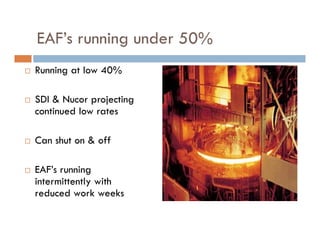

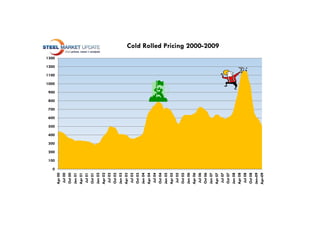

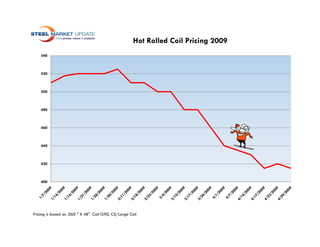

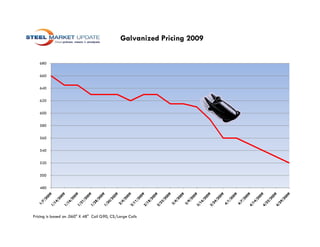

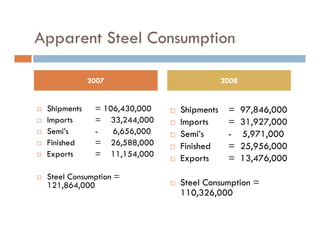

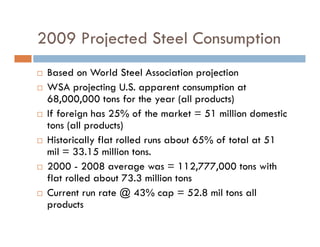

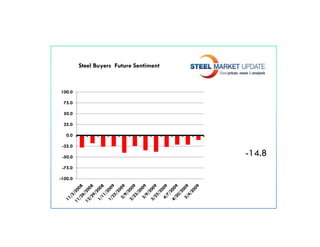

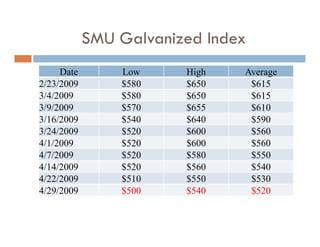

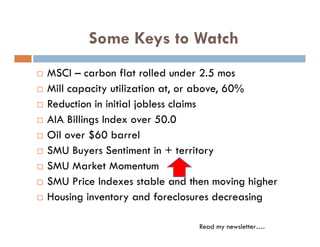

The document provides a detailed update on the steel market as of May 2009, highlighting key player John Packard and the current market conditions, including production statistics, sales trends, and economic impacts. It notes significant challenges such as reduced capacity and demand in the U.S. market, along with foreign market influences. Key figures include a projected steel consumption of 68 million tons for the year, alongside an analysis of the impacts on various sectors like automotive and construction.