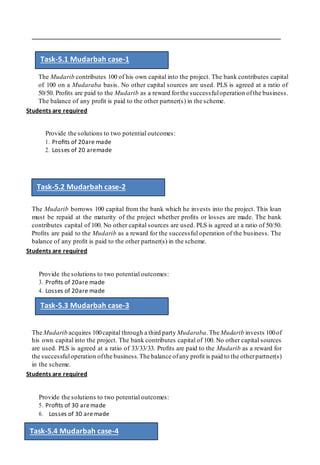

The document outlines various tasks for students related to Islamic finance. It discusses key concepts like the Islamic economic system, asset-backed financing, capitalism, and Musharaka. It provides case studies on Musharaka, Mudarabah, Diminishing Musharaka, Murabaha, and Ijarah. Students are asked to write reports, conduct case analyses, visit Islamic banks to learn practical applications, and more. The overall document serves to educate students on important Islamic finance principles and mechanisms.