This document discusses the history and development of Islamic accounting and auditing standards in Malaysia. It provides details on:

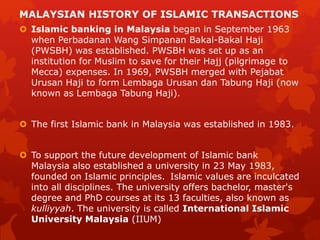

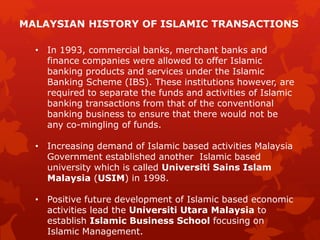

- The establishment of the first Islamic banks and universities in Malaysia in the 1980s to support Islamic finance.

- Key organizations established by the Malaysian government to regulate and develop Islamic economic initiatives and institutions.

- The issuance of guidelines by Bank Negara Malaysia on financial reporting for Islamic financial institutions, which introduced additional reporting requirements compared to conventional standards.

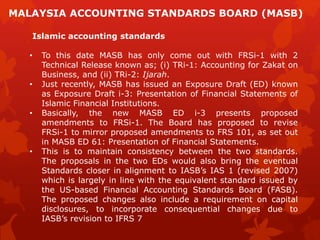

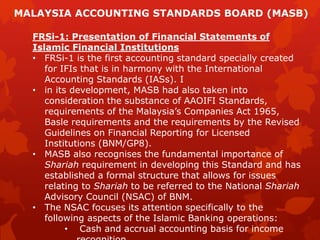

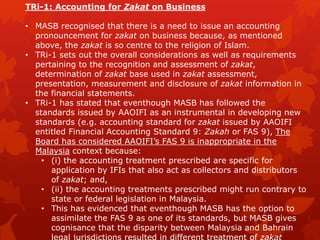

- The role of the Malaysian Accounting Standards Board in developing the first Islamic financial reporting standard and other exposure drafts to provide accounting guidance for core Islamic finance concepts.

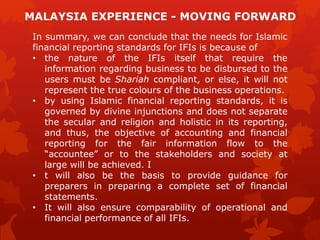

- Challenges in standardization due to differences of opinion among